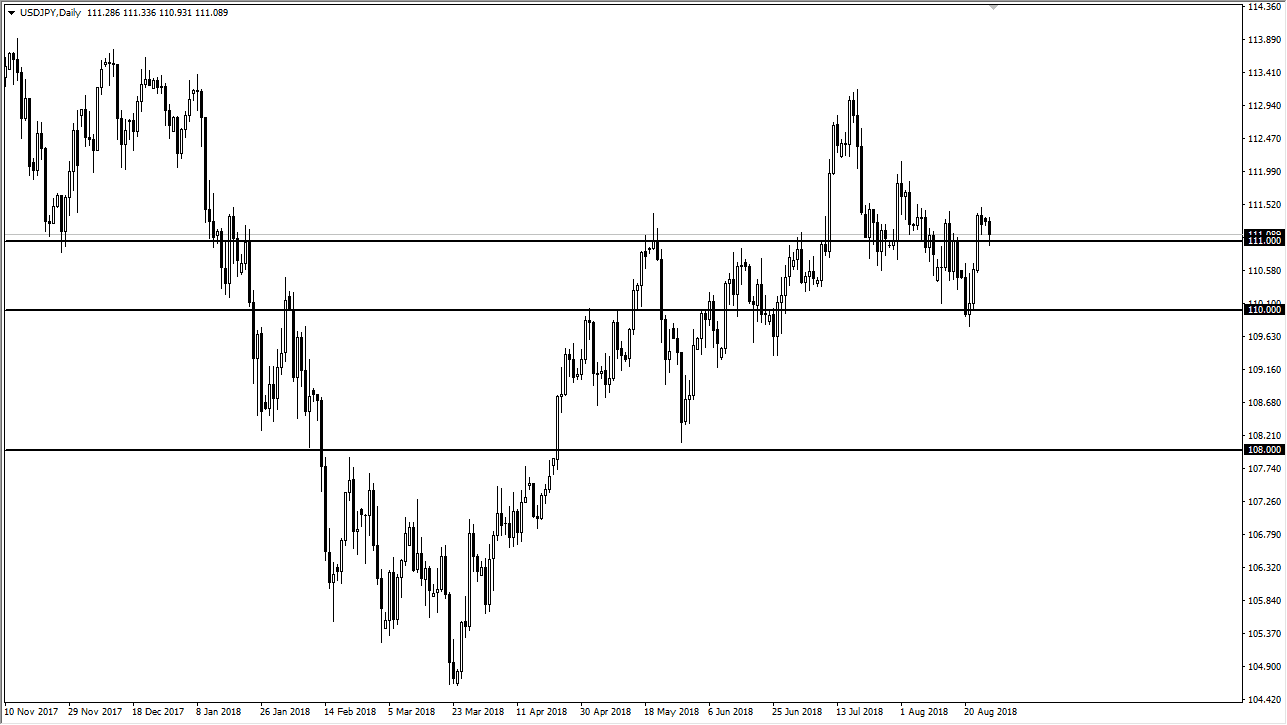

USD/JPY

The US dollar struggled slightly against the Japanese yen during trading on Monday as traders came back from the weekend. We did find support at the crucial ¥111 level though, so I think that the downside is somewhat limited. Remember, this pair is highly sensitive to overall risk appetite and of course global trade, especially between the United States and China. As the US has made a deal with Mexico, this means that the Donald Trump administration can pivot towards China again. Hopefully, we will see some type of good news on that front, which should send this pair higher. Even if we were to break down below the ¥111 level, I think there is more than enough support at the ¥110 level to keep this market afloat. Although it’s a highly risk sensitive pair, the fact that it has the US dollar and it will keep it somewhat sluggish.

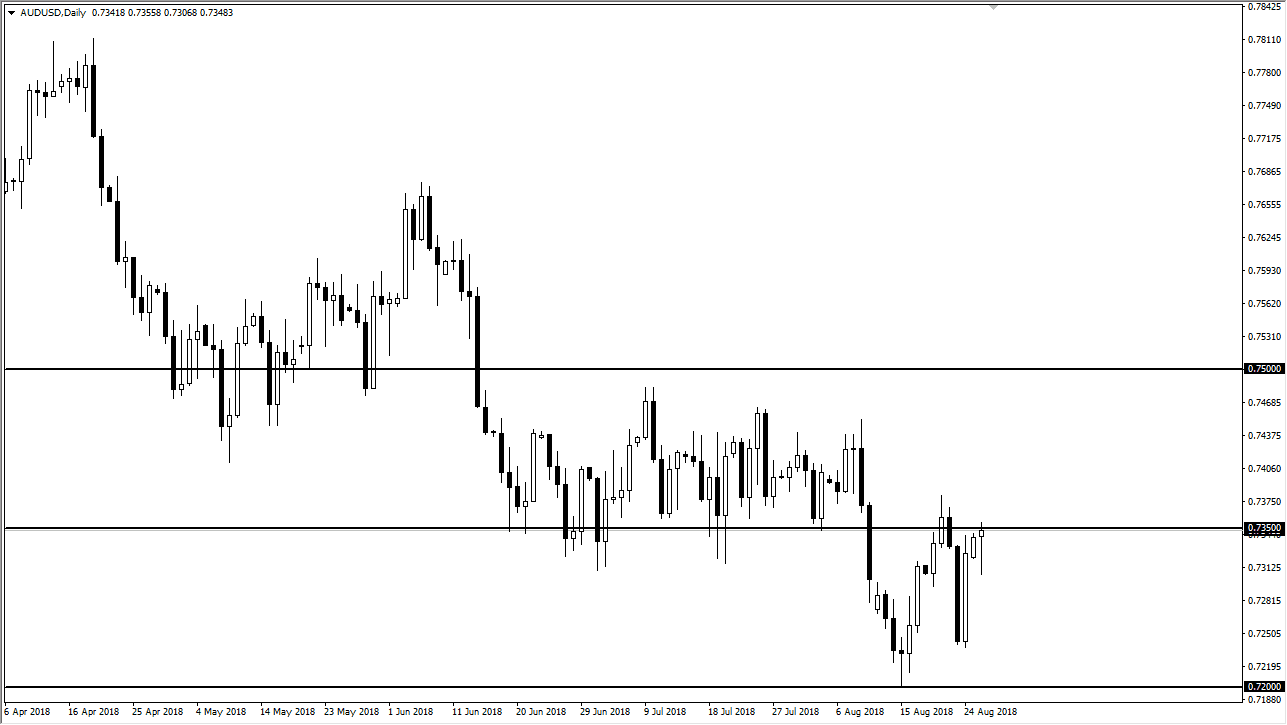

AUD/USD

The Australian dollar initially fell during the session but found enough support to turn around of form a hammer. This is a very good sign, and it suggests that the Aussie dollar is going to continue to try to rally from here. The Aussie is highly sensitive to all things China -related as well, so keep in mind that both of these pairs will probably have some influence coming from the Sino-American trade relations. Pay attention to gold as well, because that also can move the Australian dollar. As we close out the session it looks as if we are trying to break above the 0.7350 level, which of course is a very bullish sign. If we can clear that area, then we will reenter the previous consolidation between 0.7350 on the bottom, and the 0.7450 level in the top. At that point, I would start eyeballing the idea of 0.75 above.