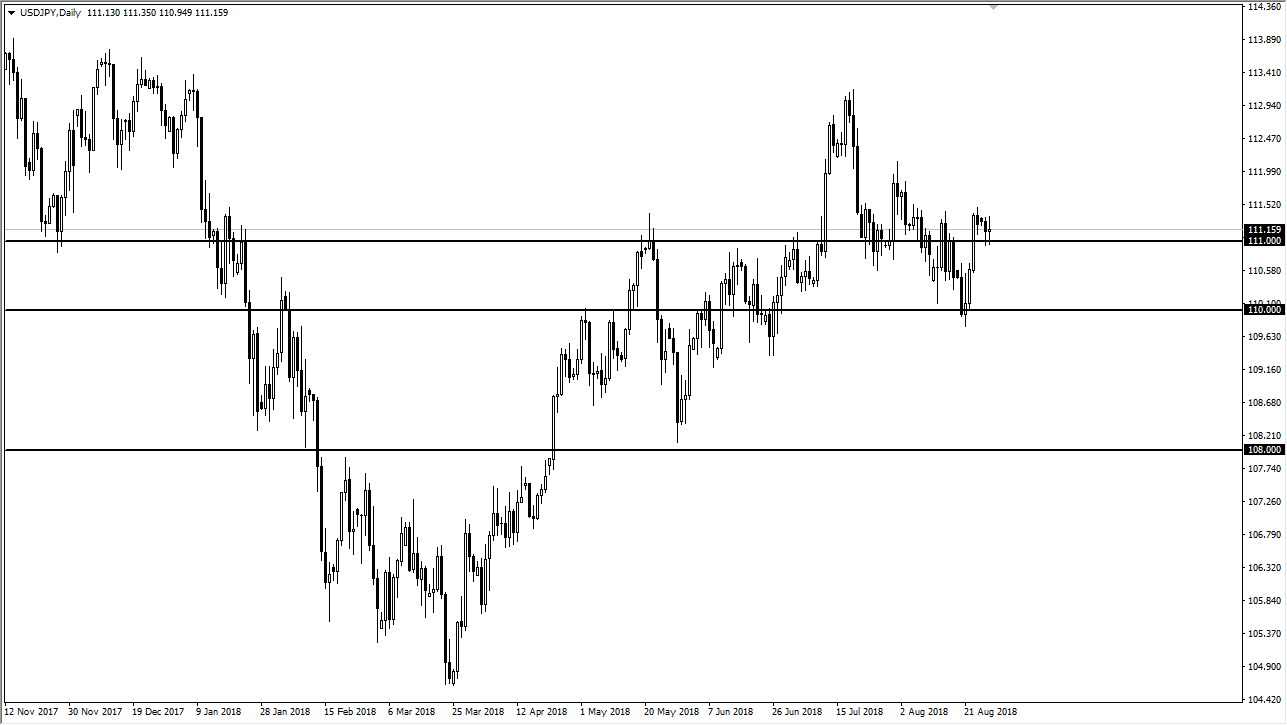

USD/JPY

The US dollar continues to go back and forth during the last couple of sessions, using the ¥111 level as support. By doing so, it has been stubbornly bullish, but not enough to pick up momentum. I think the market is essentially one that you will have to trade in 50 pips increments, meaning that if we go higher, I would take profit at ¥111.50, and if we break down below the ¥111 level, I think at that point we would probably go looking towards ¥110.50 level. At this point, the market looks as if it isn’t ready to make a definitive move in either direction, so that is a likely going to be a major concern for anybody looking for more than a short-term trade. This pair is highly sensitive to the US - China trade situation, so keep an eye on those headlines.

AUD/USD

The Australian dollar fell slightly during the day but did not break down below the hammer for the Monday session, leaving a bit of hope out there that we could rally and break above the 0.7350 level. However, right now it looks as if there is enough resistance above the cost selling pressure on short-term rallies, so although I do think eventually we do break out to the upside, it’s going to take a certain amount of momentum building. Looking at the US dollar seemingly ready to flex its muscles against several other currencies right now, I think that we probably get a pullback here as well. This will be especially true if something happens in China or the Sino-American discussions. Pay attention to gold, it has its part to play as per usual.