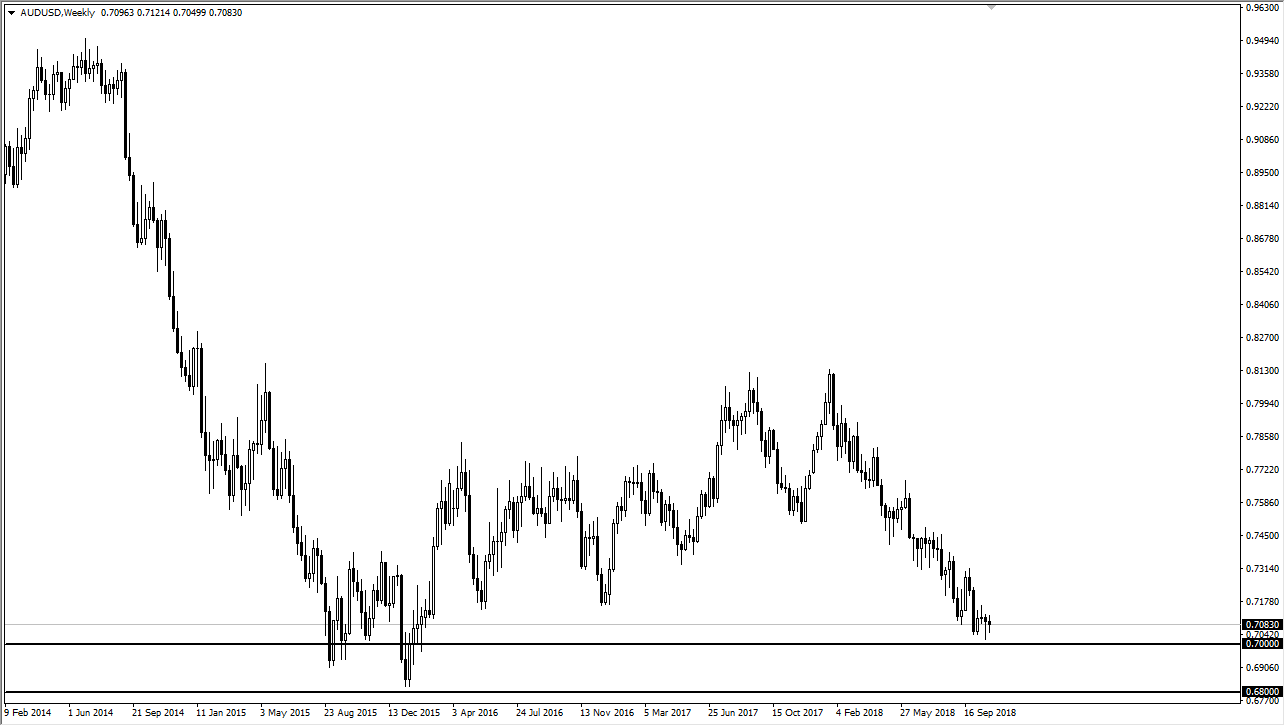

The Australian dollar has been a week for several months, and I think that the month of November could be crucial. This is because I see a “zone of support” extending from the 0.70 level, down to the 0.68 level underneath. This is an area that we had bounced from rather significantly during December 2015, so I think there’s a certain amount of market memory in this area. Beyond that, the US dollar is most certainly overbought against most currencies, with the Australian dollar being no different.

However, the Australian dollar has the dubious distinction of being highly levered to the Chinese economy and by extension the Sino-American trade relations, which of course aren’t very good to say the least. I think things get worse before they get better, and that might be what we see in the beginning of the month of November. I would expect some technical support in that area to come into play. However, if we were to break down below the 0.68 handle, then the market could unwind to the 0.66 level, and then possibly the 0.65 level.

If we do break down like that, this means that the Sino-American trade relations probably have gotten worse, which is a very real possibility. Beyond that, the Australian dollar has suffered due to poor economic figures coming out of China, which seem to be getting worse in general. Beyond that, the Australian economy itself is starting to soften up based upon the CPI number, GDP, and the like. I believe that poor fundamentals will continue to be a major drag on the Australian dollar, both internal and external. However, I would be the first person to buy this pair if we get some type of trade deal between the Americans and the Chinese as it should rip higher.