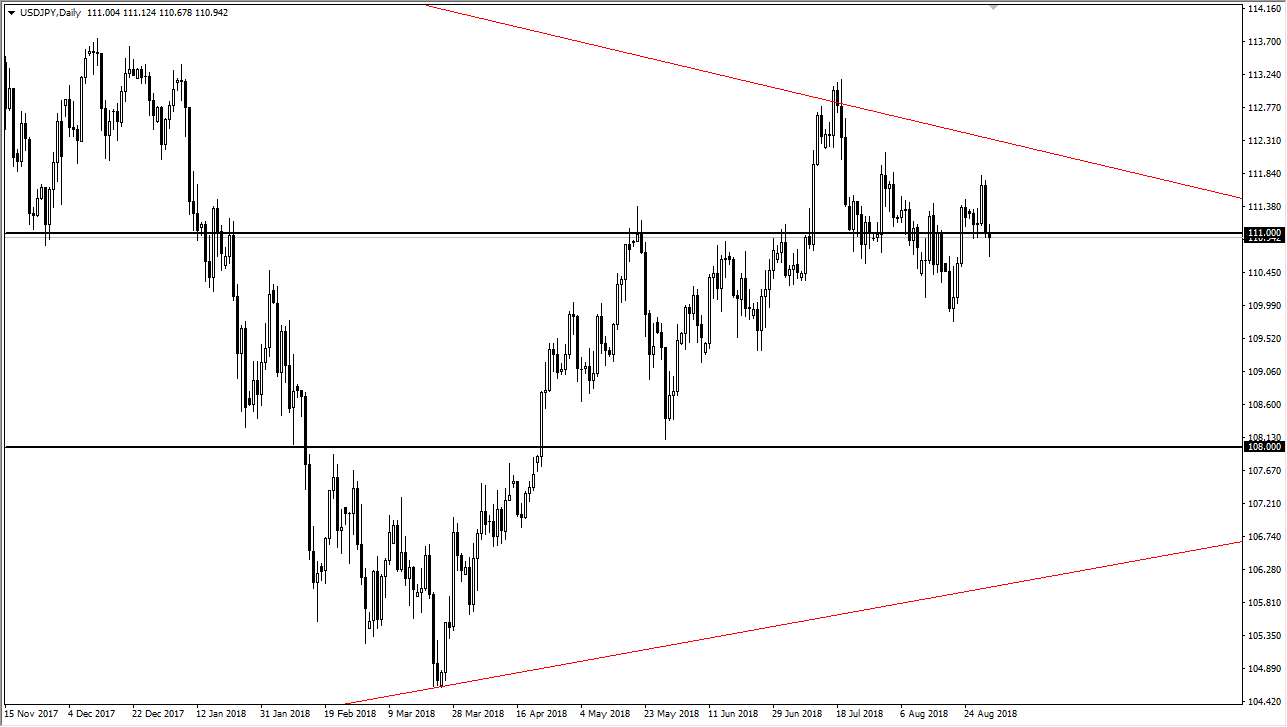

USD/JPY

The US dollar fell during the portion of the Friday trading session but bounced enough to stabilize at the ¥111 level. If we can break above the downtrend line that is marked on this chart, it’s likely that we will continue to go much higher. That is a major downtrend line that goes back months, and this pair is a perfect proxy for what’s going on the world: a lot of noise and a lot of concern. If there is an increase in tariffs against the Chinese, that could weigh upon this market. However, if things calm down and cooler heads prevail we should continue to go higher. Overall, there should be US dollar strength, but that is based upon fear more than anything else. In this marketplace it can work backwards. I think the one thing you can count on is a ton of erratic and fearful trading.

AUD/USD

The Australian dollar has broken down during the trading session on Friday, slicing through the vital 0.72 handle. Because of this, I think we are pressing the last vestiges of support and it seems likely that we could break down from here. Member, the Australian dollar is highly sensitive to what’s going on in the Chinese economy, and with the US getting ready to add even more tariffs to Chinese goods, it’s likely that we will see the Aussie suffer as a result. Overall, I think this market is going to continue to struggle, and we very well could see a drop as low as 0.70 over the longer-term. Rallies are probably to be sold, unless of course we can recapture the 0.7225 level, as it would show resiliency. As long as there are problems with the trade front, it’s likely that this pair will suffer.