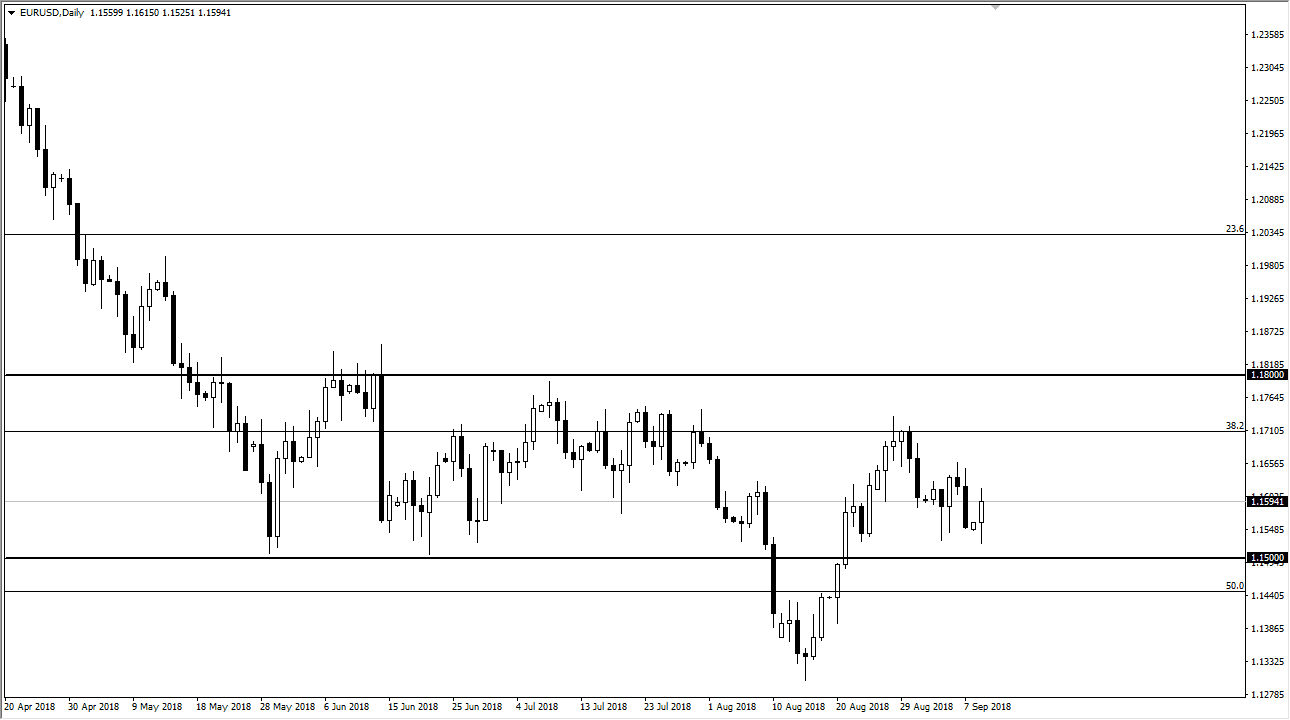

EUR/USD

The Euro initially fell during the trading session on Monday but found enough support just above the 1.15 level again to rally. This was partially due to comments coming out of an EU official suggesting that a Brexit deal within two months would be a reasonable standard. Ultimately, this will be good for both the European Union and the United Kingdom, eliminating a major source of uncertainty. However, there are a lot of concerns with emerging markets as well, which of course favors the US dollar, which shows itself here. However, it looks as if we are trying to determine a trading range between the 1.15 level on the bottom and the 1.18 level on the top again, and if that’s the case short-term pullbacks should be buying opportunities. If we were to break down below the 1.15 handle, then the market could break down to the 1.14 level, possibly even the lows.

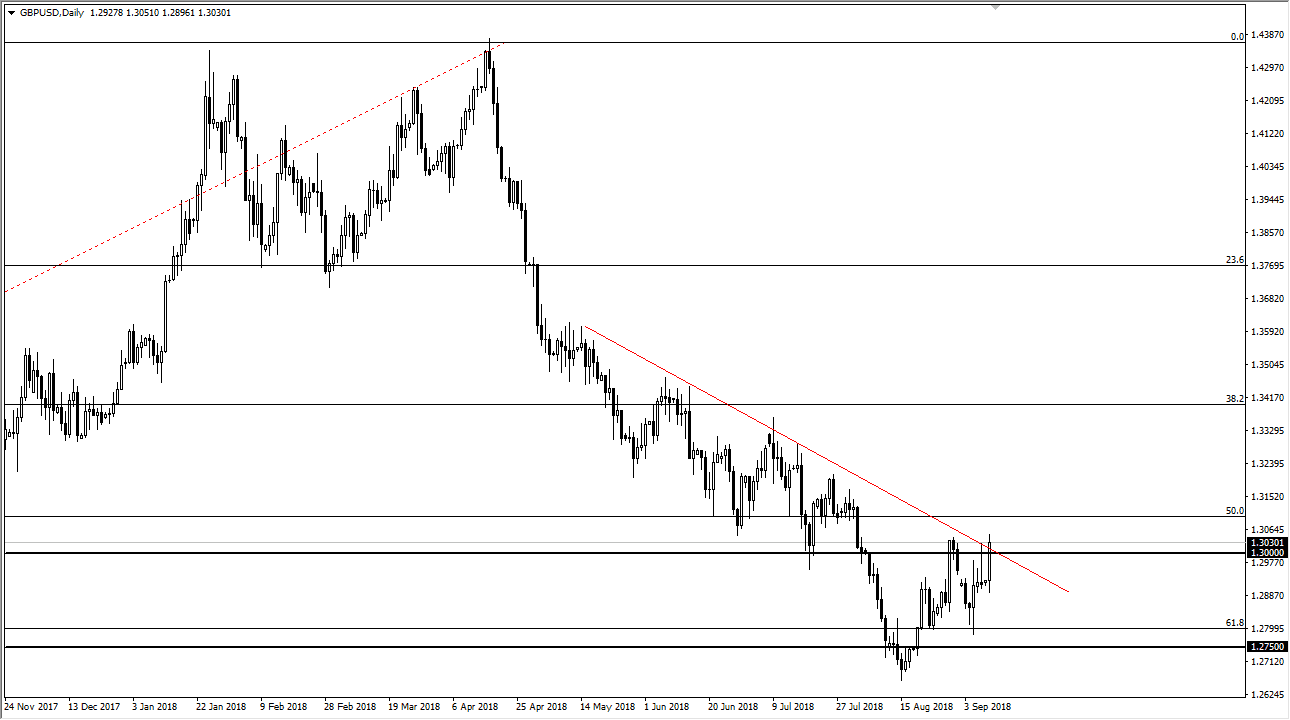

GBP/USD

The British pound exploded to the upside at those comments, because for once it wasn’t social media manipulation, it was an actual person saying these things. We are testing the downtrend line as I record this, and quite frankly I think if we can break above the 1.31 handle it will only be a matter time before the trend changes completely. If that’s the case, there could be good profits to be had long term. The alternate scenario of course is that we turn around and wipe out the daily candle, which would be very negative considering how strong it was. If that were to happen, I anticipate that the next major support level would be the 1.28 level, and then the 1.2750 level. For me, this looks like the beginning of a trend change.