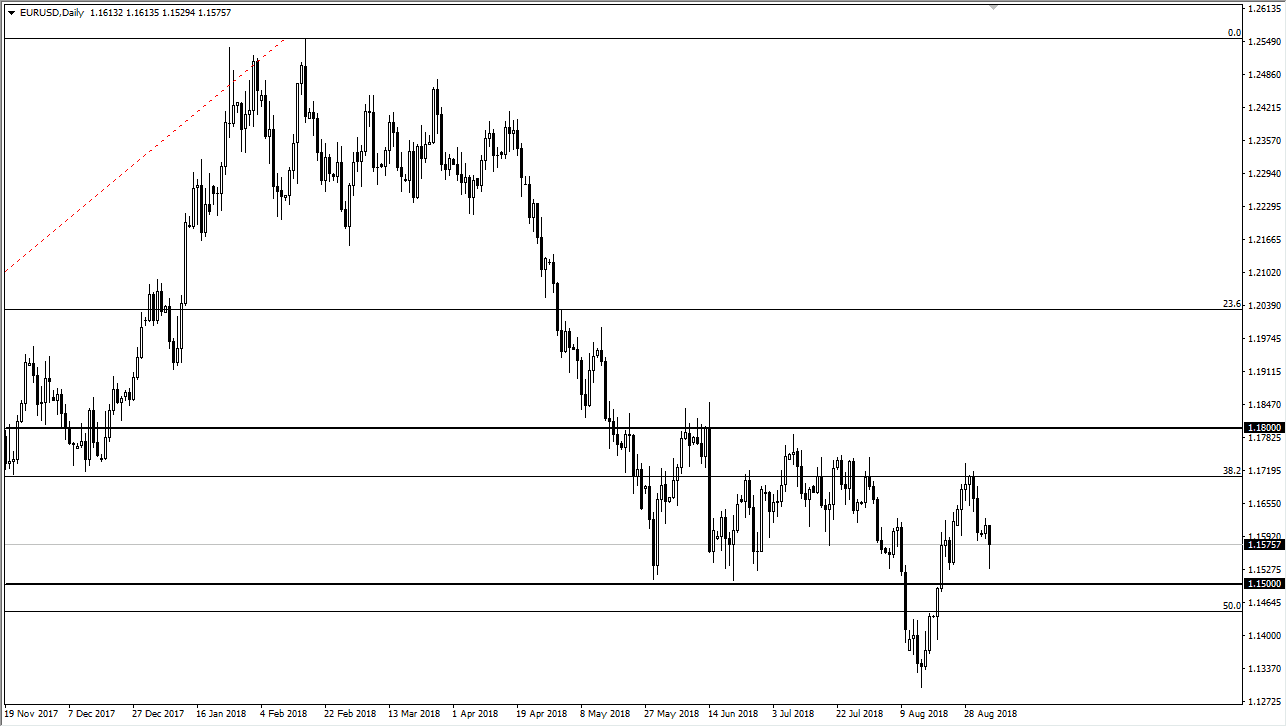

EUR/USD

The EUR/USD pair has initially fallen rather hard during the trading session on Tuesday but has turned around of form a massive hammer. By doing so, the market looks as if it is going to hold the 1.15 level, an area that is crucial for the currency. If we can break above the top of the candle stick for the day, then I think that the Euro will go looking towards the 1.1720 level again. Otherwise, if we break down below the 1.15 handle, the market will unwind to the 1.13 region over the following several sessions. I anticipate that a lot of this comes down to risk appetite, which seems to be fluctuating on a daily basis. The 1.18 level above is massive resistance, and if we can break above that level I think the market would be free to go much higher.

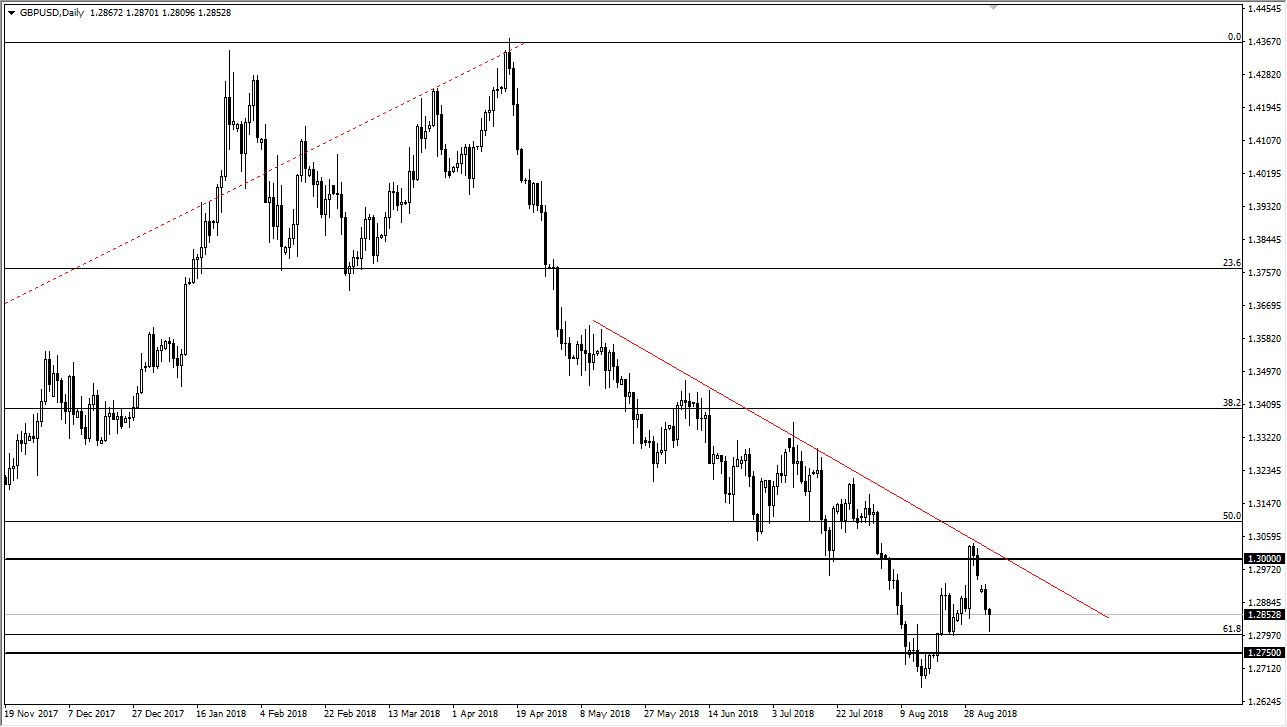

GBP/USD

The British pound initially fell during trading on Tuesday but found enough support to turn around. By doing so, it ended up forming a hammer which of course is a very bullish sign. If we can break above the top of the hammer I think we will go ahead and try to fill the gap from earlier in the week. We have the jobs number later, so that will have an influence as well, and keep an eye on the downtrend line that is just above. If we can break above that, then I think the British pound could go much higher. I believe that the 1.2750 level underneath will continue to offer significant support as well. Overall, I believe that today’s action was crucial. However, we obviously have a lot of headwinds coming from the Brexit and all the political theater in Great Britain.