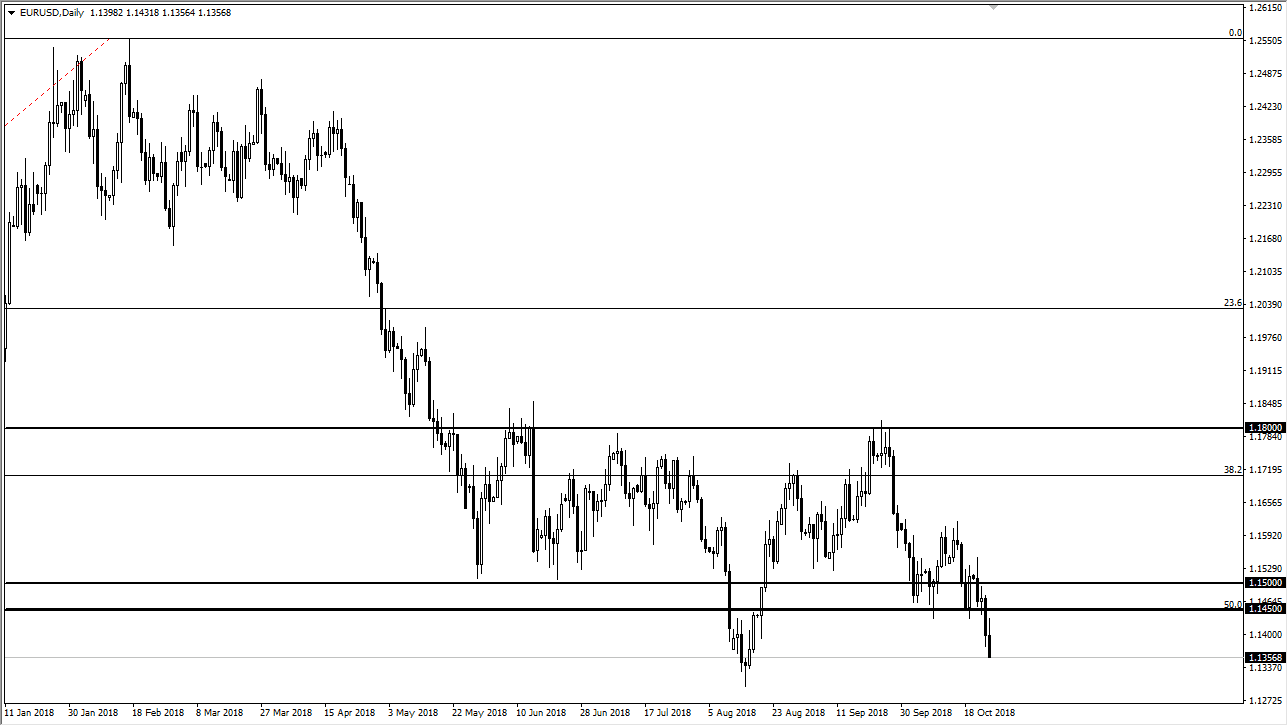

EUR/USD

The Euro initially tried to rally during the trading session on Thursday but then broke down rather significantly. By doing so, we are reaching a fresh low as again, and this was especially exacerbated after the ECB press conference during the day. It was suggested that perhaps some of the economic numbers were softer than expected, and therefore accommodative policy may be needed for longer. Contrast that with the Federal Reserve which is looking to raise rates, it makes perfect sense that the Euro has struggled. However, there is a lot of support just below, so I think at this point we will probably get a short-term rally that we can start selling if we get some signs of exhaustion on shorter-term charts. I believe in the meantime it’s probably best to simply wait for opportunities to start selling again.

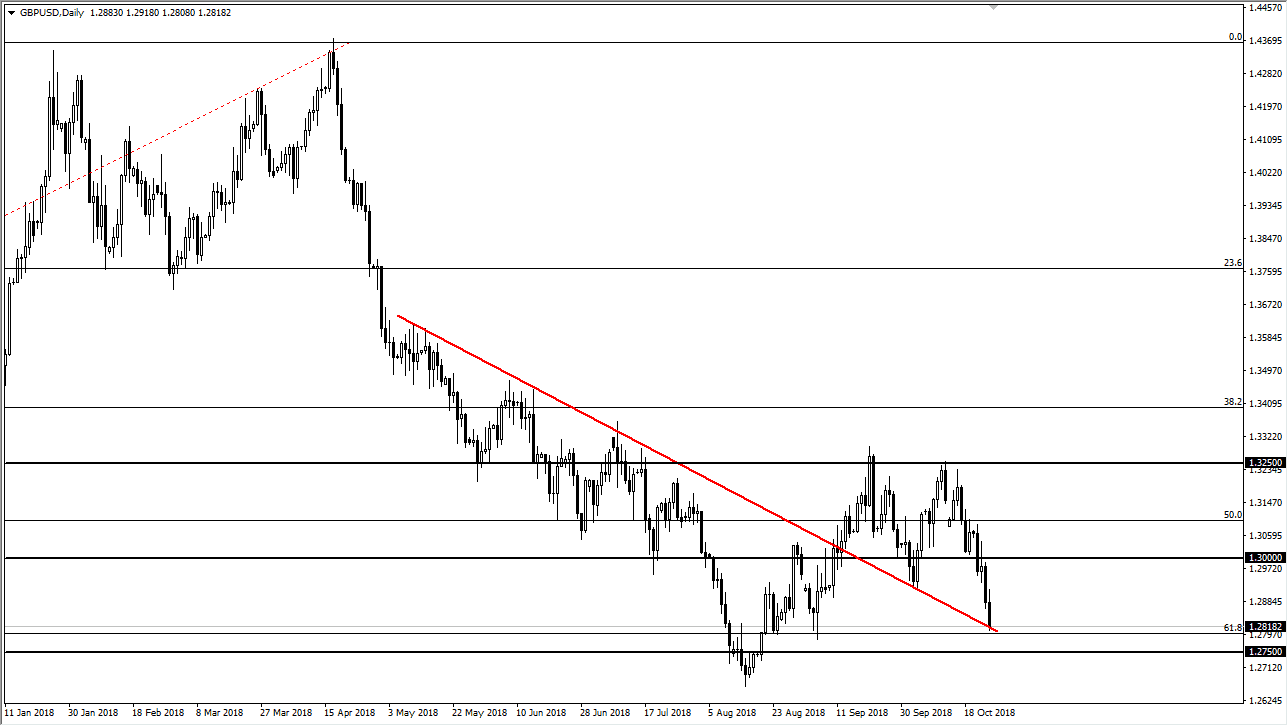

GBP/USD

The British pound initially tried to rally as well, but then broke down significantly, reaching down to the 61.8% Fibonacci retracement level again. The previous downtrend line has offered a bit of support late in the day, but I think this is a market that is very dangerous to mess with right now. I think at this point it’s likely that the area could offer a little bit of support, but I think the next couple of days are going to be very crucial, as we have broken through that line, and then have gone back and forth. Ultimately, I think we are trying to decide whether we are going to turn around and form and uptrend. I think it would take something remarkable for that to happen but technically it still possible. If we break down through the 1.2750 level, then the market should break down even further.