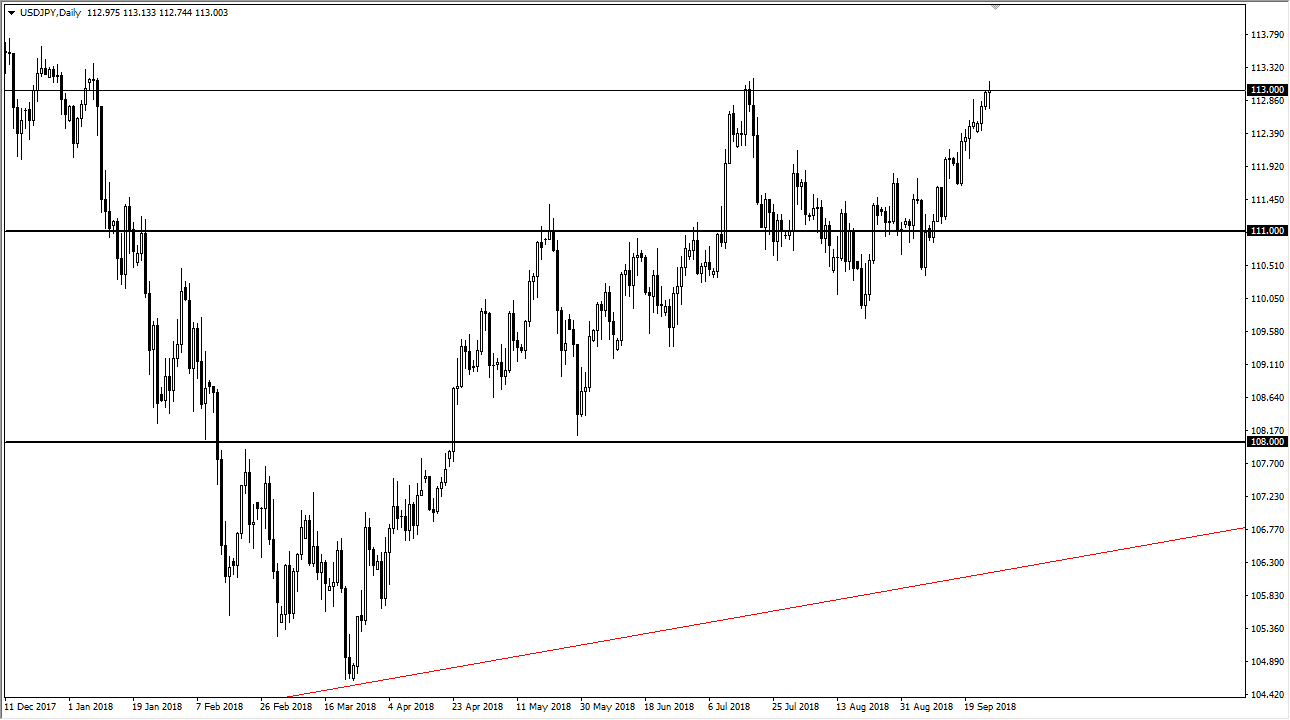

USD/JPY

The US dollar has been very volatile against the Japanese yen during the FOMC statement session as one would expect, breaking above the ¥113 level a couple of times during the day, but suddenly not hovering just around there at the time I am recording this. However, it does look as if the market is trying to break out and with higher interest rates coming down the road it’s very unlikely that there will be much to stop it from happening. Ultimately, I think that the market probably goes looking towards the ¥114.50 level above, which is a major resistance barrier. Interest rate differential continues to favor the United States by far, as the Bank of Japan is light years away from doing anything remotely close to monetary policy tightening. I still prefer to buy the dips going forward and have been building up a core position.

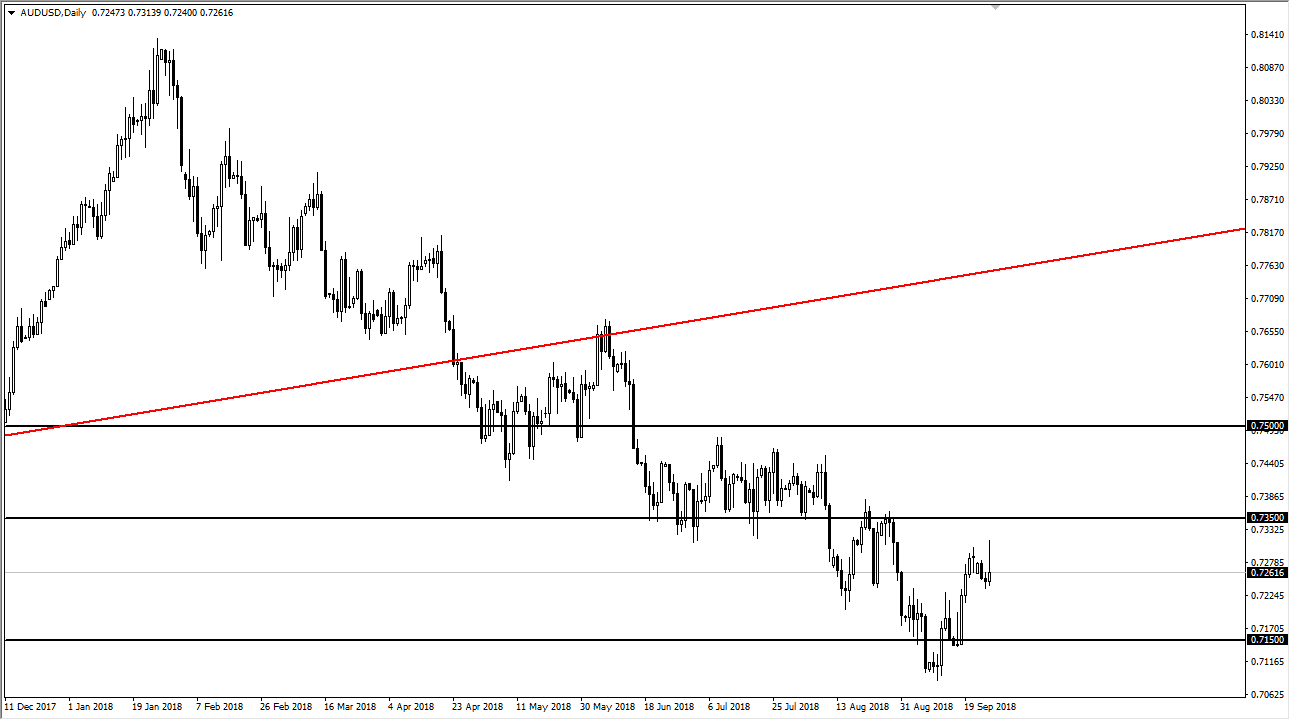

AUD/USD

The Australian dollar initially tried to rally during the trading session on Wednesday but gave back most of the gains in order to form a massive shooting star like candle. This shows just how little trust there is in the Aussie rally at this point, and I think this foretells more US dollar strength against it. Beyond that, the trade war continues to heat up, so keep that in mind as well. Even if we were to rally from here I anticipate that there will be a lot of resistance above at the 0.7350 level, so I was looking for an opportunity to sell anyway. We may get a bit of a bounce, but that bounce should give us an opportunity to pick up the US dollar “on the cheap.” However, if we did turn around to break above the 0.7350 level that would be massive in its implications.