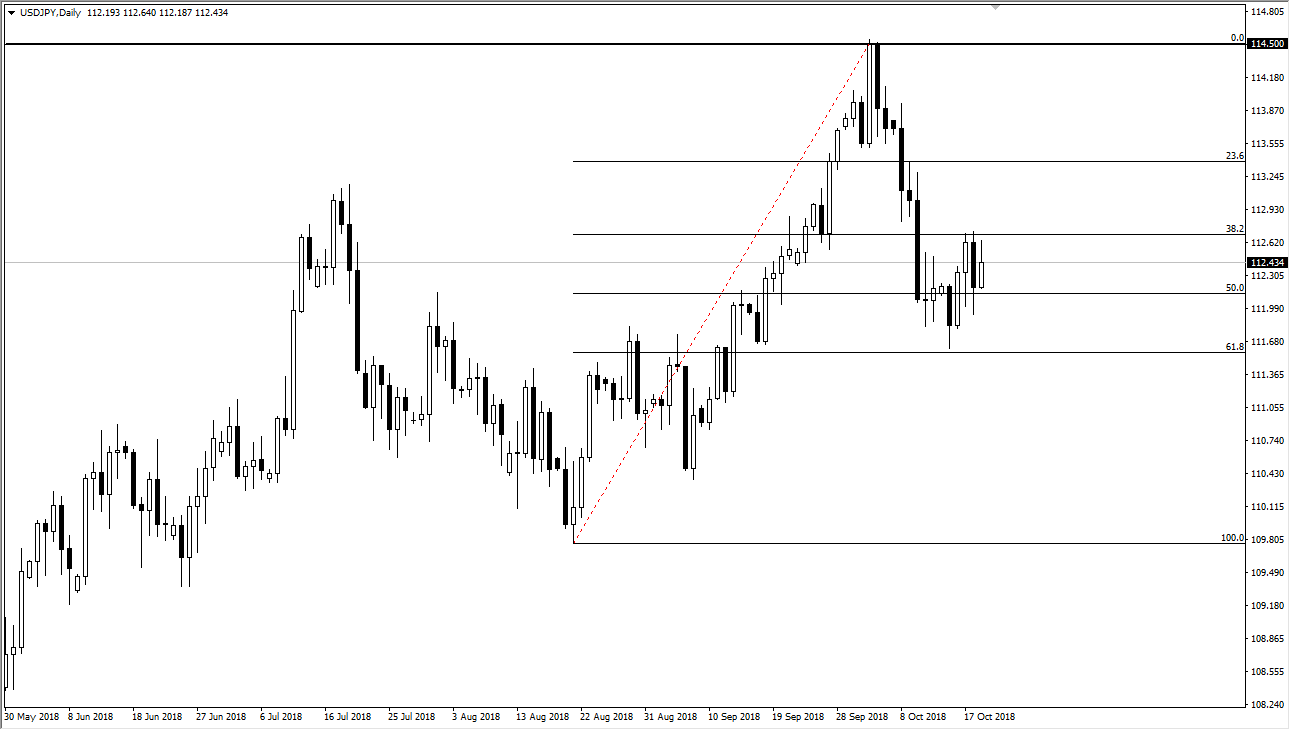

USD/JPY

The US dollar rallied significantly against the Japanese yen during the trading session on Friday, as we continue to see a bounce from the 61.8% Fibonacci retracement level. As markets stabilize, I anticipate that this market will continue to go higher, and therefore it’s likely that we will see bullish pressure. I think the market breaking above the highs from the last couple of days will be a bullish sign, but it will probably take a bit of work to get that done. We are in and uptrend, and I think this is simply a confirmation of that uptrend as we move to the upside. Overall, I believe that buying the dips continues to work unless of course we break down below the ¥111.50 level, which would break the 61.8% Fibonacci retracement level. Unless we get some type of flight to safety, this pair should continue to attract fresh buying.

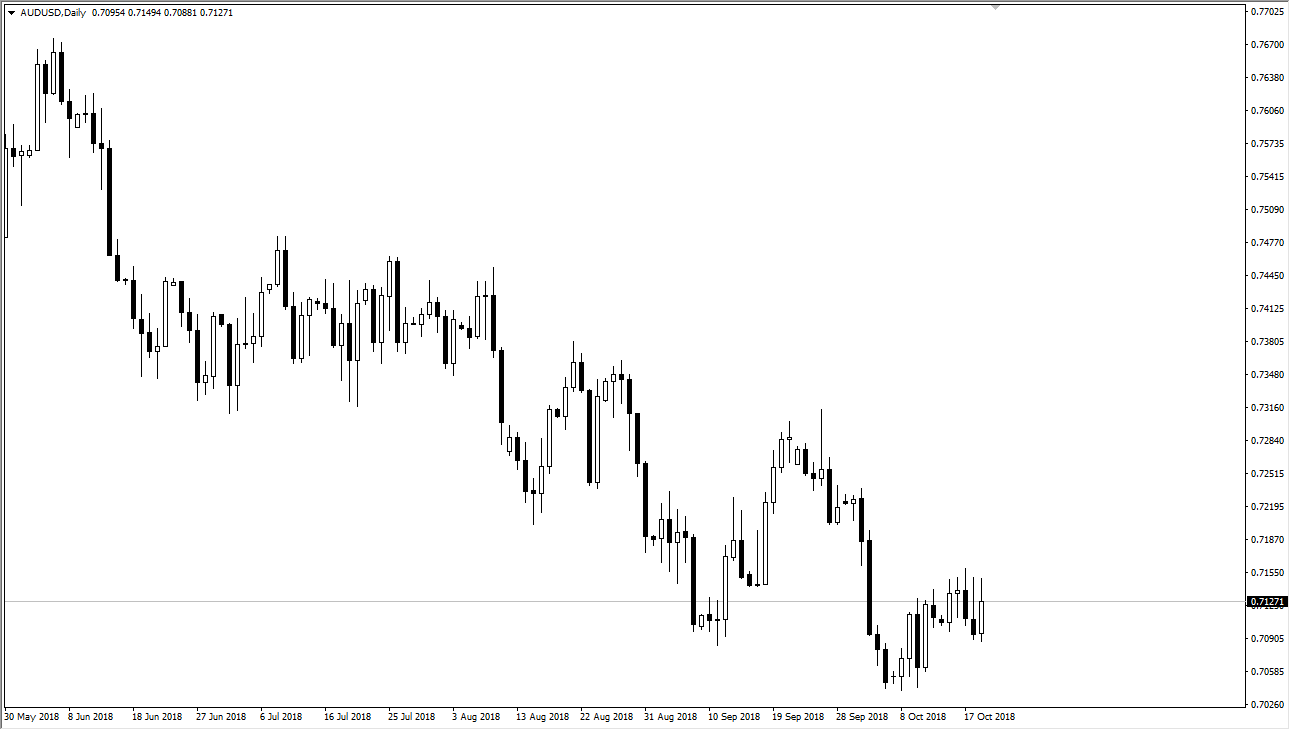

AUD/USD

The Australian dollar has rallied a bit during the day, but overall it’s still in a very negative downtrend. The 0.7150 level above should continue to be resistance, so I think it’s going to be difficult to go higher. Even if we do, the 0.72 level above will also offer resistance from what I have seen. In general, I like the idea of selling short-term rallies as we continue to see a lot of tension between the United States and China, which of course has a negative influence on the Aussie. If we break down to a fresh, new low then I think the market goes to the 0.70 level after that, and then possibly even the 0.68 handle. If we do break above the 0.72 handle, then I think the market could be bought and go much higher.