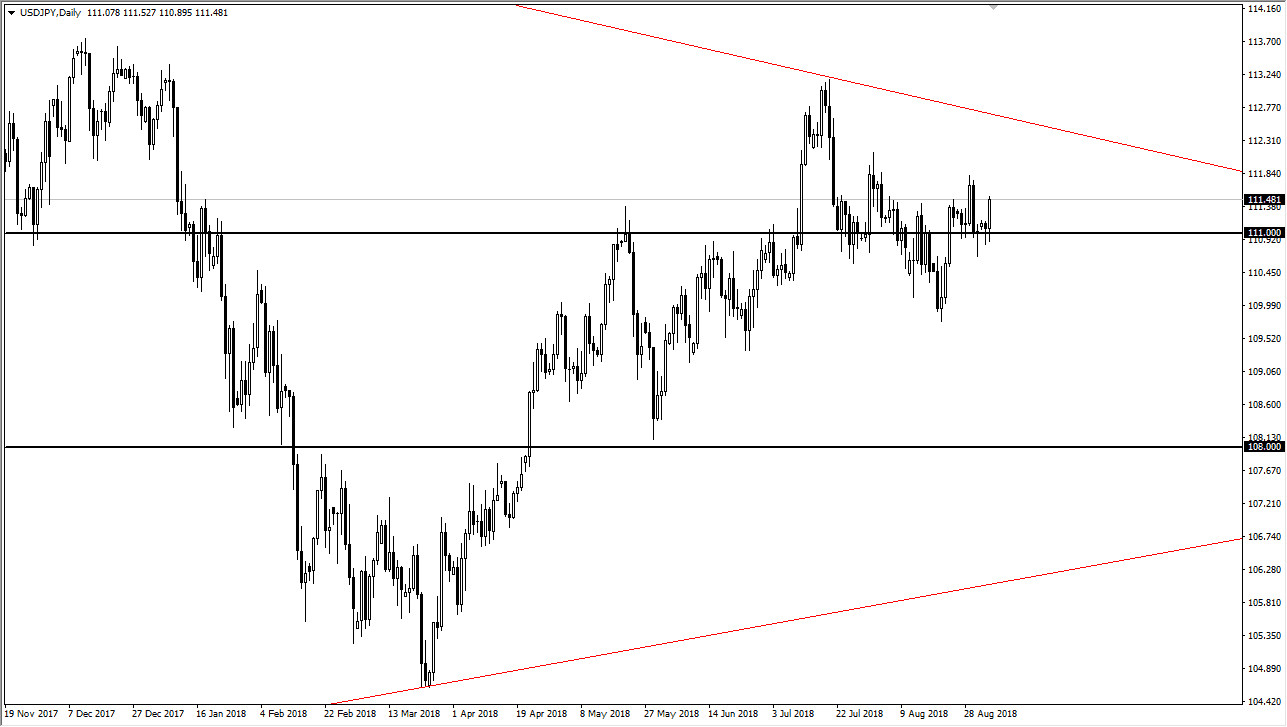

USD/JPY

The US dollar initially pulled back against the Japanese yen, but then rally to above the ¥111 level to form a bullish candle. By doing so, we have tested the ¥111.50 level again, an area that continues offer resistance. Quite frankly, the words “dead money” come to mind when looking at this market. The US dollar continues to be strong, and that lists this pair overall, but at the same time there are a lot of global concerns, which put downward pressure on this pair as the US/China relations continue to sour. That has people jumping to the Japanese yen for safety, and at this point the market just has no idea what to do with itself. Markets are confused in several fronts, and this is certainly one of them. I would advise against trading this market unless you are looking to scalp back and forth.

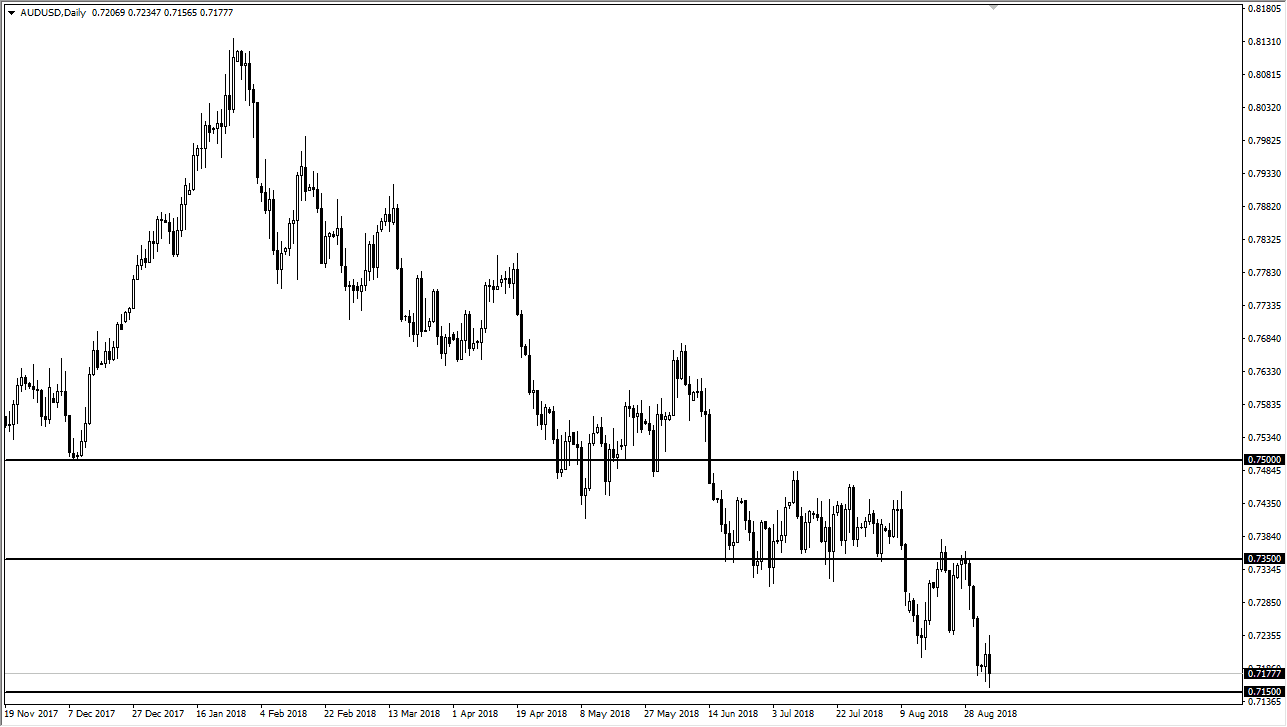

AUD/USD

This is a market that is testing major lows at the 0.7150 level, and if we can break down below there, the Australian dollar could unravel down to the 0.70 level. One would have to think it wouldn’t take much in the way of a headline shock to have the panic sellers jump back into the market. My suspicion is it will have to do with something in China, be it trade relations with the United States or continued drain on the local stock markets. However, until we break down below the 0.7150 level, clearly the risk is skewed to the upside as the Australian dollar is so historically cheap. If we do break out to the upside, I think at that point we would probably go looking towards the 0.7350 level above that has been such reliable resistance. All things being equal though, I would not be surprised at all to see this market break down again.