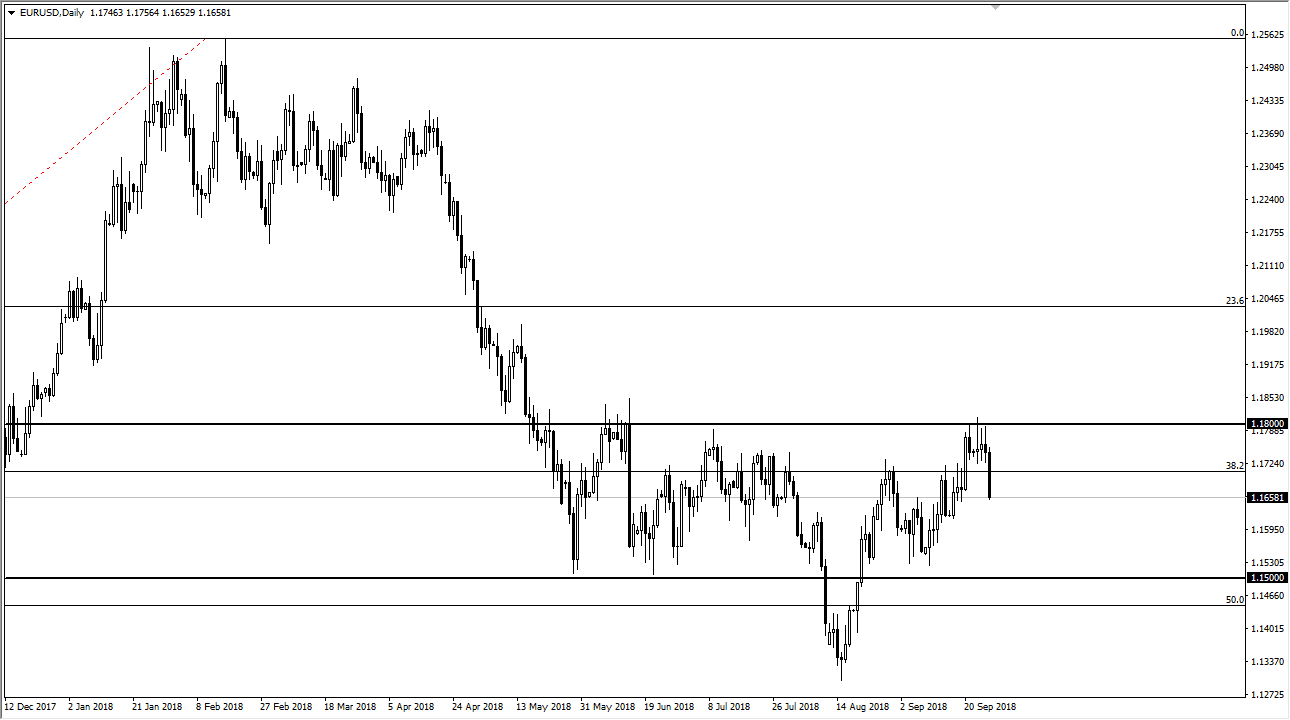

EUR/USD

The Euro broke down significantly down during the session on Thursday, breaking below the bottom of three previous shooting stars. That is a very negative sign, and I think that the market rolling over the way it has simply shows that we are more than likely going to continue the overall consolidation that we have been in. The 1.18 level above has been resistance, just as the 1.15 level has been support. At this point, I anticipate that we stay in this range, and therefore it’s likely that we have further downside to go. It makes sense, because the Federal Reserve is much more aggressive about monetary policy tightening than the ECB is. The inability to break above the 1.18 level says that we are simply not ready to break out of the range.

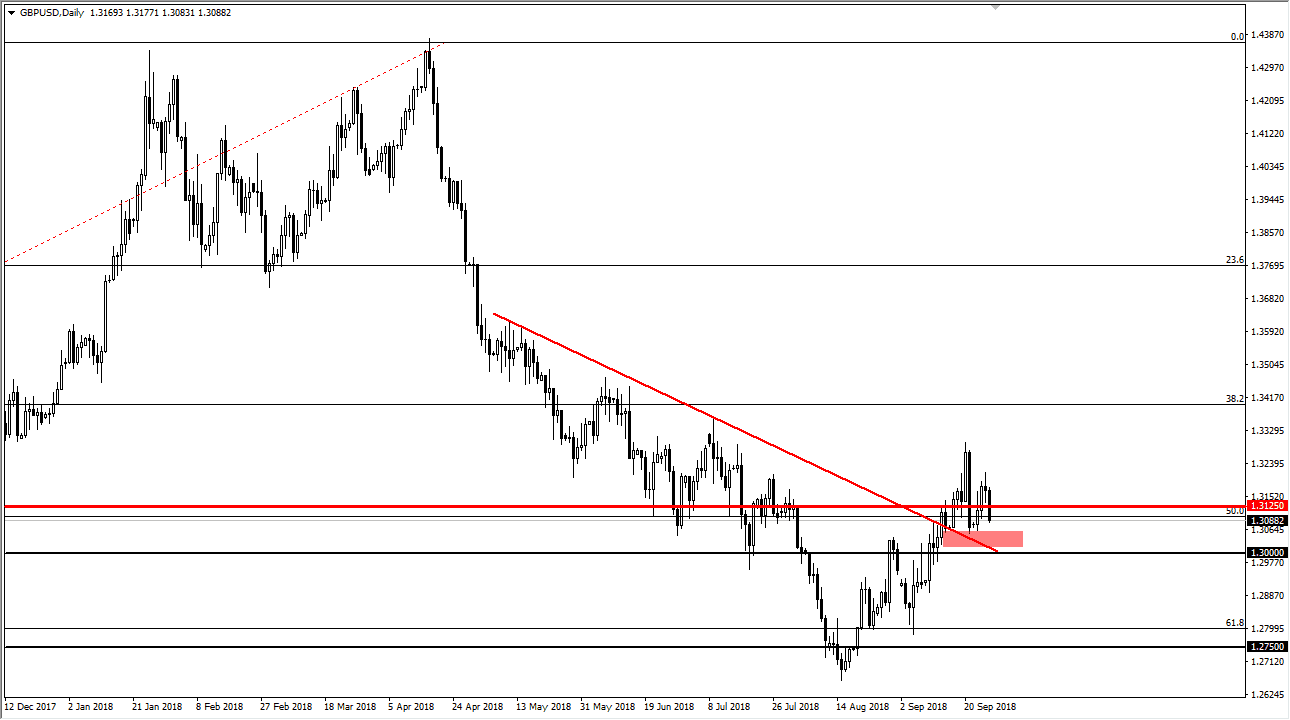

GBP/USD

The British pound also broke down, slicing through the 1.3125 level, an area that is previous support and resistance. However, we have the downtrend line offering support underneath, and I think that the 1.30 level underneath should also be massive support. Ultimately, this is a market that continues to see a lot of volatility, and I think that it’s only a matter of time before the value hunters will come back. I see a massive amount of support just below, and it’s quite common to see a breakout of a trend turned into consolidation before a reversal. That might be what’s going on here, but ultimately I think that the next couple of days will be rough and range bound. I’d be very cautious about my position size, and only add if the market goes in your direction. If we turn around and break down below the 1.30 level, then we unwind another couple of candles.