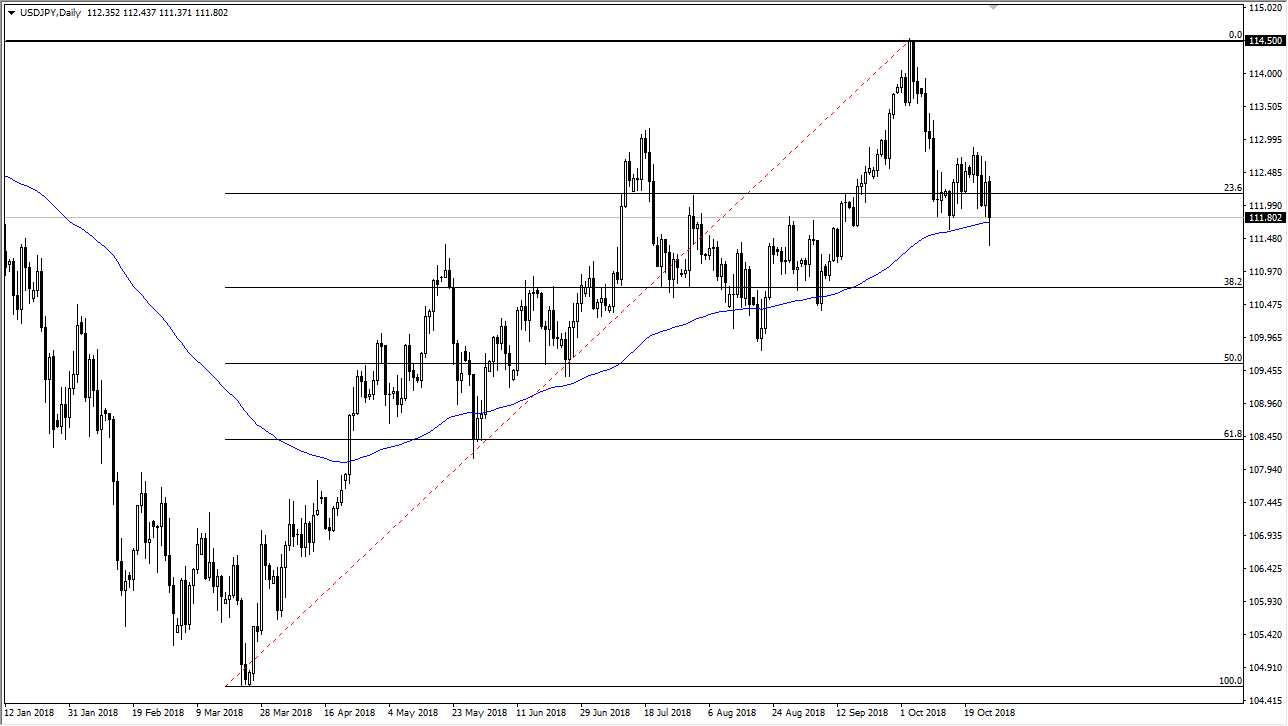

USD/JPY

The US dollar fell against the Japanese yen on Friday, as we continue to see a bit of a flight to safety overall. However, you can see that the 100 EMA has offered a bit of support and looking at this chart I think we are still very much in and uptrend. That being the case, you should look to this market from a bullish attitude longer term, but I also recognize that we continue to see headlines out there that have people looking for safety overall, and of course this pair is highly sensitive to the stock markets which have been absolutely hammered as of late. Looking at the candlestick for Friday, if we break down below the low of the day, then I think we go looking towards the ¥111 level. Overall though, I think that the recovery towards the end of the day is at least something to give you hope.

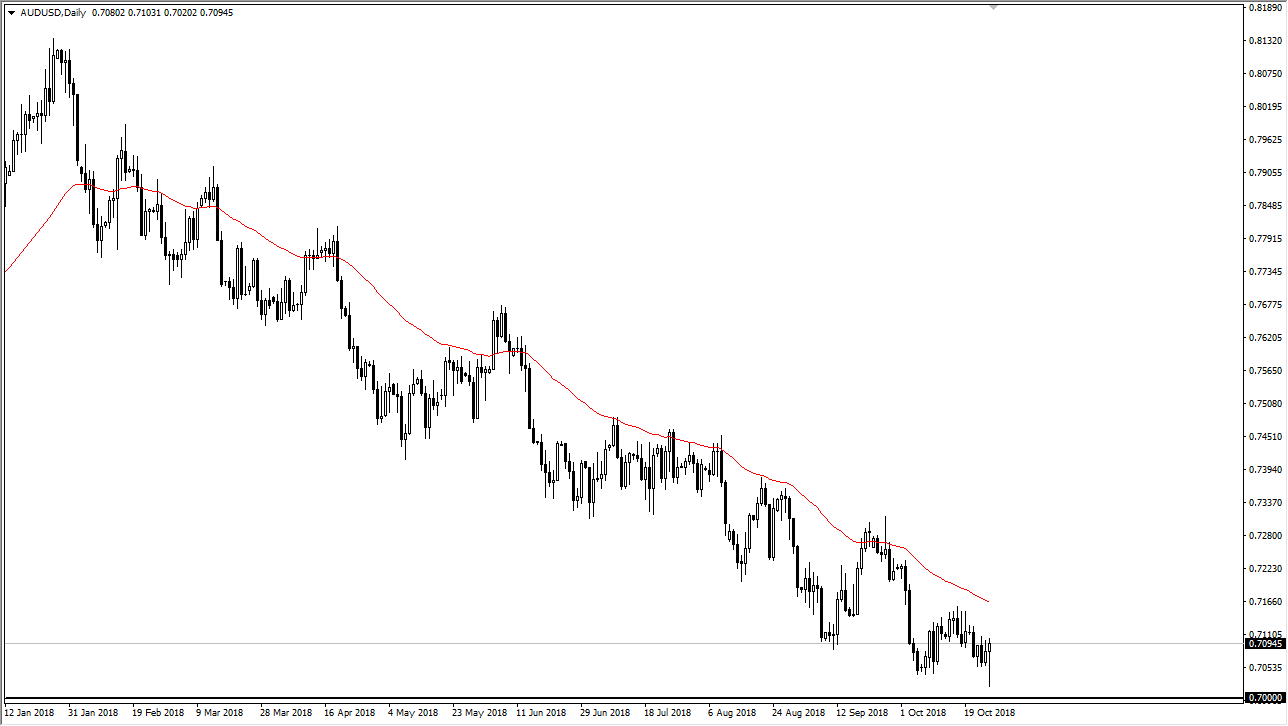

AUD/USD

The Australian dollar bounce quite nicely from just above the 0.70 level, which of course is a very psychologically important figure. The hammer is huge, which of course is a good sign. This is a pair that is highly sensitive to the situation between the United States and China, and the completion of the reversal for the day could be the beginning of a bit of a rally. However, I think that selling at levels above probably makes more sense, because we are in such a relentless downtrend. Beyond that, it could just be simple short covering for the week, as traders don’t want to get to exposed to the markets over the weekend, protecting themselves from headline risk over the weekend. It would only take a quick and errant headline coming out of either Beijing or Washington to send this pair back down.