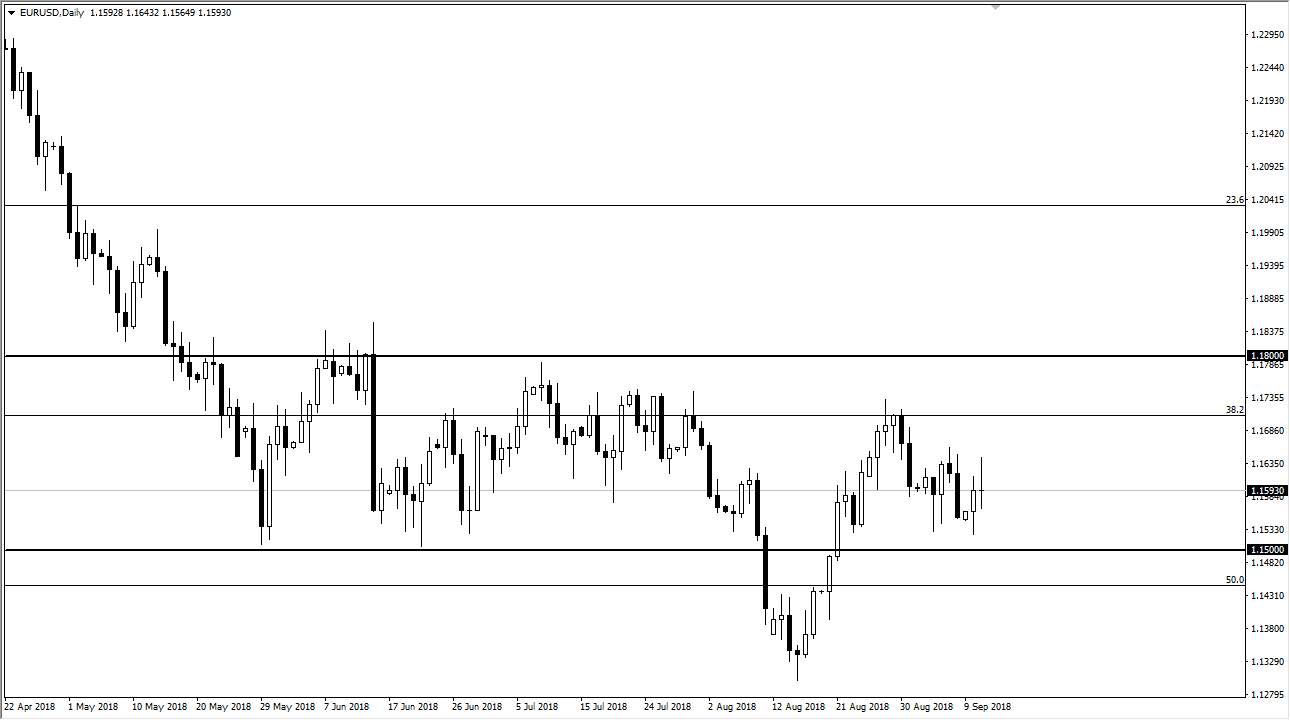

EUR/USD

The Euro tried to rally during the trading session on Tuesday but ran into a buzz saw of resistance. By doing so, it looks as if we are trying to form some type of shooting star, showing just how difficult it’s going to be to take off to the upside. However, you can also make the argument for a bullish flag trying to form, it most certainly the 1.15 level seems to be supportive. Because of this, I’m willing to buy short-term pullbacks, especially near that area. If we can break above the top of the candle stick for the day, that also is a bullish sign, perhaps sending the market towards the 1.1750 level again. Currently, the market looks likely to continue to trade between the 1.15 level as support and the 1.18 level above as resistance.

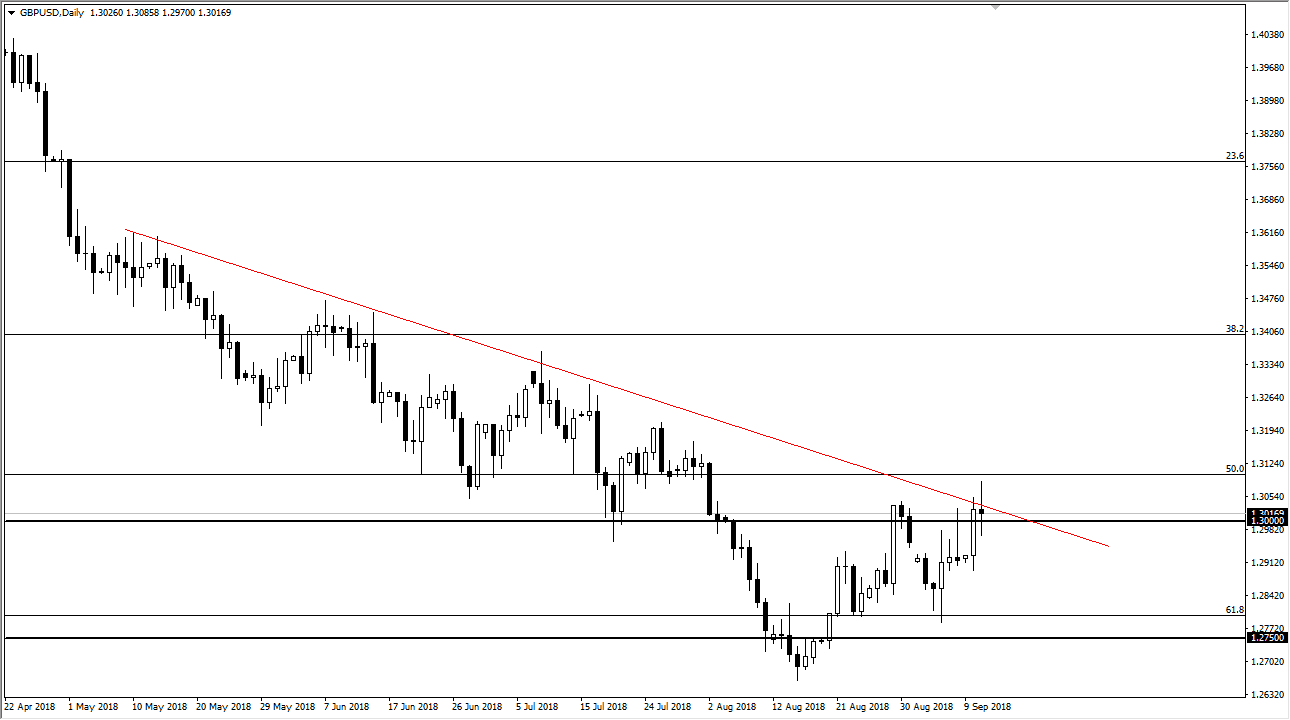

GBP/USD

The British pound was noisy again during trading, as certain headlines cross the wire to move it in both directions. For example, an EU minister suggested that the UK should be cautious about “crossing a redline”, while an Irish minister suggested that a deal was possible within the next couple of weeks. At the end of the day, we ended up with a neutral looking candle at the downtrend line. At this point, we need to clear the top of the daily candle stick for Tuesday to be comfortably long biased. The meantime, we could get a little bit of a pullback but I certainly think there is support underneath. Unfortunately, what we have seen as over the last couple of days has been that every time there is the slightest whiff of positive news coming out of the Brexit negotiations, this market explodes to the upside. After that, something else will be said that would turn things back around. I think that’s going to be the case going forward. I do think that we are trying to change the trend.