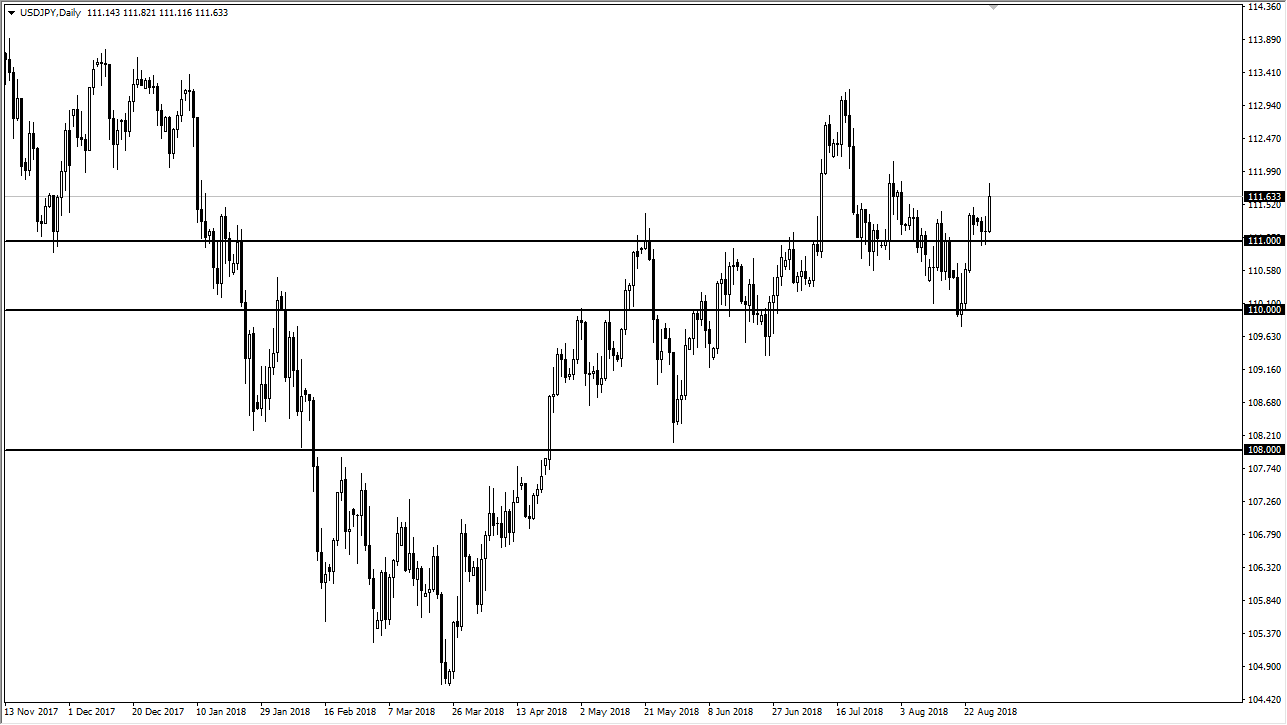

USD/JPY

The US dollar rallied during trading on Wednesday, breaking above the recent resistance and clearing the ¥111.50 level. The ¥111 level underneath should offer support, but I think that given enough time we should rally on short-term pullbacks. I think that the market is trying to go higher, and the massive move to the upside in the stock markets of course have push this market as well. I believe that the market will try to reach towards the ¥113 level, as long as the stock markets can remain somewhat positive. This is because the interest rate differential between the two economies certainly favors more bullish moves. Short-term pullbacks continue to offer buying opportunities, and I have no interest in shorting this market after what we have seen over the last 24 hours.

AUD/USD

The Australian dollar has fallen during the trading session, reaching down towards the 0.73 level. At this point, the market looks as if it is trying to find buyers in that area though, and we are starting to make a small series of “higher lows.” That’s a good sign, and if we can break out above the 0.7350 level the market will more than likely go looking towards the 0.75 level. Pay attention to gold, it will have its influence as per usual, but I think the bigger question here is the US dollar. I think this is a risk appetite type of question. I think that this market will ultimately go higher, but it will obviously be very choppy. If we were to break down below the 0.72 level, that could unleash sellers into this market and send it down to the 0.70 level next.