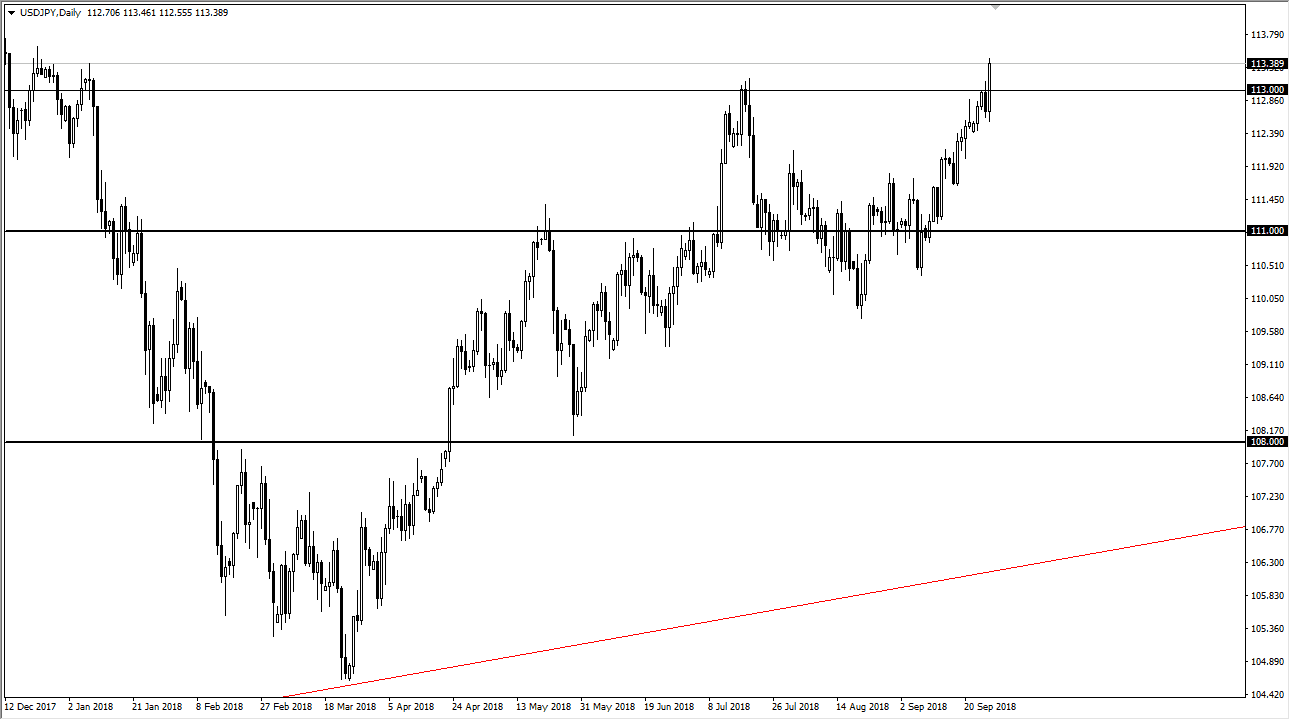

USD/JPY

The US dollar rallied significantly during the session on Thursday, as we have finally broken above the ¥113 level. By closing above there at the end of the day, that’s a very bullish sign and I think we are heading towards the ¥114.50 level. That’s the area of major and resistance, and I think it will be difficult to get above there. If we did, it would become even more of a “buy-and-hold” market. I anticipate a lot of noise in this pair, but with the interest rate differential most decidedly favoring the United States, it makes sense that the buyers return to this market looking for value every time it pulls back. By closing above ¥113, that is a very valid and very strong sign going forward. This pair is sensitive to the US/China trade war, so it does slow it down a bit.

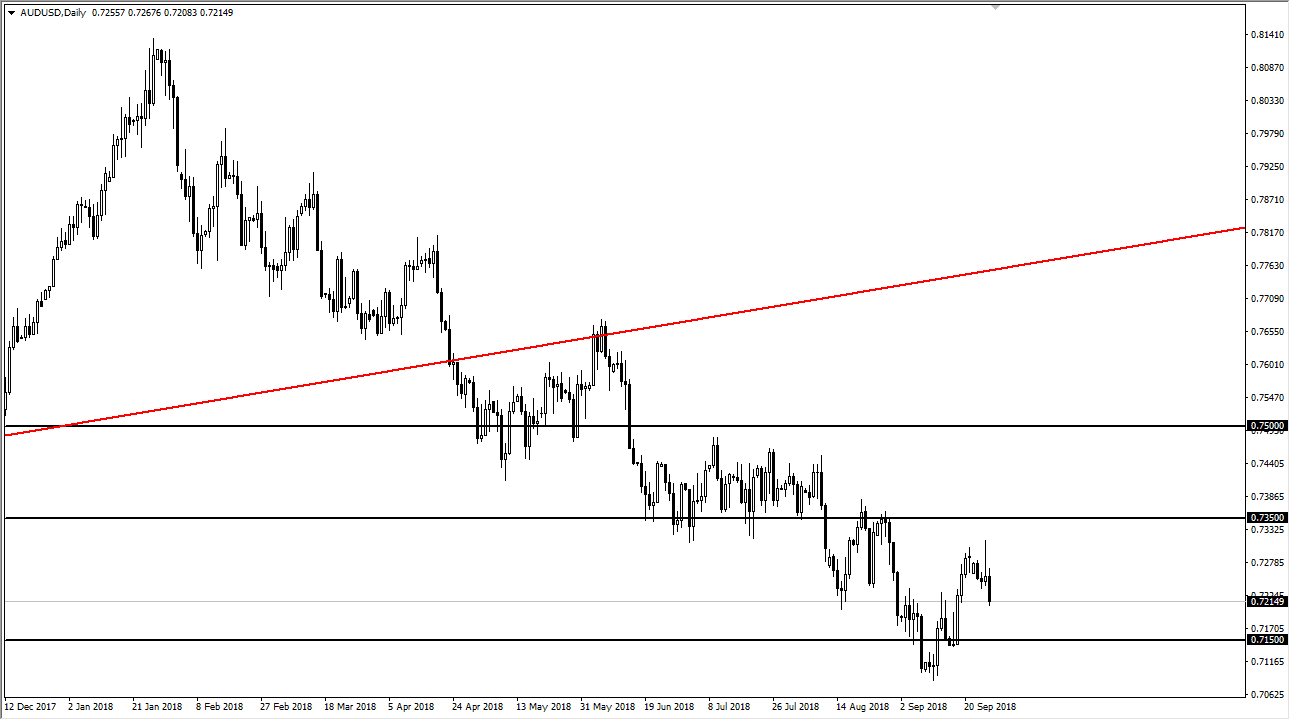

AUD/USD

The Australian dollar has broken down below the bottom of the shooting star from the previous session, showing signs of a move down to lower levels. At this point, I anticipate that the 0.7150 level will be supportive, and then of course the 0.70 level after that. If we rally from here, I think that will continue to be a selling opportunity. The 0.7350 level above is massive resistance, and I think it would be a bit of a surprise if we broke above there. Ultimately, I think that the market continues to find sellers every time we rally, because quite frankly the Australian dollar is highly sensitive to the situation between the Americans and the Chinese. After all, the Australians provide a lot of the raw materials for the Chinese economy, and that continues to be a major issue here.