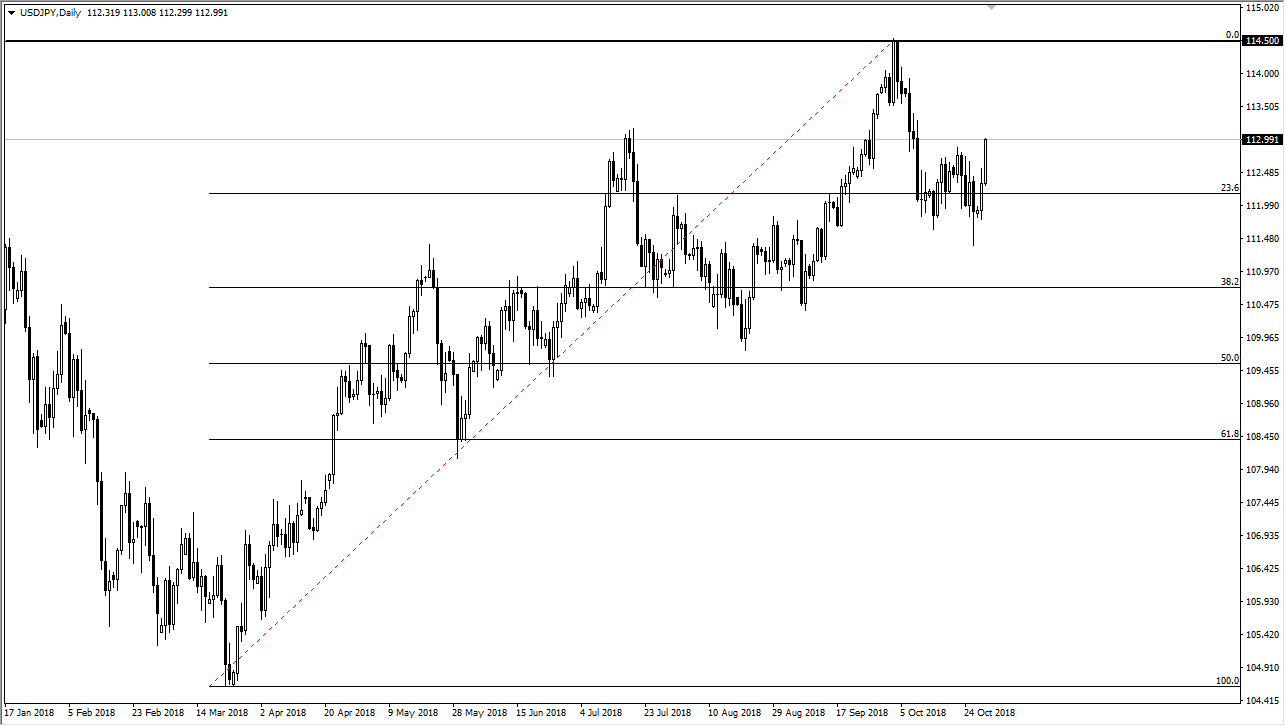

USD/JPY

The US dollar has rallied against the Japanese yen during the trading session on Tuesday, reaching towards the ¥113 level, which of course is a psychologically important level. However, I would point out that there is a massive bearish candle that we are trying to take out from a couple of weeks ago, and that is a scenario that should cause a bit of resistance just above. At this point, I think that we are probably finding an attempt to break out to the upside again, and with the S&P 500 gaining over a percent during the trading session certainly helps. At this point, I think that we will continue to see another attempt to break out, and I think the next 50 pips are going to be crucial. At this point, we are still very much in and uptrend so I think that we will eventually go higher but a short-term pullback would not be a huge surprise at all.

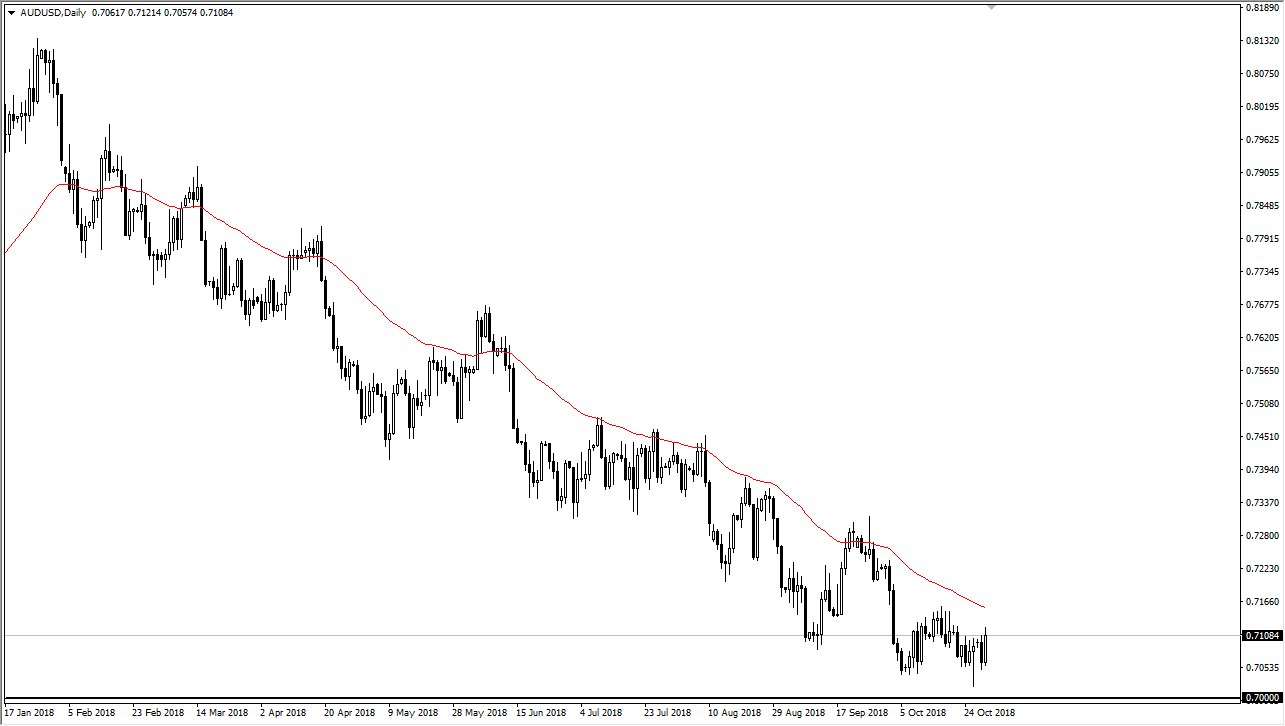

AUD/USD

The Australian dollar also rallied during the trading session, but unlike the other pair in this video, it focuses almost solely on China these days. Ultimately, we are in a very bearish market, and that is true until we break the 0.73 handle above. In other words, rallies at this point continue to be selling opportunities but the 0.70 level has been rather stringent with its support, and I think we will continue to see value hunters in that general vicinity. It doesn’t mean that we can break down below there and based upon the longer-term charts it would not surprise me at all if we do. All it would take us some negative headline out there about the Sino-American relations.