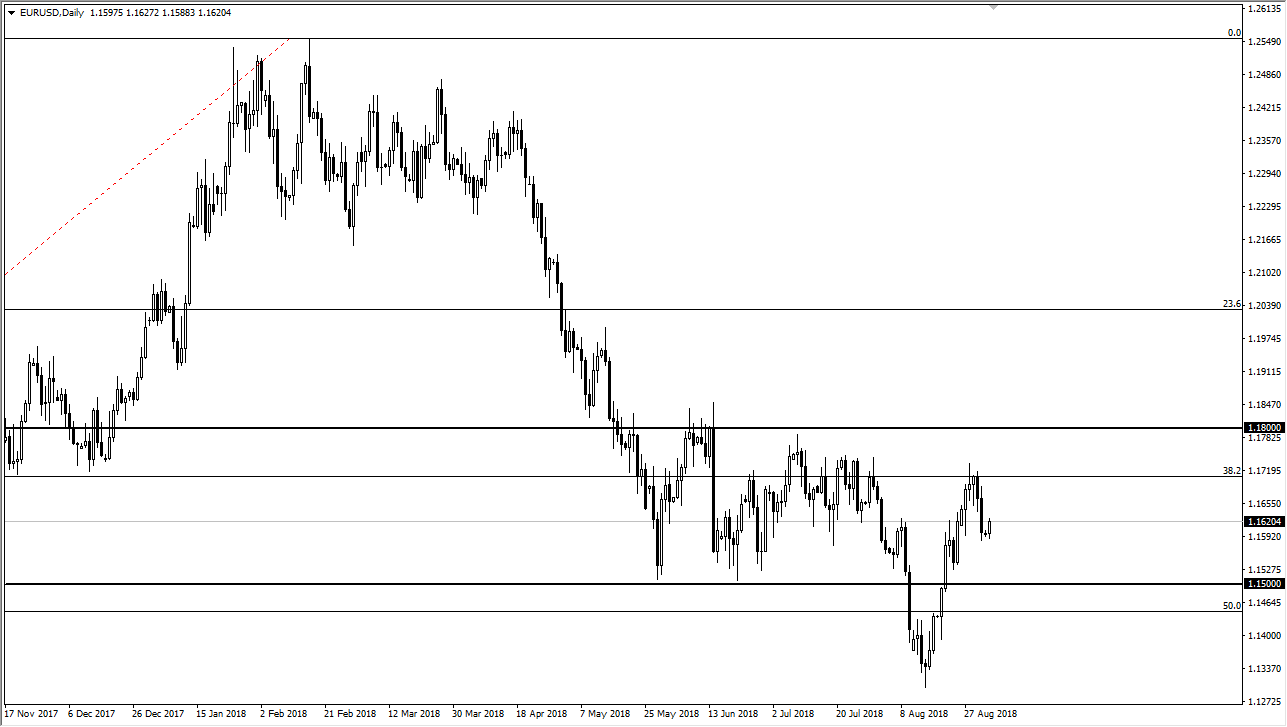

EUR/USD

The Euro rallied a bit during the day on Monday, showing signs of life again as the 1.16 level has offered support. The market continues to try to break to the upside, but the biggest thing that I see here is that we are hanging about in a massive consolidation area with the 1.15 level underneath offering support, and the 1.18 level above there looking for resistance. The market looks very likely to remain choppy, and this of course will continue to be an issue with traders getting involved in the market, as the Turkish contagion issue is a never-ending menace, and of course the Brexit continues to be a major issue for the European Union, so overall I think that this market continues to be very skittish to that situation as well. Longer-term, if we can break above the 1.18 level, then we can go to the 1.20 level, perhaps even higher than that. I would anticipate a lot of volatility.

GBP/USD

The British pound gapped lower to kick off the week, and I think it’s possible that we may see a turnaround to fill that gap rather soon, as is typical in the currency markets. The downtrend line as you can see on the chart recognizes the 1.30 level as a potential apex that will have to be overcome, and therefore could send this market much higher. The 1.2750 level underneath could offer massive support as a “floor” as well, and that could be another buying opportunity. If we close below the 1.2750 level, then the British pound will continue to go lower. I think that the Brexit continues to be the biggest issue here, but eventually we will get some type of resolution, and then I believe the British pound will explode to the upside.