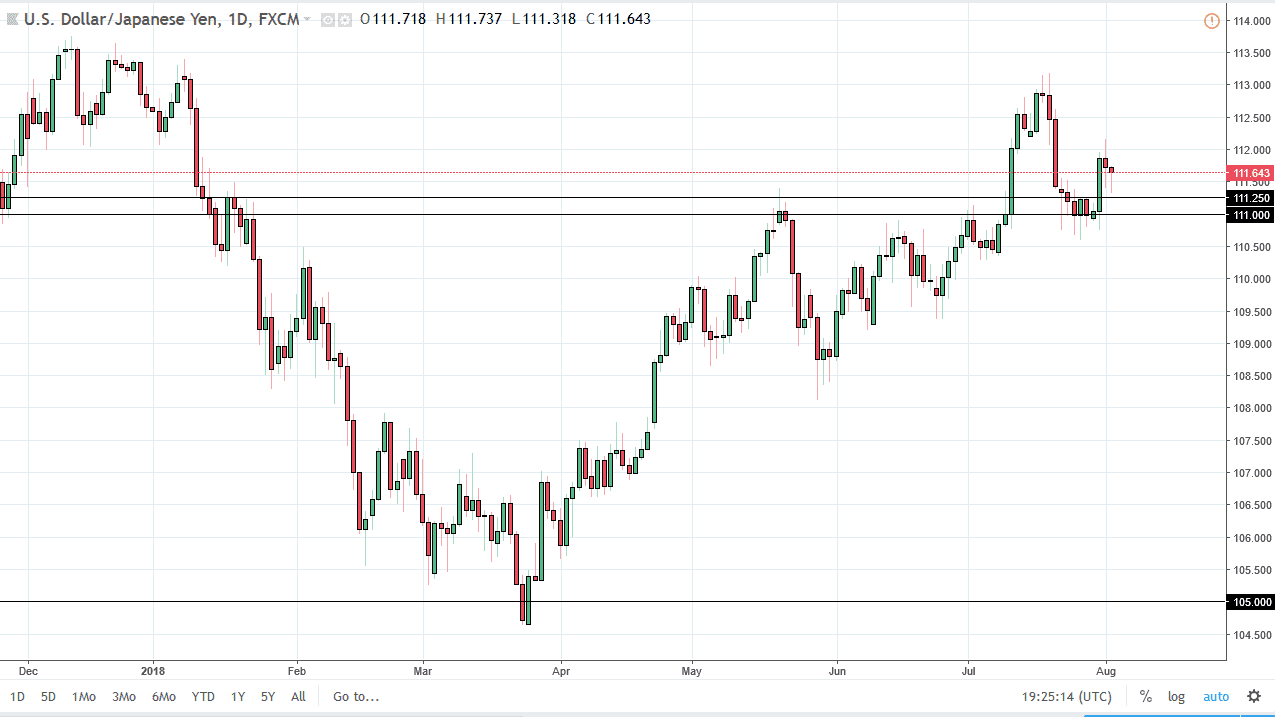

USD/JPY

The US dollar fell initially during the trading session on Thursday but found support near the ¥111.25 level. We turned around to form a hammer, which of course is a bullish sign. After the impulsive candle during the day on Tuesday, it looks like the buyers have come in on the dips, and I think that this market will probably go higher. Overall, I anticipate that this market will favor the upside, and if we get a decent sized jobs number, that could provide more fuel to the fire, sending this market to the upside. Overall, I still believe in short-term pullbacks as buying opportunities, and I think that if we can stay above the ¥110.50 level, the market should continue to look positive overall. If we break down below the ¥110 level, then we could fall much further.

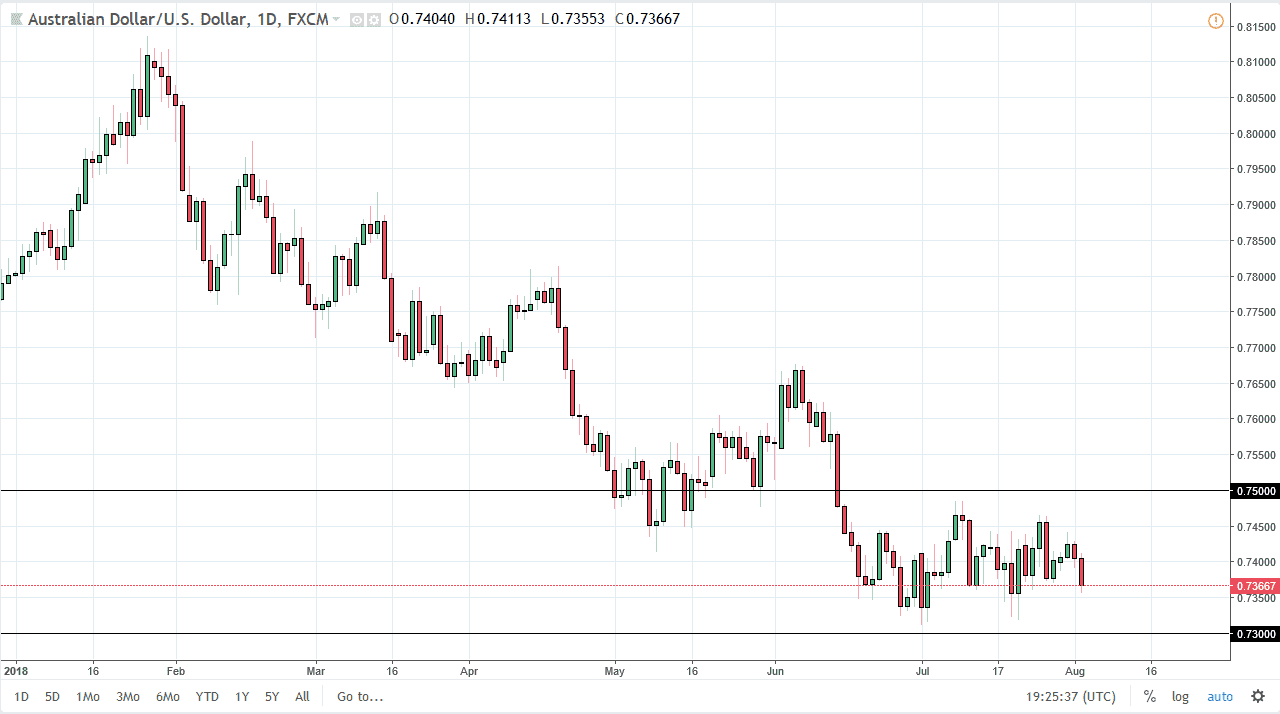

AUD/USD

The Australian dollar fell during the trading session on Thursday, reaching towards the 0.7350 level. There is a significant amount of support extending down to the 0.73 handle, but with the jobs number today it’s difficult to put a lot of faith into the market until we get a close. The 0.73 level underneath should continue to be massive support, so I think it’s only a matter of time before the buyers would come into play if we reach down there. However, if we do close below the 0.73 level, the Australian dollar will unwind to go looking towards the 0.70 level after that. I see the 0.75 level as resistance above, and a break above that level could open the door to the 0.76 level in the short term, perhaps even the 0.80 level longer-term. Today will be very noisy.