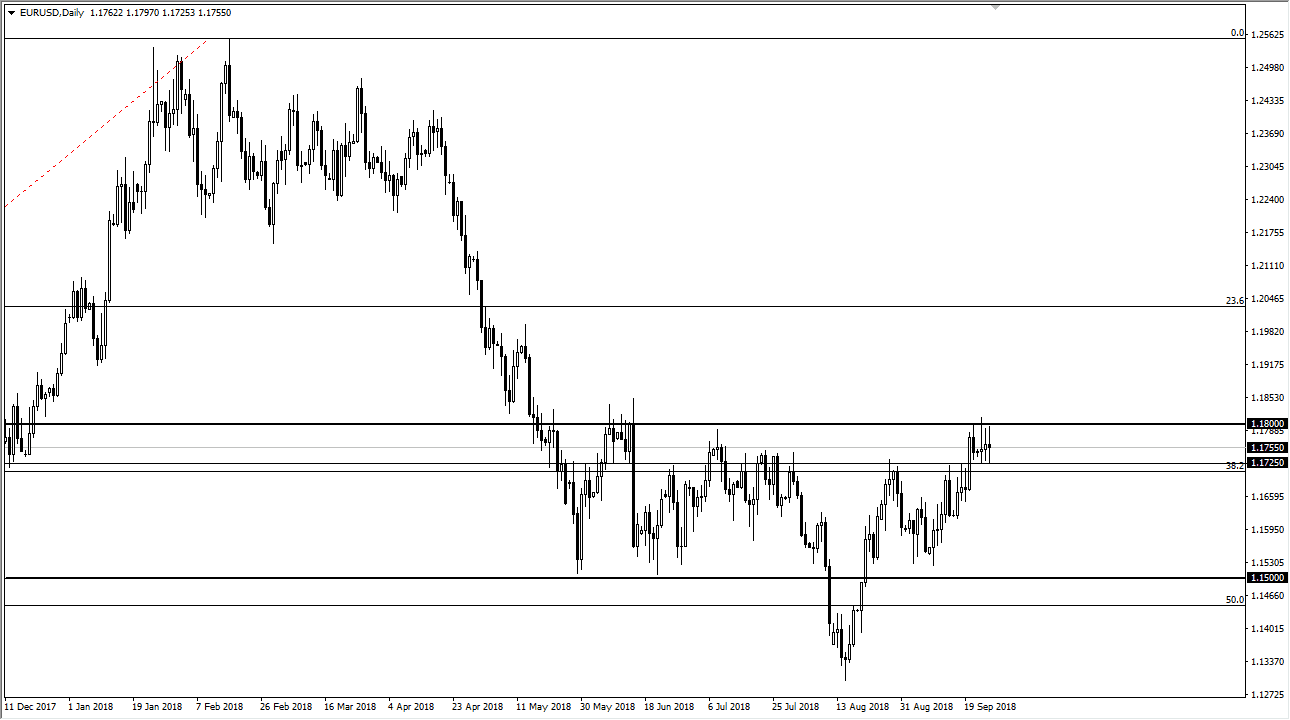

EUR/USD

The Euro went back and forth violently during the day on Wednesday as the FOMC statement had everybody’s attention. The 1.18 level above has offered resistance yet again, but again we see the 1.1725 level offer support. This is a massive consolidation and quite frankly there is only one question to ask here: “can we break above 1.18?” If we do, the market goes higher, perhaps reaching towards 1.20 level. If we don’t, we will eventually find a reason to break down towards the 1.1725 level and below it. At that point, I would anticipate a move to the 1.15 level as it is obvious the market has no idea where to go from here. This would probably be a sudden move and could be rather reactive to some type of headline or sudden shift in sentiment.

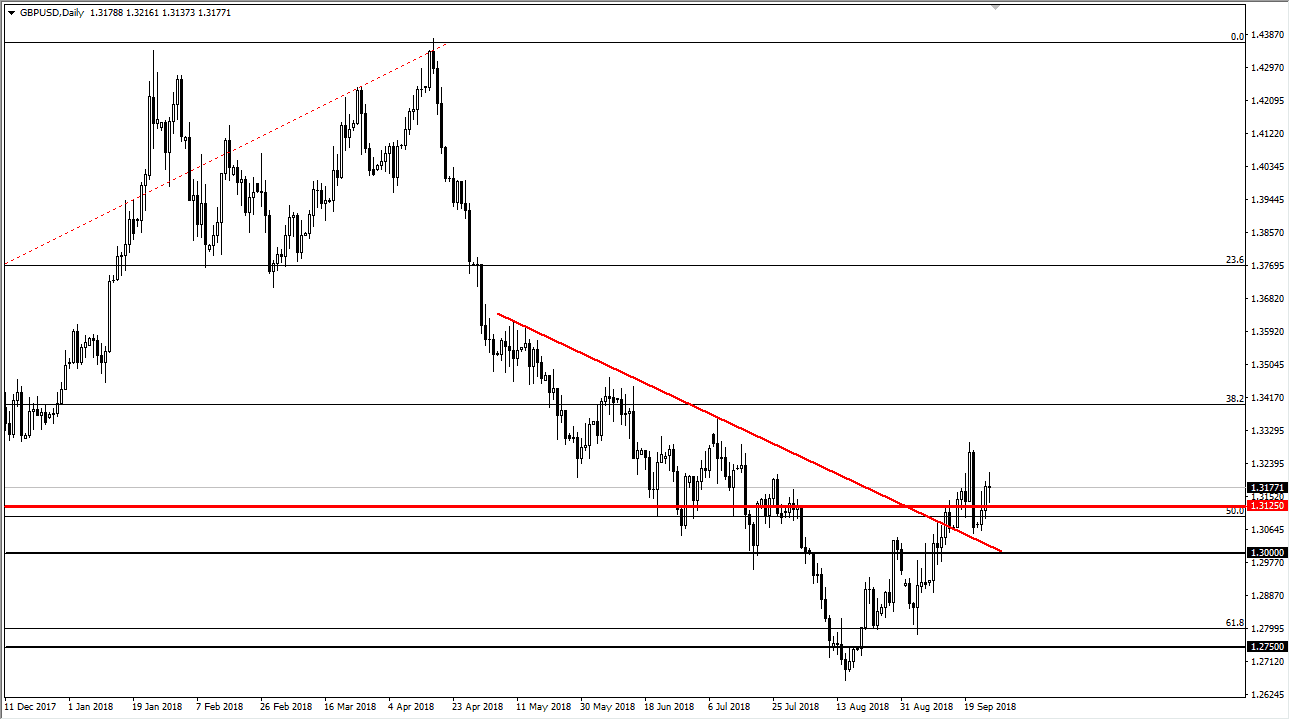

GBP/USD

The British pound has gone sideways overall during the day, essentially trying to figure out where to go next. The 1.3125 level has offered support, and that is crucial and what has been a nice move higher overall. However, we got a massive selloff last week and of course we have all of the noise from the Brexit negotiations. With that in mind it’s difficult to imagine a scenario where it’s going to be easy to trade this market. I believe in the longer-term validity of the uptrend, but I also recognize there will be the occasional setback and therefore you should look for pullbacks to pick up a little bits and pieces of a potentially larger position. I believe that the 1.30 level is the “floor” in the market, so a break down below that level would be rather drastic for the negativity in the market.