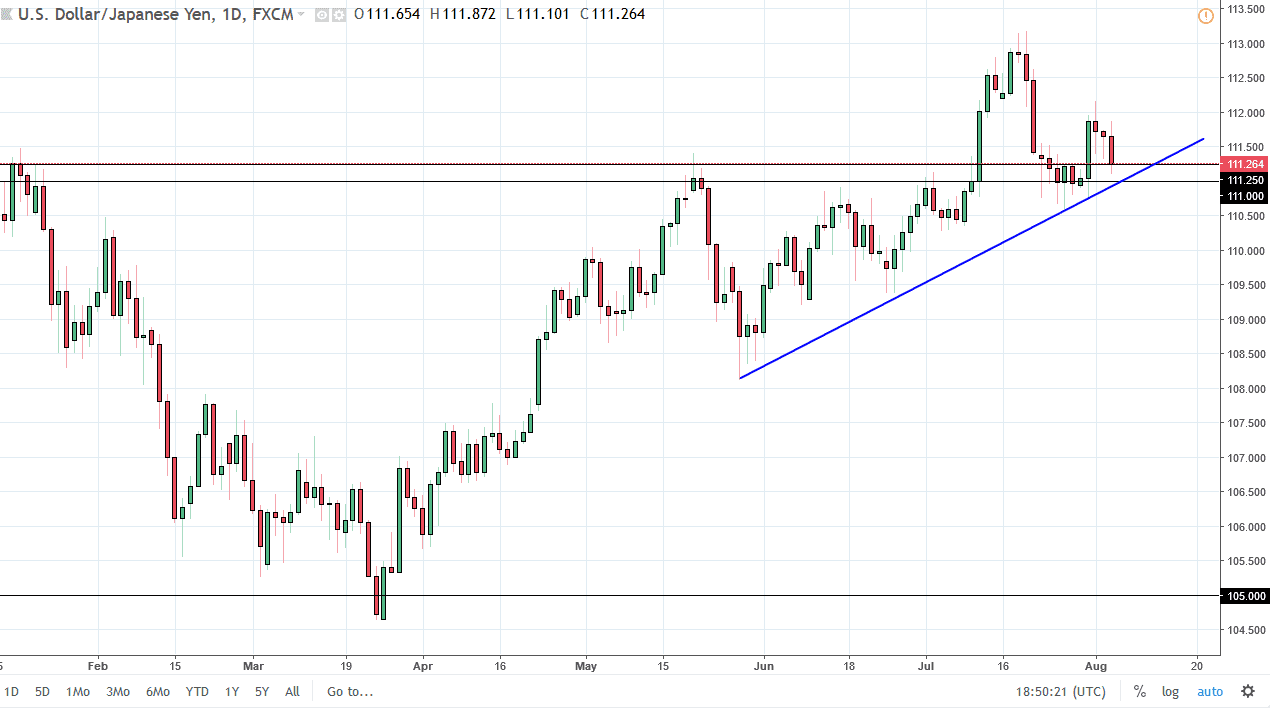

USD/JPY

The US dollar initially tried to rally against the Japanese yen during Friday’s trading, but a weaker than anticipated jobs number did no favors for the greenback. However, we have a nice uptrend line just below and a zone of support that extends down to at least the ¥111.25 level, giving me hope for a bit of a bounce. On the other side of that coin of course is the fact that the weekly candle is a bit of a shooting star, not necessarily a great sign either. In the end, I think what this means is that we are going to see a lot of short term back and forth choppiness in this pair, but if we break down below the ¥110.50 level, I think it then start to look for shorting opportunities, where I would expect to see support at ¥110, and then again at the ¥109 level.

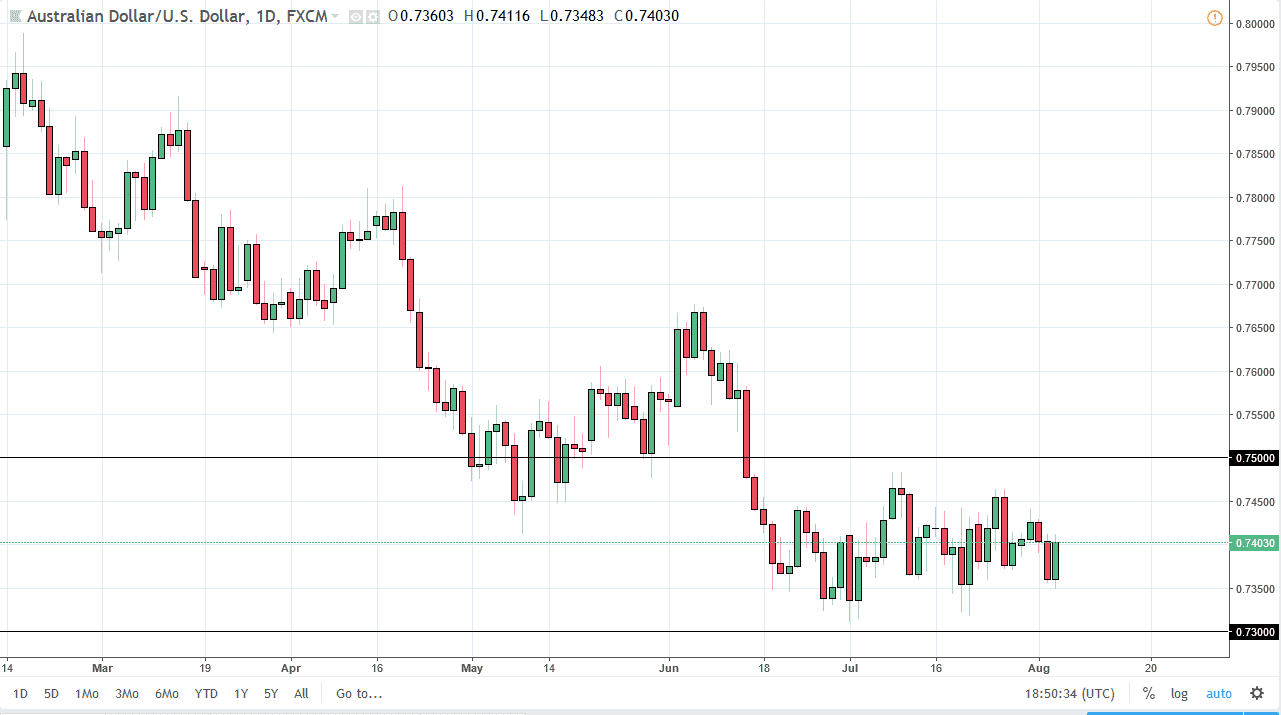

AUD/USD

The Australian dollar is probably the best currency right now to trade back and forth with a range bound system. This is because we simply cannot get anywhere, as the sellers seem to come back somewhere near the 0.7450 level, while the buyers come in and push things back up at the 0.7350 level. For what it’s worth though, it does look like that there are several currencies getting ready to make a move against the US dollar, so that could put upward pressure in this market. We are most certainly in a major level on the longer-term charts, so I think eventually we will break out to the upside. However, if we don’t and we end up rolling over, the market could unwind down to the 0.70 level. This is typically the quietest time of year, so it may take some time to get out of this range.