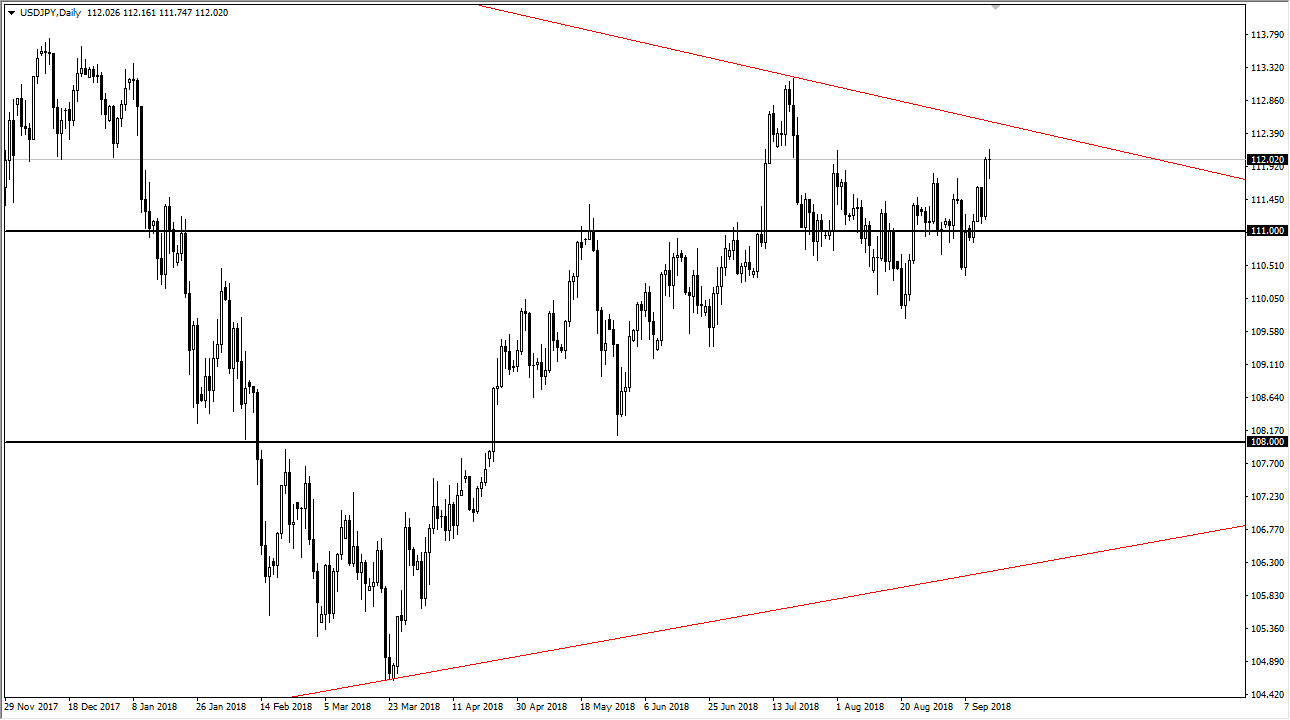

USD/JPY

The US dollar rallied but then gave back the gains during the trading session on Friday against the Japanese yen. There are a lot of concerns when it comes to global trade right now, and that of course will weigh upon this pair. The fact that President Trump plans on slapping another 200 billion in tariffs against the Chinese ahead of talks has the market thinking negative thoughts about any type of settlement, and that will continue to be a weight around the neck of this pair because it is highly levered to stock markets. However, the US dollar has been enjoying a bit against many of the other major currencies out there, so I think that keep this in a back-and-forth type of situation. If we can break above the ¥112.50 level, we would clear the downtrend line to go much higher. Ultimately, I think that’s what happens but we may get a pullback in the meantime down towards the ¥111 level.

AUD/USD

The Australian dollar try to rally again during the trading session on Friday but gave back most of the gains. By doing so, we have triggered a sell signal based upon the shooting star from the previous session. The 0.7150 level has offered a bit of support, so all is not lost but quite frankly I think if we break down below that level we will test the lows again, and then perhaps go looking towards the 0.70 level, something that I think is bound to happen regardless. With that in mind, I am a seller of short-term rallies as they appear, and of course shows signs of exhaustion. I think this pair will need to see the US and China being a bit more agreeable with each other before it turned around and rallies.