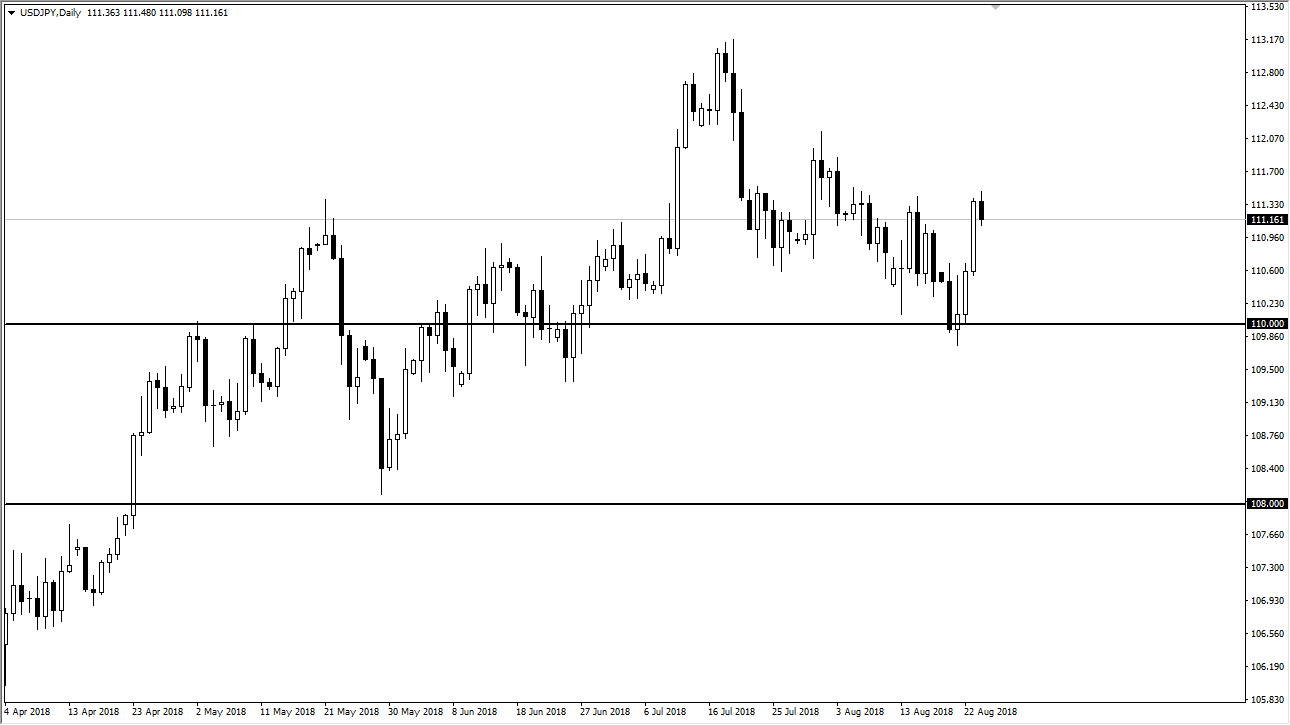

USD/JPY

The US dollar pulled back slightly against the Japanese yen during trading on Friday, perhaps in a bit of position squaring ahead of the weekend. We are currently pressing the ¥111.50 level, and I think at this point we were probably going to see a little bit of a pullback. The pullback should be constructive though, and I think that there will be plenty of value hunters below. Because of this, I’m looking for a pullback to pick up a little bit of value. I recognize that the ¥110 level should be massive support, and therefore I think it’s only a matter of time before there will be buyers jumping into this market. It’s not until we clear the ¥110 level on a daily close that I begin to worry. At this point, keep in mind that we have had a “risk on move” during the Friday session, so that should help this market down the road.

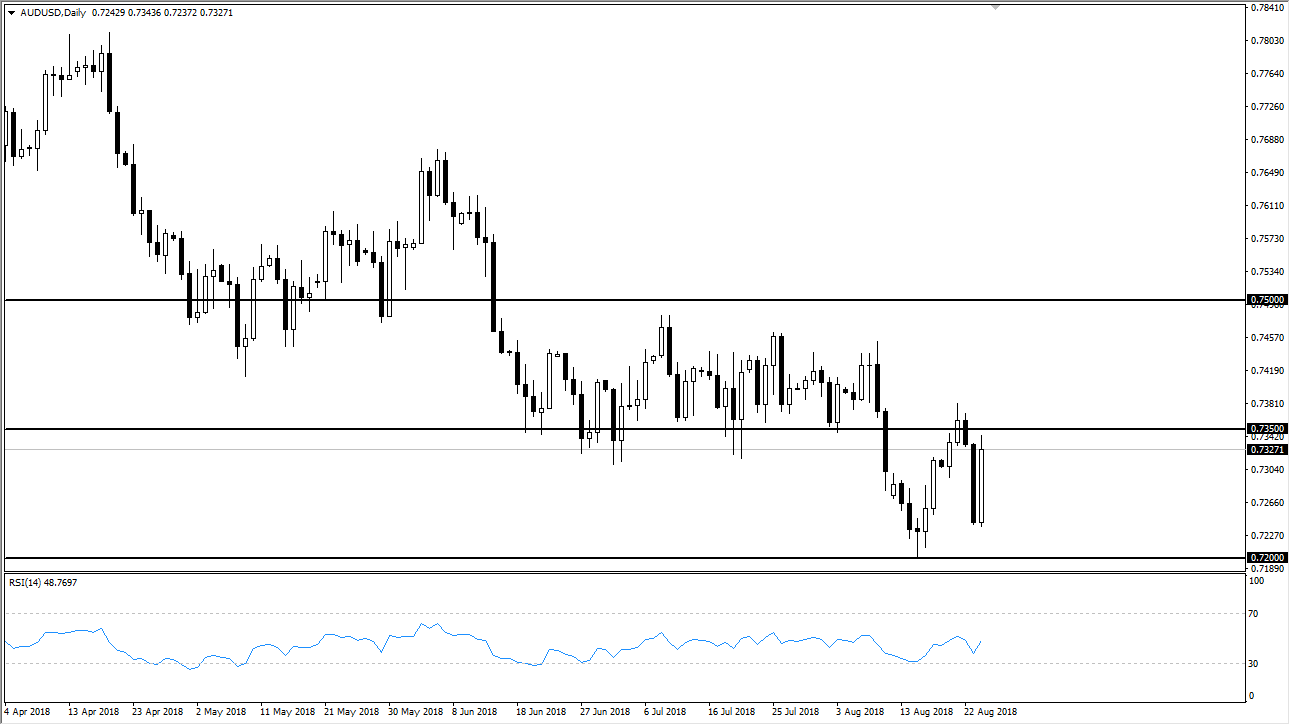

AUD/USD

The Australian dollar has rallied during the trading session on Friday as the Prime Minister situation has been cleared up in that country. Now I think we are going to continue to see this market focus on the situation between the Americans and the Chinese, and of course the Gold markets as well. The 0.7350 level has caused resistance in the past, just as it has caused support. Because of this, it’s not overly surprising that we have struggled to get above there during the day. However, I think if we can break above the high from earlier in the week, the market is likely to continue going higher, perhaps to the 0.7450 level. In the meantime, pullbacks should be thought of as potential buying opportunities