S&P 500

The S&P 500 rallied significantly during the day but turned around to form a shooting star for the day. However, this was quadruple witching day, which is the culmination of four different option expirations. At this point, I would read too much into the shooting star other than the 2950 level was a bit too much for the market to overcome. I think a pullback could come, but quite frankly that should be a nice buying opportunity in what is an obvious strong uptrend. If we break above the 2950 handle, then the market probably goes to the 3000 level. This is a market that continues to grind higher, but ultimately I think that the volatility will probably only pick up going forward, as we have so many global headlines that could rock the markets back and forth. I bullish, but cautious.

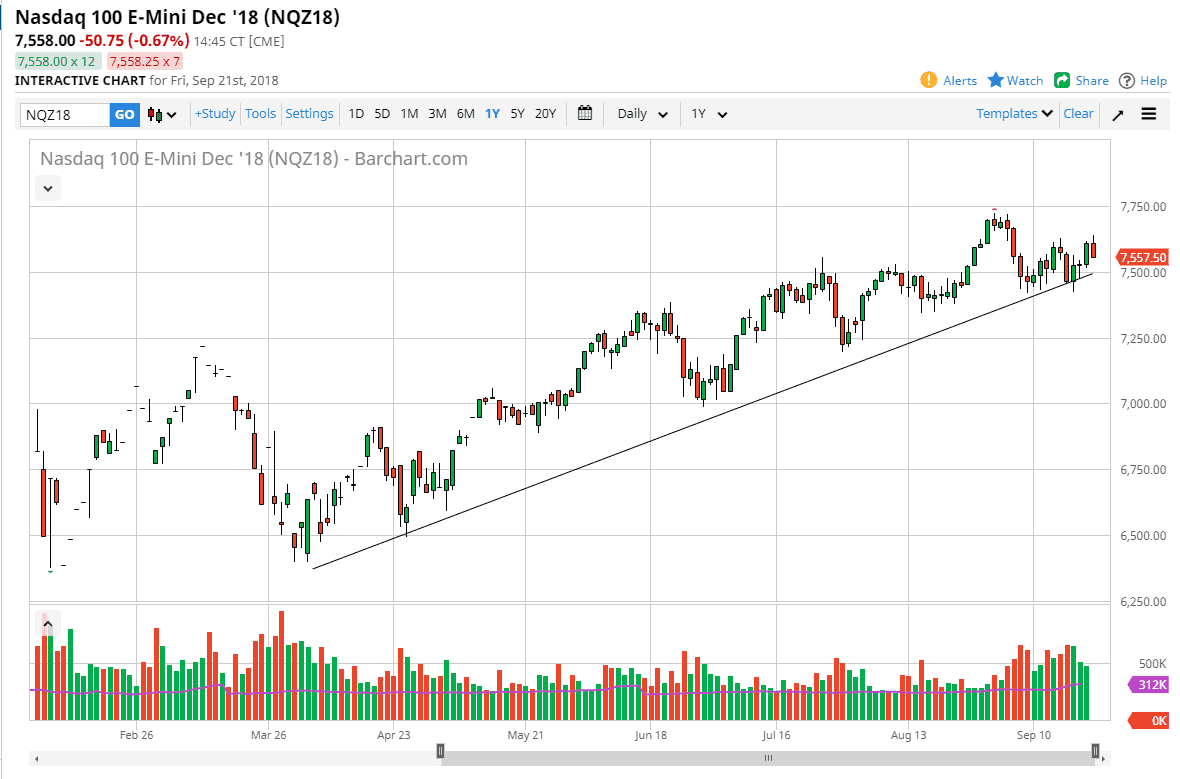

NASDAQ 100

The NASDAQ 100 initially tried to rally during the day, but then broke down as we have seen the market trail the S&P 500 for some time. I think that the market probably will continue to find buyers underneath, as the trend line has been so reliable. The NASDAQ has found a significant amount of resistance near the 7625 handle, but also has this uptrend line working as support, so I think at this point it’s likely that we are going to see this ascending triangle break out to the upside. If we do break down below the uptrend line, that could send this market down to the 7425 initially, and then 7250. I do believe in the uptrend though, and I think we should continue to see value hunters command on these dips. Again, with quadruple witching happening, you can’t read too much into the late day weakness.