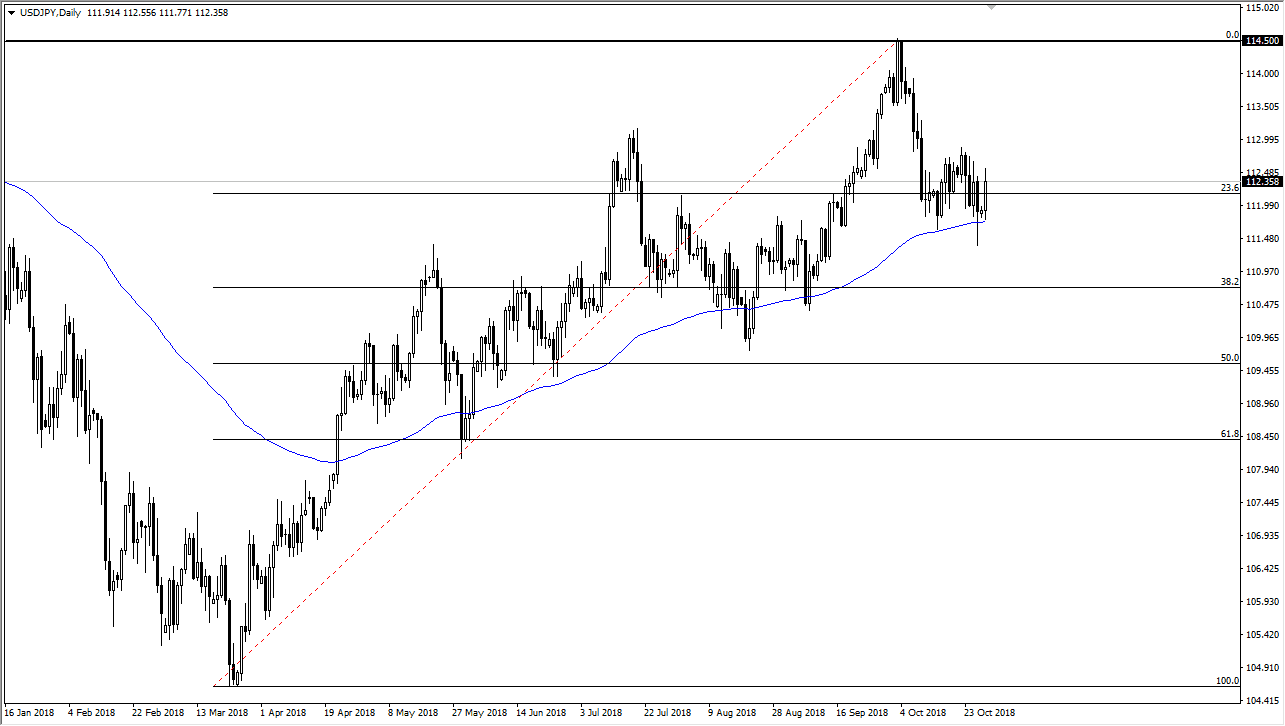

USD/JPY

The US dollar has bounced a bit during the trading session on Monday, using the 100 EMA on the daily chart as dynamic support. Breaking above the ¥112.50 level during the day was a good sign, but we need to clear the ¥113 level to continue to go much higher. Ultimately, if that happens I think that we will then go looking towards the ¥114.50 level, which has been massive resistance recently. Remember that this pair is rather sensitive to risk appetite, something that has been very volatile as of late. If we break down below the hammer on Friday, I think that we could go down to the ¥111 level. That’s an area that is supported by the 38.2% Fibonacci retracement level as well. Overall, I do prefer the longer-term trend to the upside, but I also recognize that there is a lot of fear out there. I would keep my position size somewhat small in this volatility.

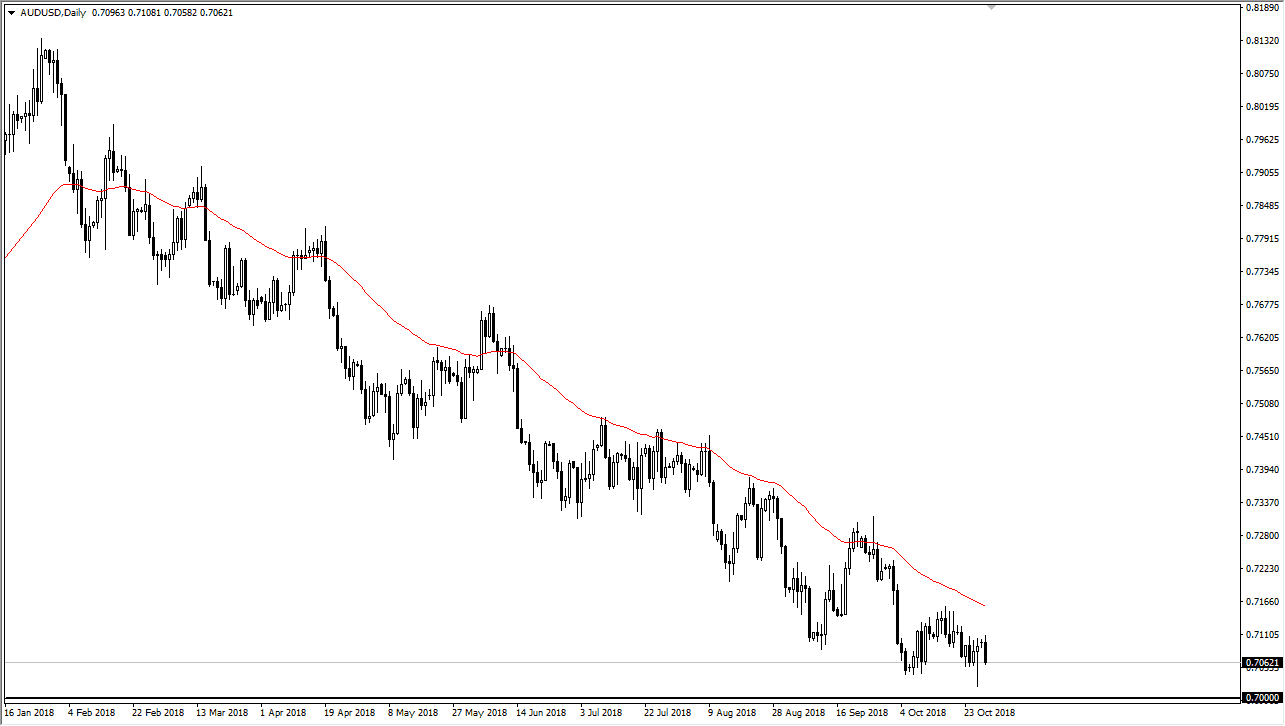

AUD/USD

The Australian dollar has fallen during the trading session on Monday, as we continue to see a lot of volatility around the world. This market is certainly struggling during the last several weeks, as the Sino-American relations continue to be a major issue. I see the 0.70 level underneath as being supportive, and area that of course is a large, round, psychologically significant figure. If we can break down below that level, the market should go to the 0.68 handle, based upon longer-term charts and of course the geopolitical concern, it’s probably going to continue to be easier to sell this pair than to buy it. Higher interest rates in the United States and of course the US dollar being a bit of a safety bid, I like selling rallies that show signs of exhaustion.