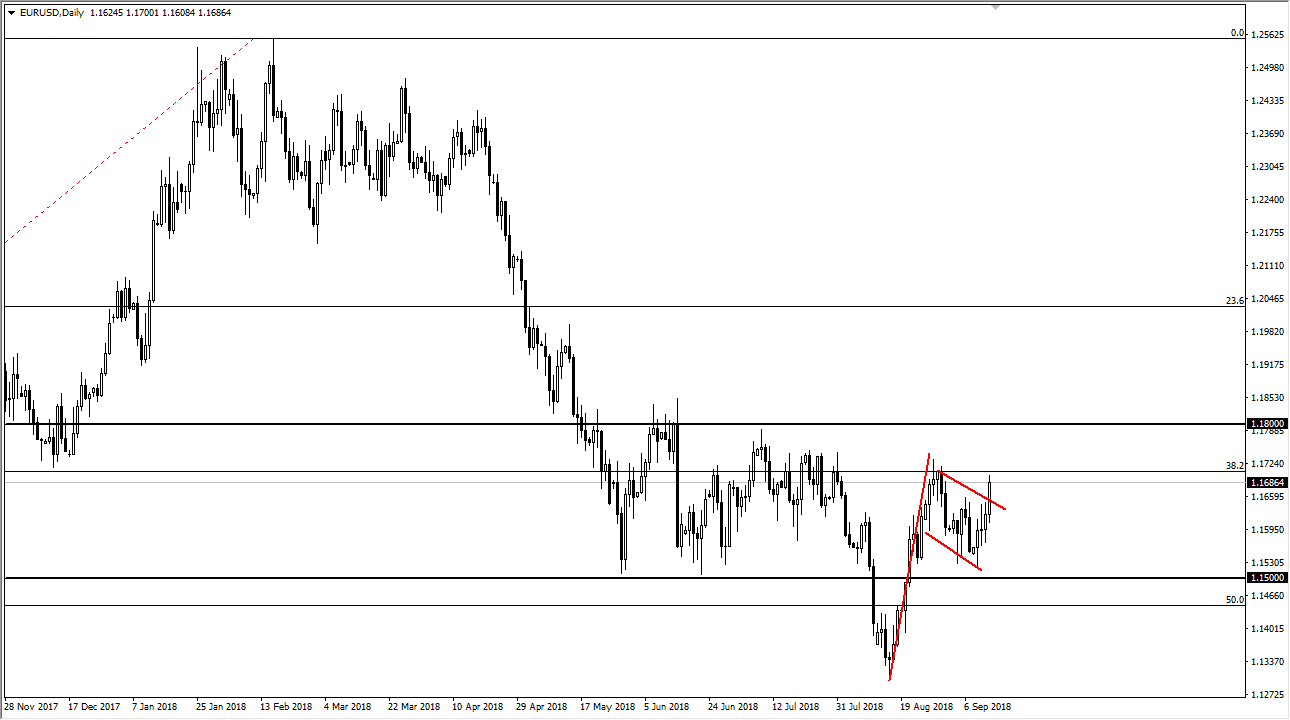

EUR/USD

The Euro rallied significantly during trading on Thursday as CPI numbers in America missed. Interestingly enough, Mario Draghi suggested that the ECB would be in extreme easy mode until at least summer of next year, which wasn’t exactly bullish. However, the US dollar was the one punished. As a result it looks as if we are trying to break out to the upside. I have drawn a bullish flag of sorts on the chart, which I’m not necessarily convinced of quite yet as we are plowing right into major resistance, but if it does turn out to be true it signals a move towards the 1.20 level. I do think that eventually will get there, but I anticipate that we will probably get pullbacks in the meantime to try to collect more momentum. There is a lot of resistance at the 1.1750 level that extends to the 1.18 handle. Look for value and then take advantage of it.

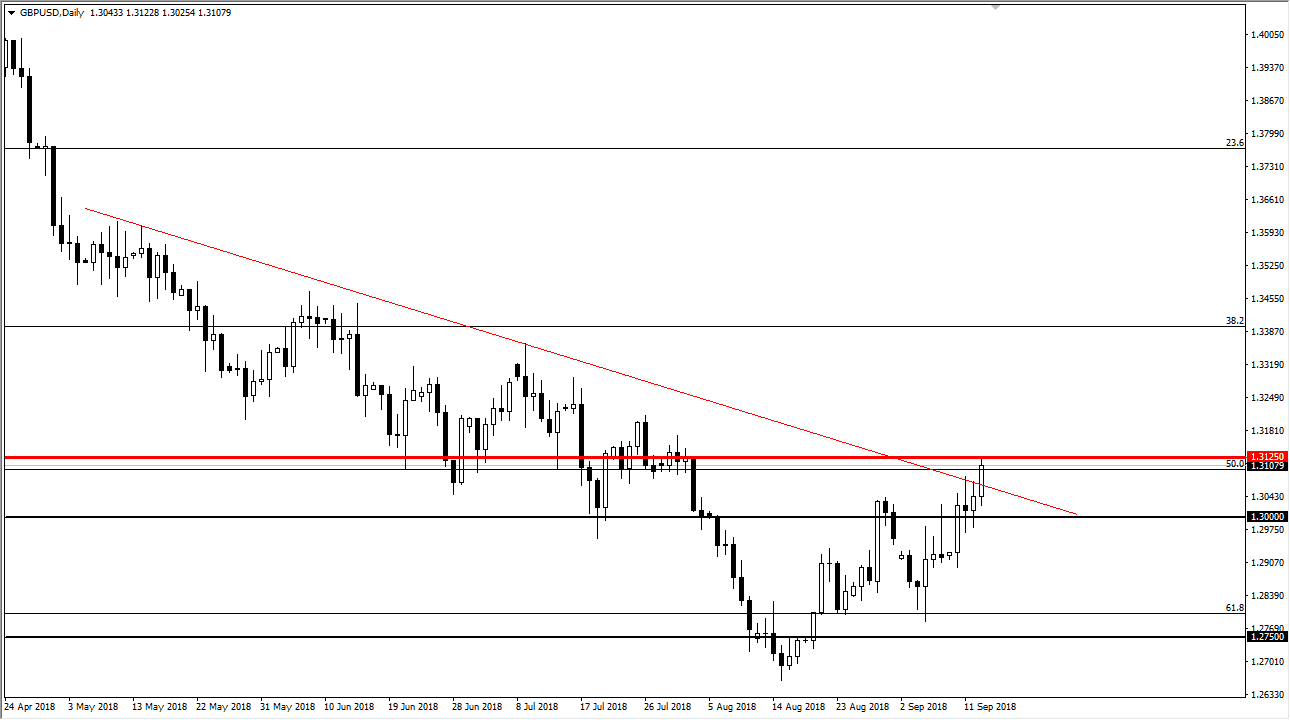

GBP/USD

The British pound rallied as well due to the same reasons, slamming into the 1.3125 level. You can see that there is a massive negative bar that form there, and a lot of noise right before it. I think that’s an area that if we can break above, would prove that the trend is changing overall and that we will continue to grind away to the upside. This is early days, but I think the British pound may have already seen its low. If that’s the case, longer-term money is starting to come in and I think a break above that candlestick marked by the huge red line could be a flush of money jumping in and shorts jumping out.