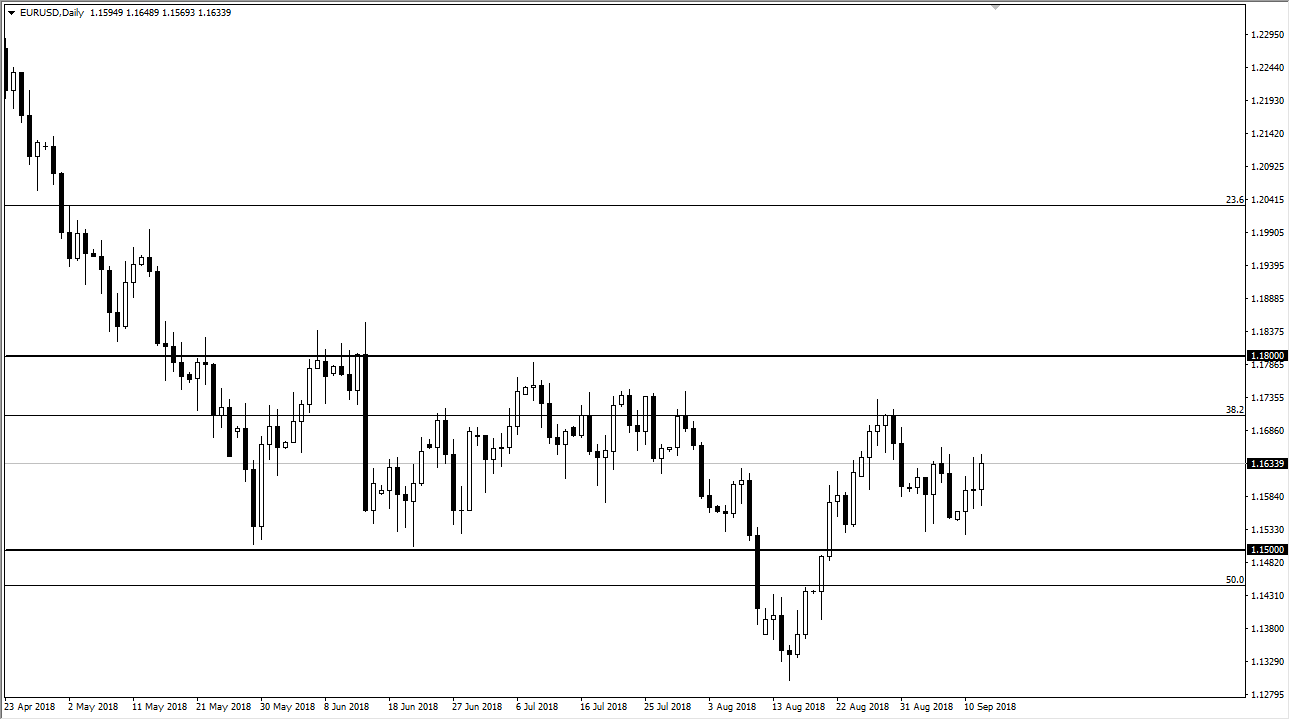

EUR/USD

The EUR/USD pair initially pulled back during the trading session on Wednesday but turned around to show signs of strength again. At this point, you can make an argument for a bit of a bull flag, and as such we could be looking at a potential move to the 1.20 level. I think that at this point the market is very erratic though, so it’s hard to make any long-term analysis although I would say this: The Euro is historically low in this area. Look at this chart, I think that short-term pullbacks will continue to be buying opportunities with the 1.15 level offering significant support, and therefore potentially a “bottom” to the market. However, the US dollar will continue to be picked up based upon fear when we get bad headlines out there, which of course was not the case during the session on Wednesday. At this point, buying the dips seems to be working.

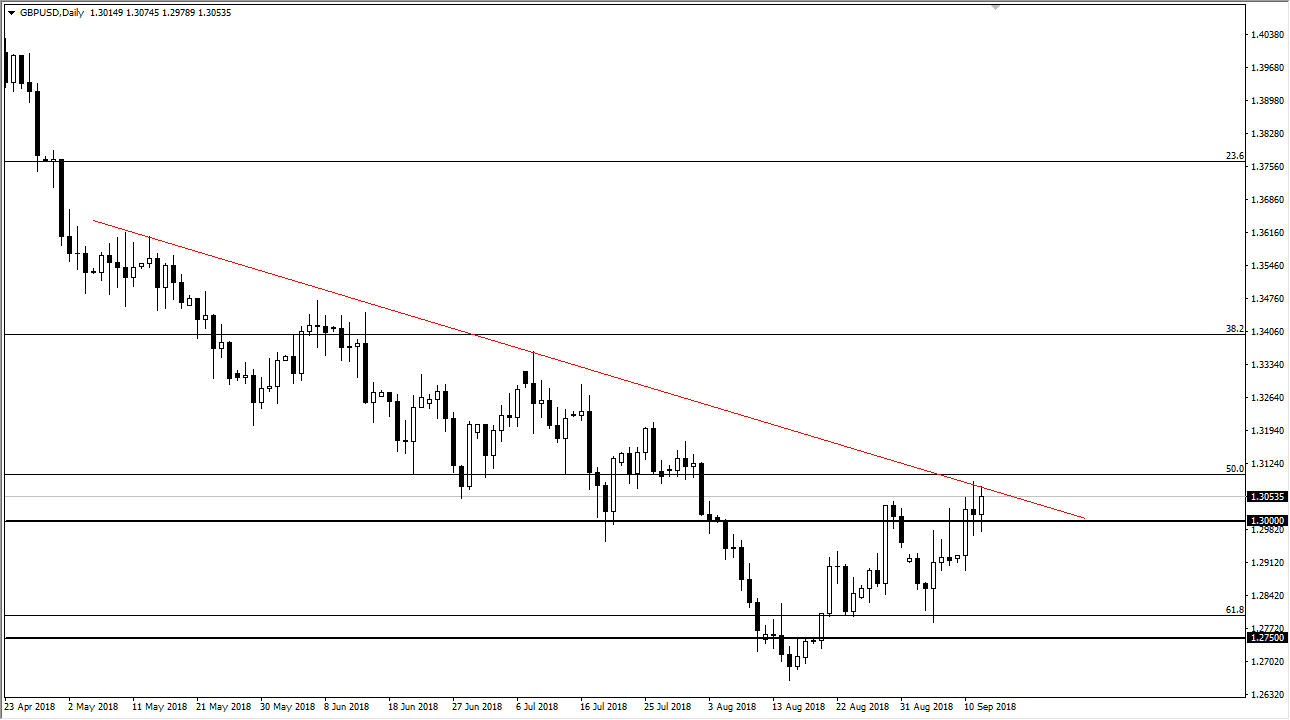

GBP/USD

The British pound got a boost again during the day on Wednesday, as it appears that the Brexit conversation continues. Looking at this chart, it’s obvious that there is a downtrend line that we need to pay attention to, and if we can break above the top of the bearish candle from the 1.3125 region, then we could go much higher. That would be a break out to the upside, and I think at that point in time they would be a lot of longer-term money jumping into this market. However, in the meantime this will be all about the Brexit and the most recent headline coming out about it. I would say this though, it seems that positive headlines are moving this market much quicker than -ones are.