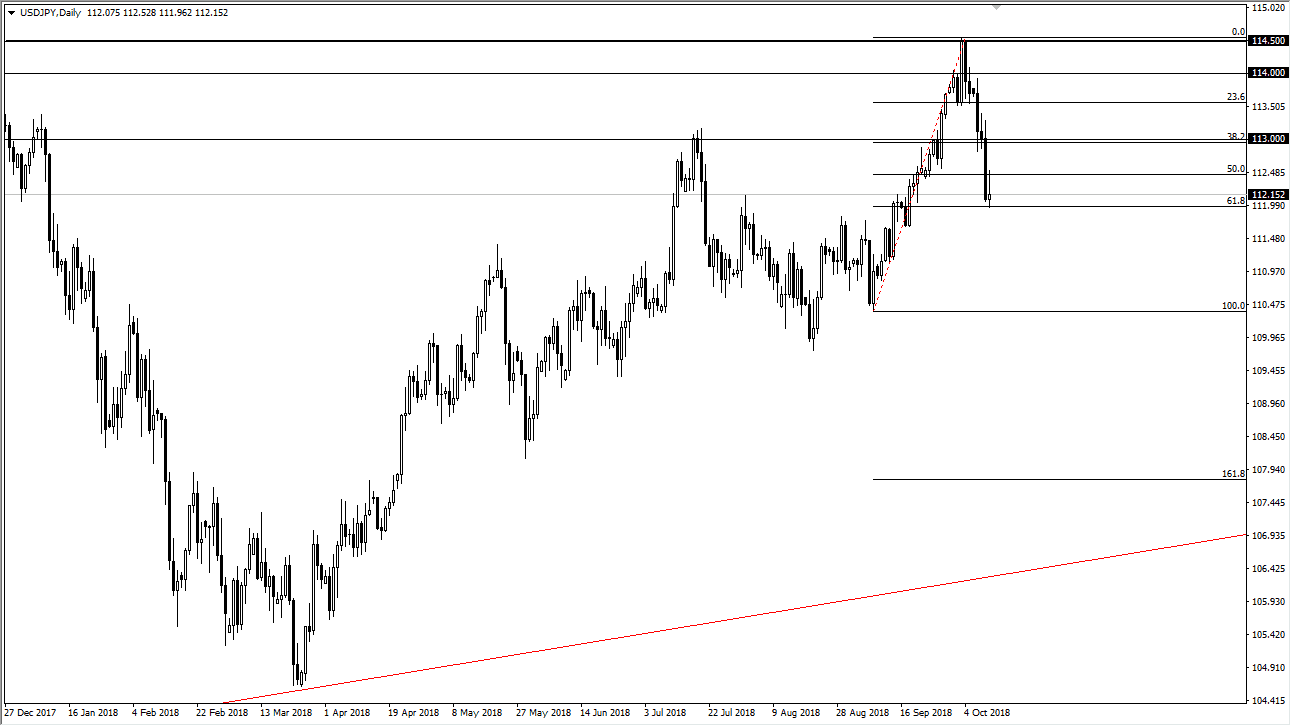

USD/JPY

The US dollar initially tried to rally against the Japanese yen during the day on Thursday but found enough resistance to turn things around and form a bit of an inverted hammer. We are sitting right at the 61.8% Fibonacci retracement level, an area that of course would attract a lot of attention. This is an area where I would expect to see some support, but the candle stick does have me a bit concerned. However, if we can break above the top of the inverted hammer that is a buying opportunity. That’s a very bullish sign, and I think many traders out there would be more than willing to jump in. If we break down below the 61.8% Fibonacci retracement, then we could very well unwind down towards the ¥111 level, and then the ¥110 level after that.

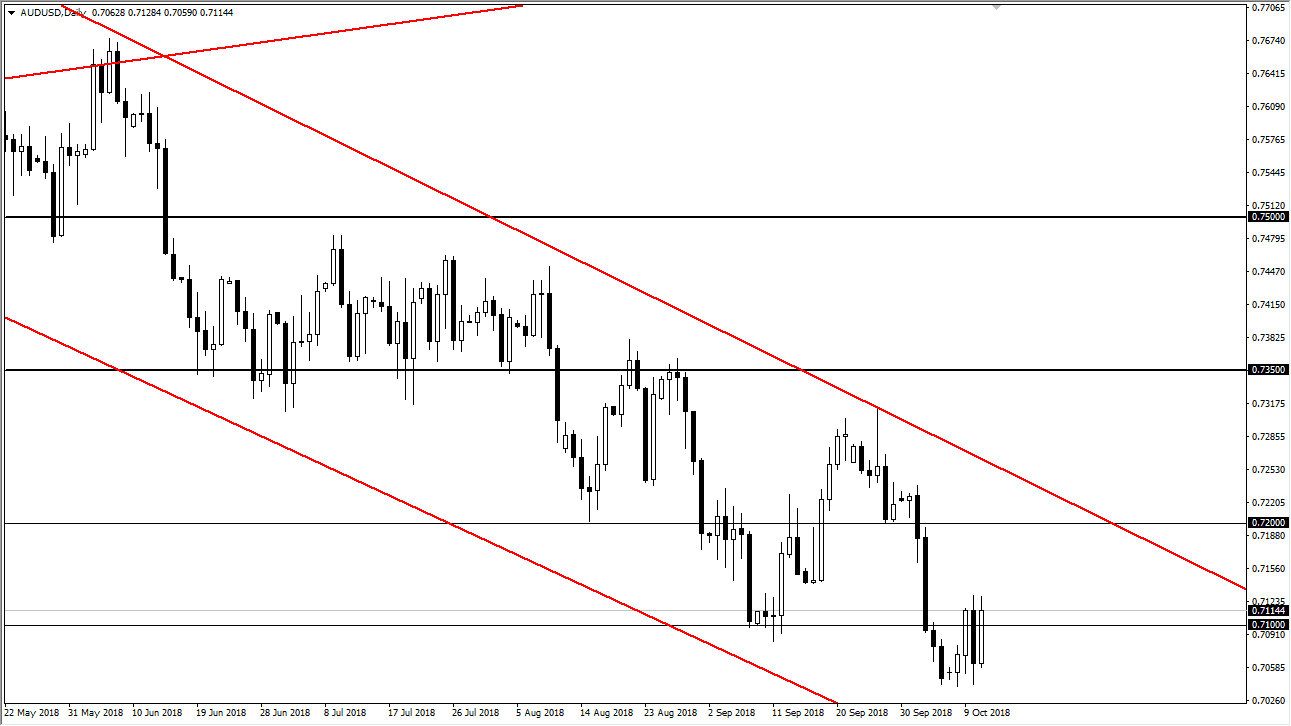

AUD/USD

The Australian dollar had a very bullish session during the day as the Americans missed on their CPI figures, and gold absolutely shot to the moon. However, were still very much in a major downtrend, so therefore I’m looking for an opportunity to start selling. Overall, I think that we probably have some short term bullishness coming back into the marketplace, but I also recognize that it isn’t necessarily going to be very easy to hang onto that trade as we continue to see a lot of volatility not only due to the geopolitical concerns around the world and of course the trade tariffs that keep getting slapped upon the Chinese and the Americans by each other. This of course continues to be a major issue, so I’m looking for some type of exhaustive candle to get back involved to the downside.