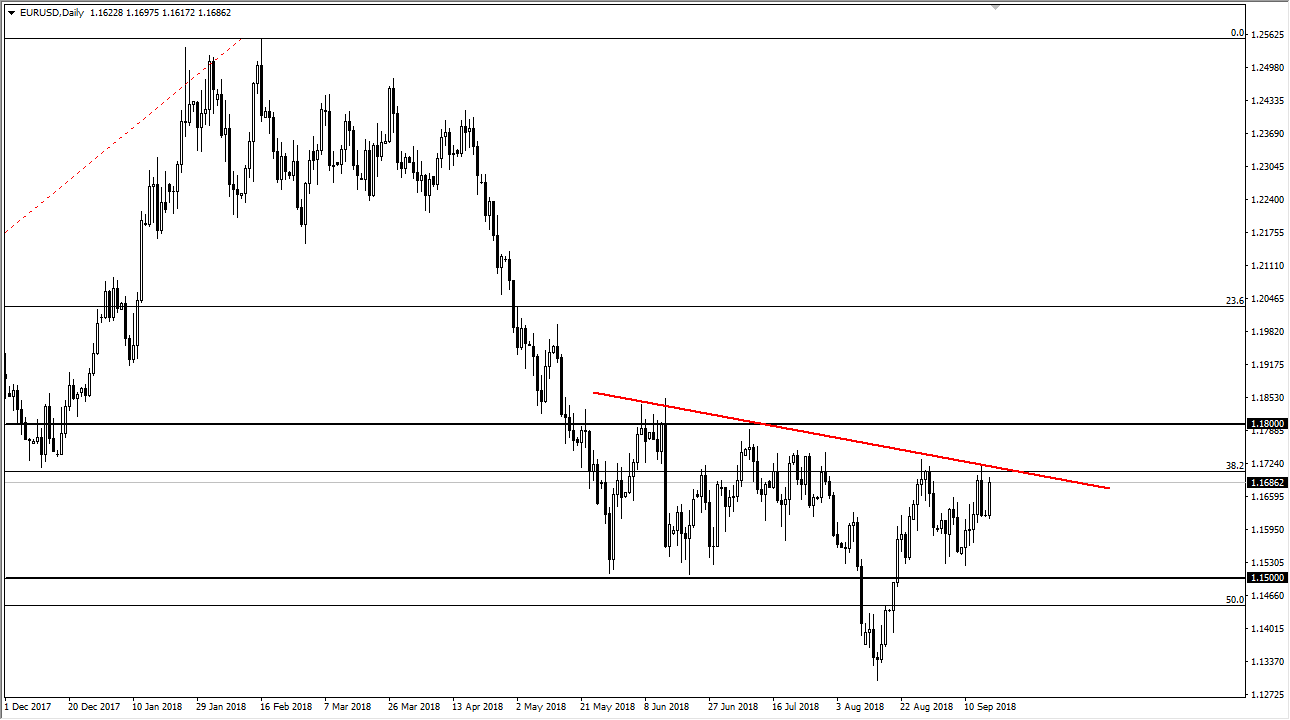

EUR/USD

The Euro rallied significantly during the trading session on Monday but remains below this downtrend line that I have drawn on the daily chart. I think there is a significant amount of resistance all the way from the 1.1750 level, extending to the 1.18 handle. Any type of exhaustion above should be a nice selling opportunity though, so I’m more than willing to start getting involved to the downside on an exhaustive candle. However, if the market does close above the 1.18 level on a daily close, then I think we can go higher, perhaps reaching towards 1.20 level. This is a market the most certainly has a lot of volatility attached to it, mainly because of emerging markets, which have been strengthening the US dollar in general as of late. Ultimately, I think a pullback is very likely, but should offer a nice buying opportunity.

GBP/USD

The British pound broke higher during the trading session on Monday, breaking above the 1.3125 level. That’s an area that is crucial, and I think at this point it’s very likely that the British pound could continue to rally, but we may need to pull back occasionally. By pulling back, that gives us an opportunity to pick up a bit of value, because quite frankly the market should continue to recognize this break out to the upside, and I think at this point it’s very likely that the market breaking above this latest cluster should help solidify the idea of breaking out above the downtrend line that I also have marked on the chart. Short-term pullbacks are very likely, but that should offer a lot of value for those looking to play the long term cheapness of the British pound. Obviously, if we get any type of good news coming out of the Brexit negotiations, that will send this pair higher.