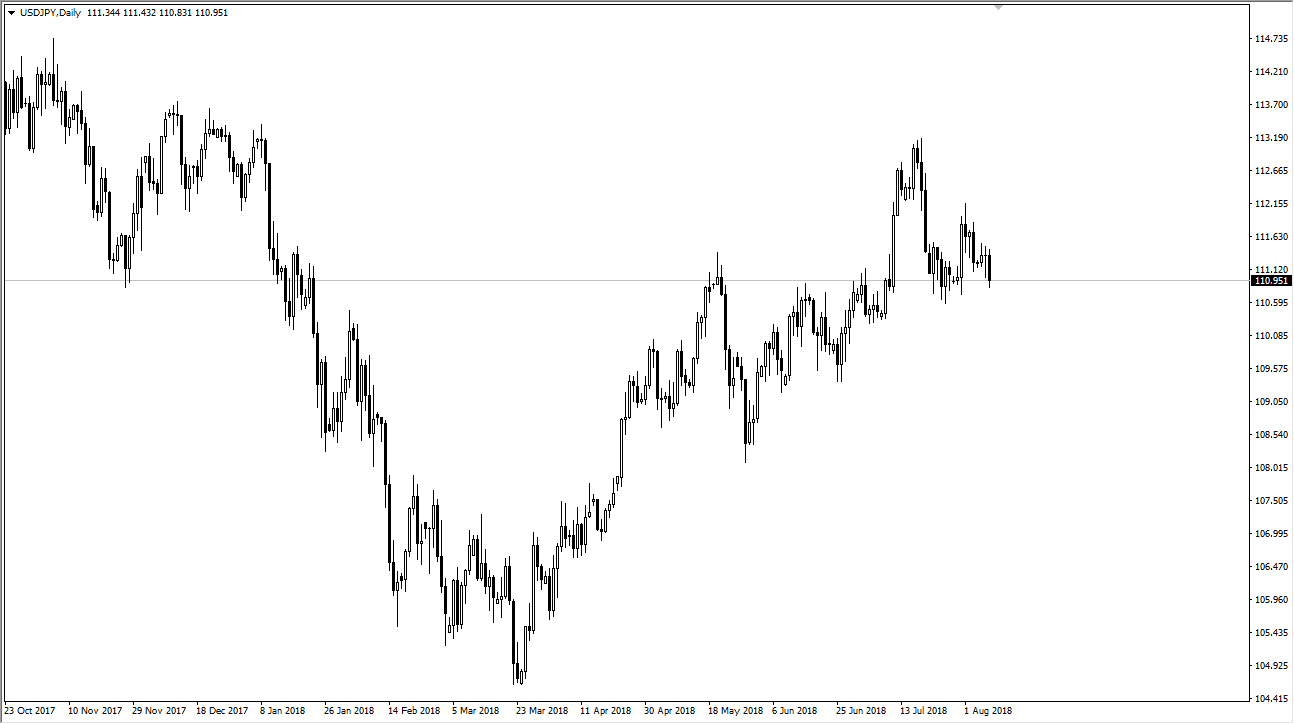

USD/JPY

The US dollar fell against the Japanese yen to reach down towards the ¥111 level. There is a significant amount of support in this general vicinity, and I think there is also support below at the ¥110.50 level, and of course the ¥110 level. I think at this point, buyers will eventually show up again. However, we may have to dip a little bit lower to find enough value hunters. Remember, this pair does tend to move with the overall risk appetite around the world, it of course the noise that’s going on in the trade war talks. If the trade wars intensified, it could drive more money towards the Japanese yen. All things being equal though, the interest rate differential most certainly favors the US dollar, which should continue to push this market higher longer term.

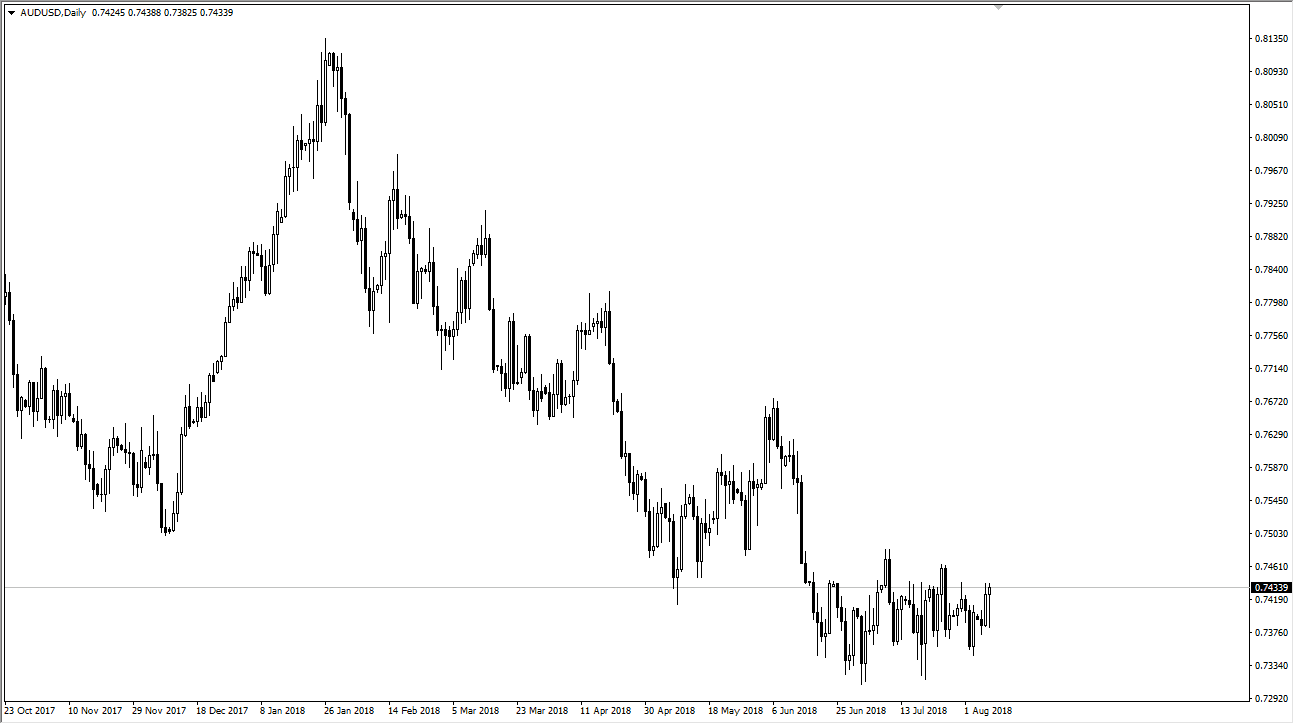

AUD/USD

The Australian dollar initially fell during trading on Wednesday but turned around to form a hammer. The hammer of course is a very bullish sign, but we have to worry about the top of resistance. I think that we need to break above the 0.75 level to start adding to any short-term buying positions that you may have on, which would be based upon the bottoming pattern that I’d talked about previously. The 0.7350 level is massive support, and I think if we clear that level to break down to the 0.73 handle, the Australian dollar could come unraveled. However, as long as we can stay above there I think it’s only a matter time before the value hunters turn things around based upon the hammer is that I see on the weekly charts. Regardless, I think the one thing you can probably count on is a lot of choppiness.