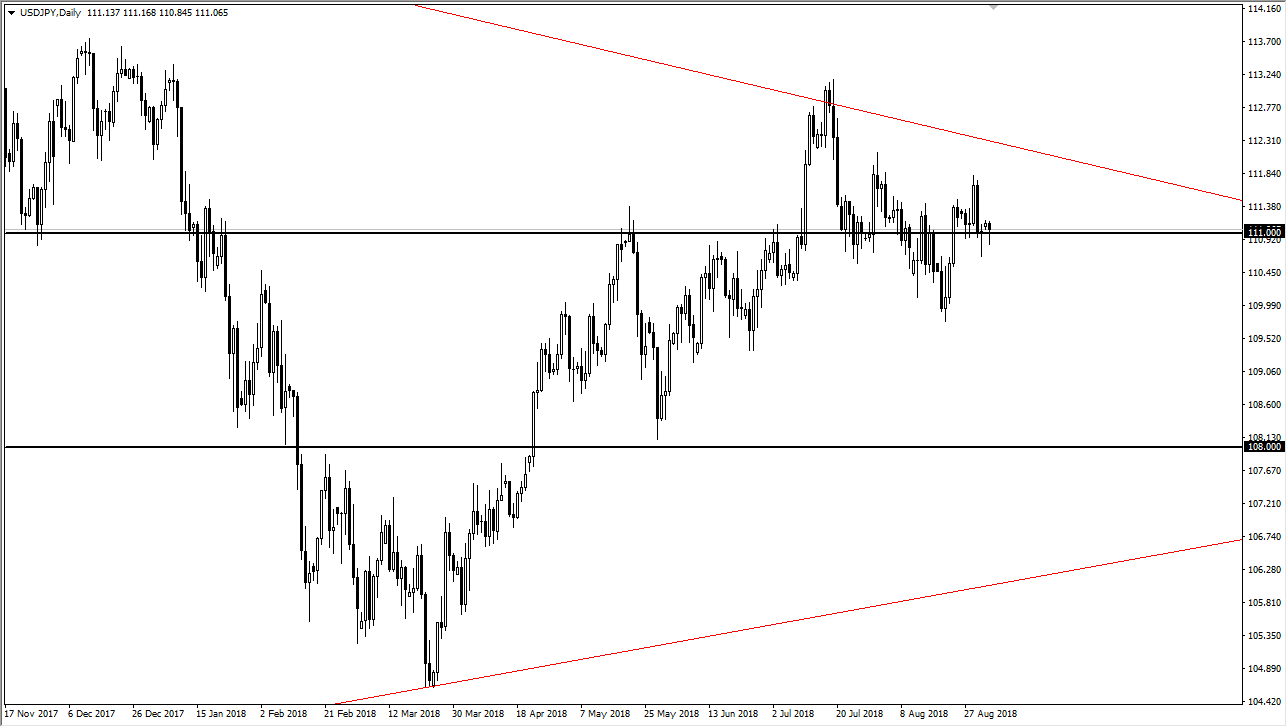

USD/JPY

The US dollar pulled back initially during trading on Monday but found support underneath the ¥111 level to cause a hammer. The market is consolidating in a huge symmetrical triangle, suggesting that we are eventually going to make an explosive move. If we can break above the downtrend line above, it could send the market much higher. At that point, I would anticipate that the ¥114 level would be a target, and then possibly more of a beginning of a longer-term “buy-and-hold” situation. I believe that if we break down below the hammer on Friday, it’s likely that we could drop to the ¥110 level, and then possibly even the ¥109 level. This is a very messy market, and I think that the overall attitude of the market could finally give us an opportunity to focus on the fundamentals, if we can get the trade war spat between the United States and China to calm down. At that point, this market should go much higher.

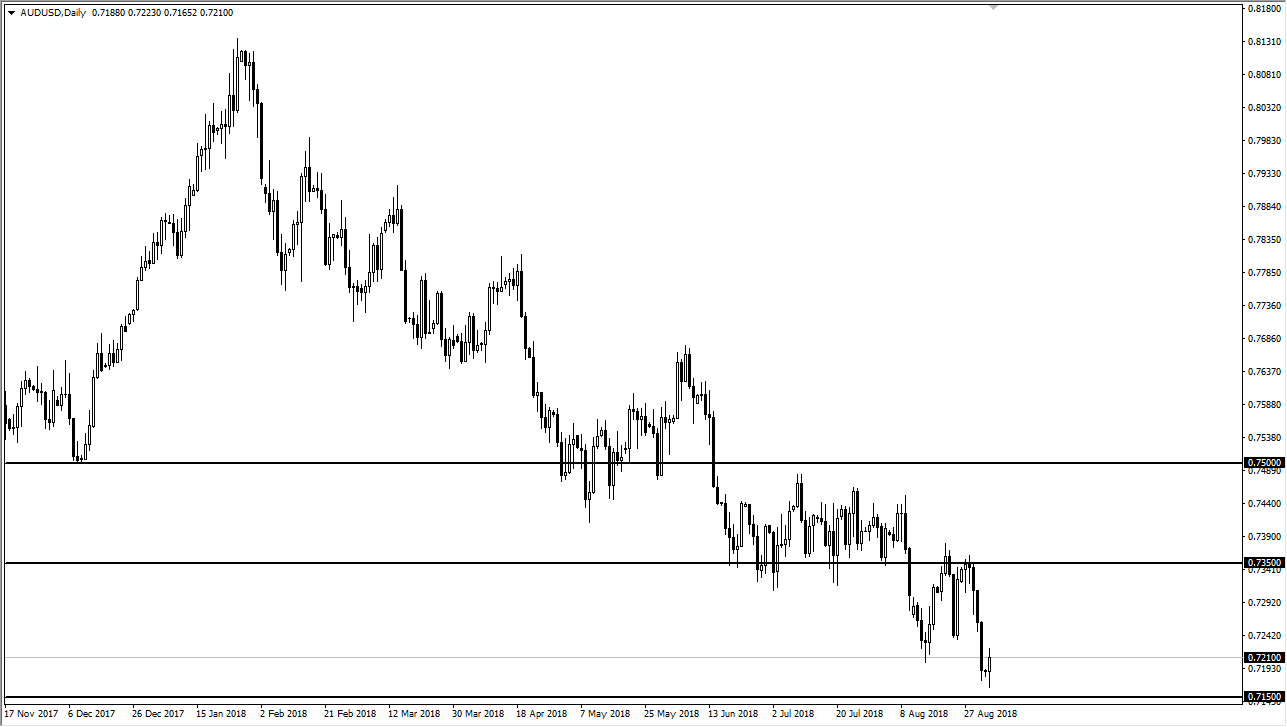

AUD/USD

The Australian dollar has initially pulled back a bit during the day but found support enough to turn around and form a hammer. The 0.7150 level underneath is a massive support level based upon the weekly charts, which essentially starts at the 0.72 handle. If we were to break down below the 0.7150 level, the market could then break down rather rapidly and reach towards the 0.70 level after that. However, if we turn around and break above the top of the candle stick for the session on Monday, that could send this market looking towards the 0.7350 level. That is the top of the recent consolidation area, so it would make sense that we would at least test it again. This is also very sensitive to the US/China situation, so if we get some type of good news from that situation, the Australian dollar should be one of the largest beneficiaries in the currency market.