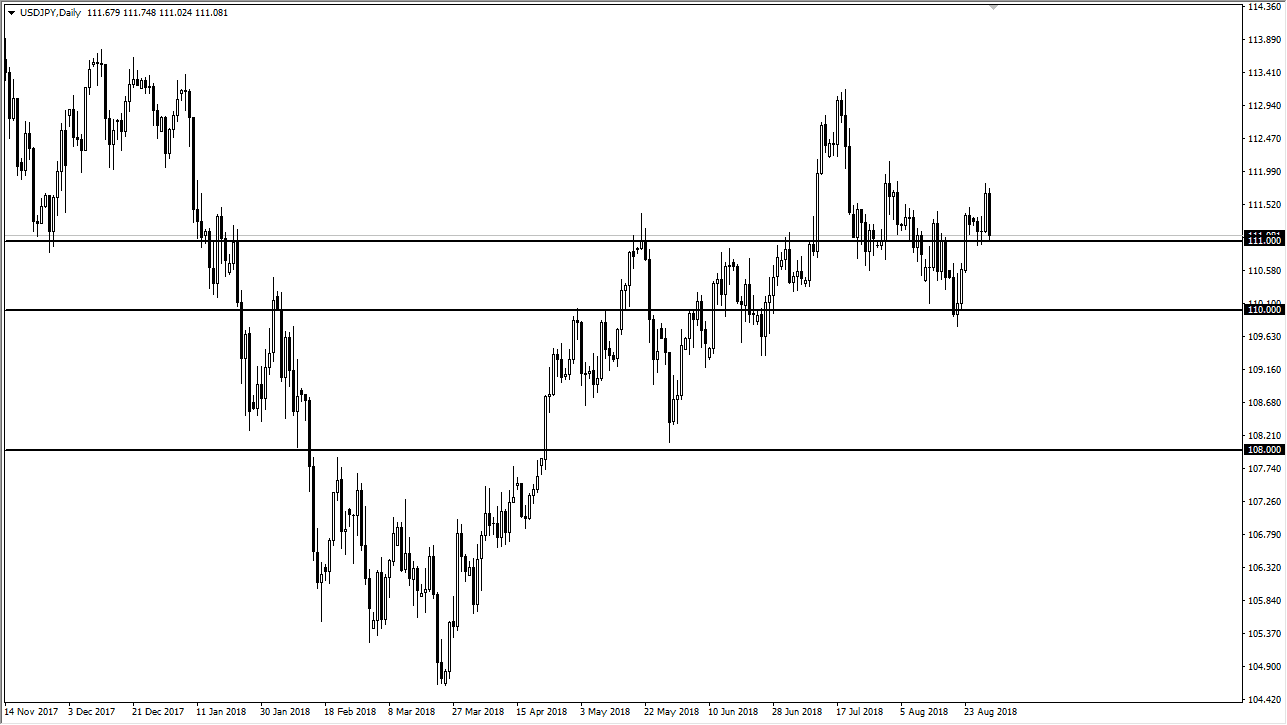

USD/JPY

The US dollar cratered against the Japanese yen late during trading on Thursday, as it was speculated that President Trump was going to slap another $200 billion with the tariffs on the Chinese. That of course is very negative for markets, but we are sitting at the ¥111 level, an area that should be rather supportive. It’ll be interesting to see where this goes from here, but this is most certainly a very negative candle stick. However, if we shall resiliency here near the ¥111 level, this could be a very bullish sign as it would show the market is going to decouple from the headlines a bit. From an interest rate differential perspective, this is a no-brainer, it should be going much higher. However, the Japanese yen is quite often looked at as the safe haven currency to go to, and that’s part of what we’ve seen. I looking to play a bounce if it comes. Otherwise, I think I will look again at ¥110.

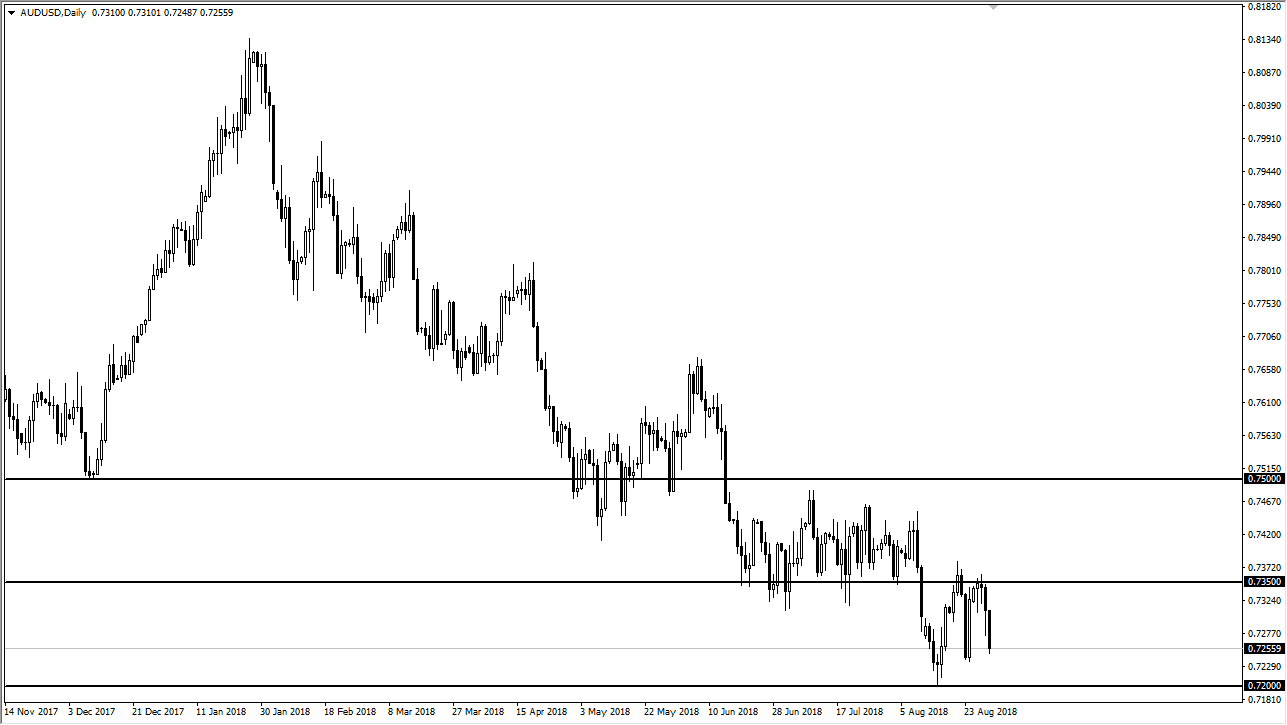

AUD/USD

The Australian dollar has fallen for many of the same reasons I believe, as the Australian dollar is so sensitive to what goes on in Asia. At this point, I think it’s only a matter time before the buyers come back though, especially near the 0.72 level. Breaking below that level would be very bearish, sending this market back down to the 0.70 level. That is an area that I think will attract a lot of attention as it is a large, round, psychologically significant figure, and of course one that has been important over the last several years. At this point though, I think there will be value hunters eventually, but below that 0.72 level, the bottom will fall out. I look at the 0.7350 above as resistance.