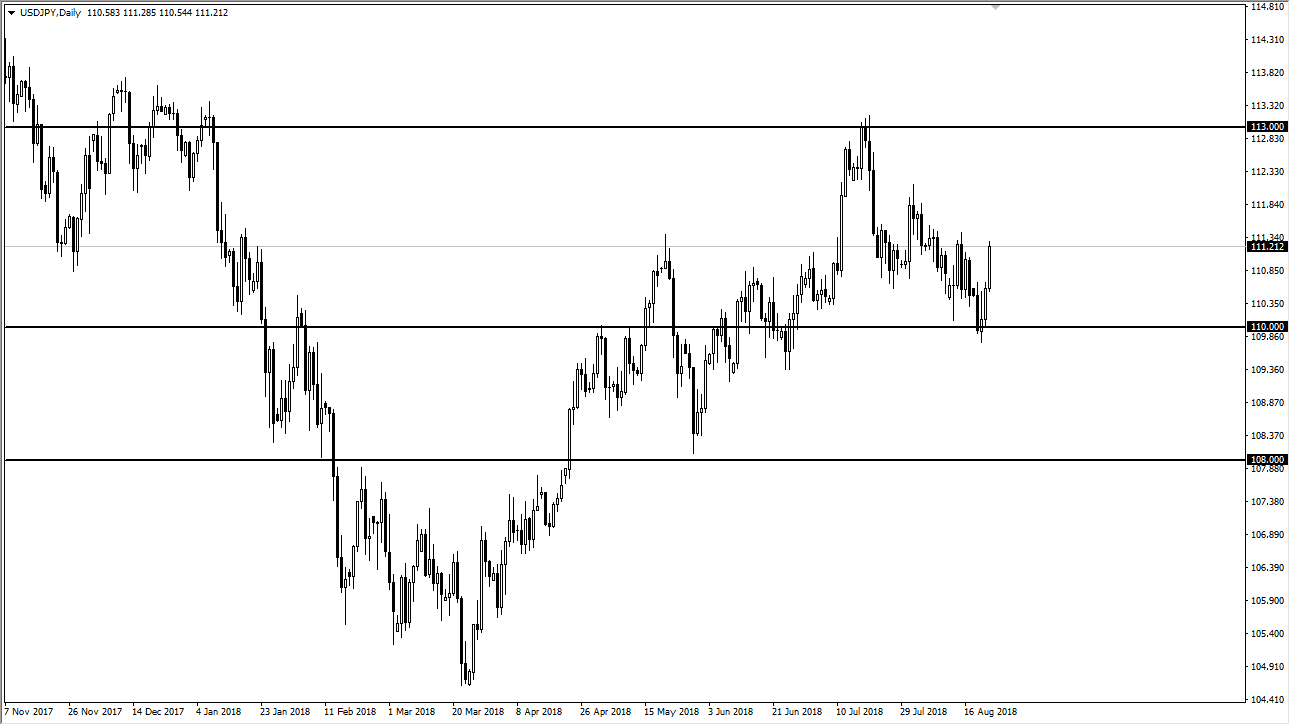

USD/JPY

The US dollar rallied rather significantly against the Japanese yen during trading on Thursday, as we continue to bounce from the ¥110 level. That’s a very positive sign, and I think at this point we will probably find buyers on dips, as the ¥110 level looks to be offering a significant amount of support. That being said, I don’t necessarily think that it’s time to jump into the market with both feet, but it does look like it’s starting to favor the upside again. Holding the ¥110 level was important, and it does show a certain amount of resiliency that I hope to we would see. The fundamental outlook for both currencies couldn’t be any different, as the Federal Reserve looks to raise interest rates while the Bank of Japan is nowhere near doing so. All things being equal, I think this pair should continue to find buyers on dips based upon value it of course hope.

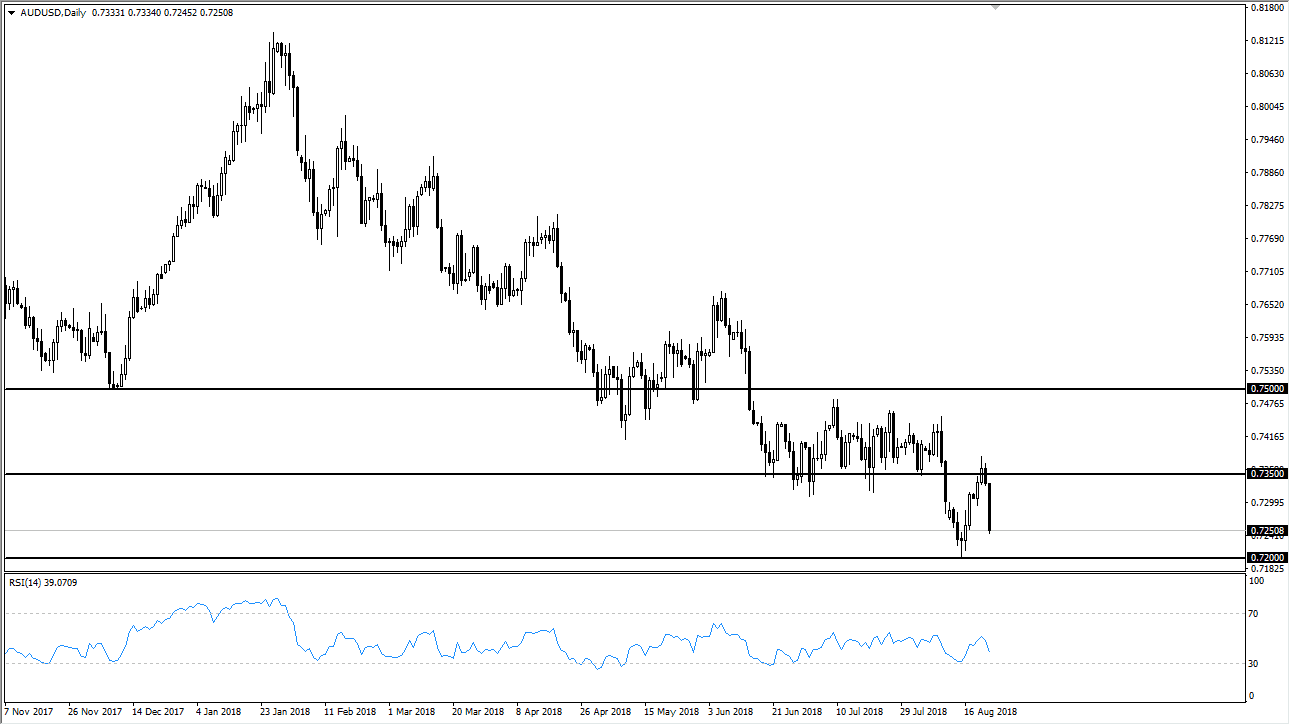

AUD/USD

The Australian dollar was a completely different situation as the political outlook in Australia isn’t that clear. People typically will sell first and ask questions later, and although I don’t think that Australia is anywhere near collapsing, you couldn’t tell the currency markets that during the day. I think that it’s only a matter of time before we see some type of value hunting, and I still believe that the 0.72 level should hold as significant support. In the meantime, I believe that the 0.7350 level offers significant resistance, and we may find ourselves bouncing around in this overall area for the next several weeks as traders are typically away at holiday this time of year, thereby making it a bit of a range bound market naturally. If the Americans and the Chinese can get something worked out, that should help the Australian dollar as it is so highly leveraged to China.