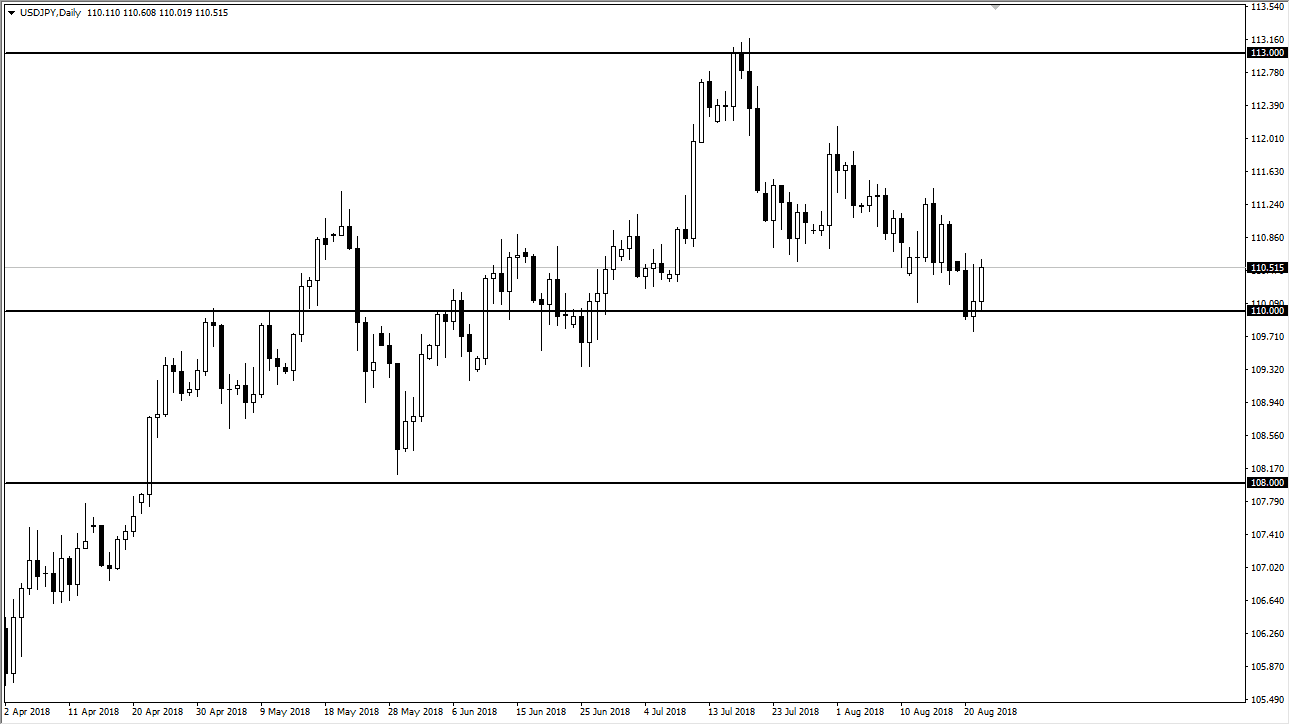

USD/JPY

The US dollar rallied against the Japanese yen during trading on Wednesday, reaching the top of the shooting star that formed on Tuesday. This is very bullish sign and I think this means that we could go higher. If we break above here, the market then goes looking towards the 111.50 level. I think there is significant support at the ¥110 level, and I would say that a shooting star that forms of the bottom of a move to the downside and then gets broken through is a very bullish sign. That doesn’t mean that we are going straight up, but I believe that the US dollar is done correctly and in this pair, at least for the short term. However, I’m the first to admit that if we break down below the bottom of the candle stick from the Tuesday session, this market will probably unravel a bit.

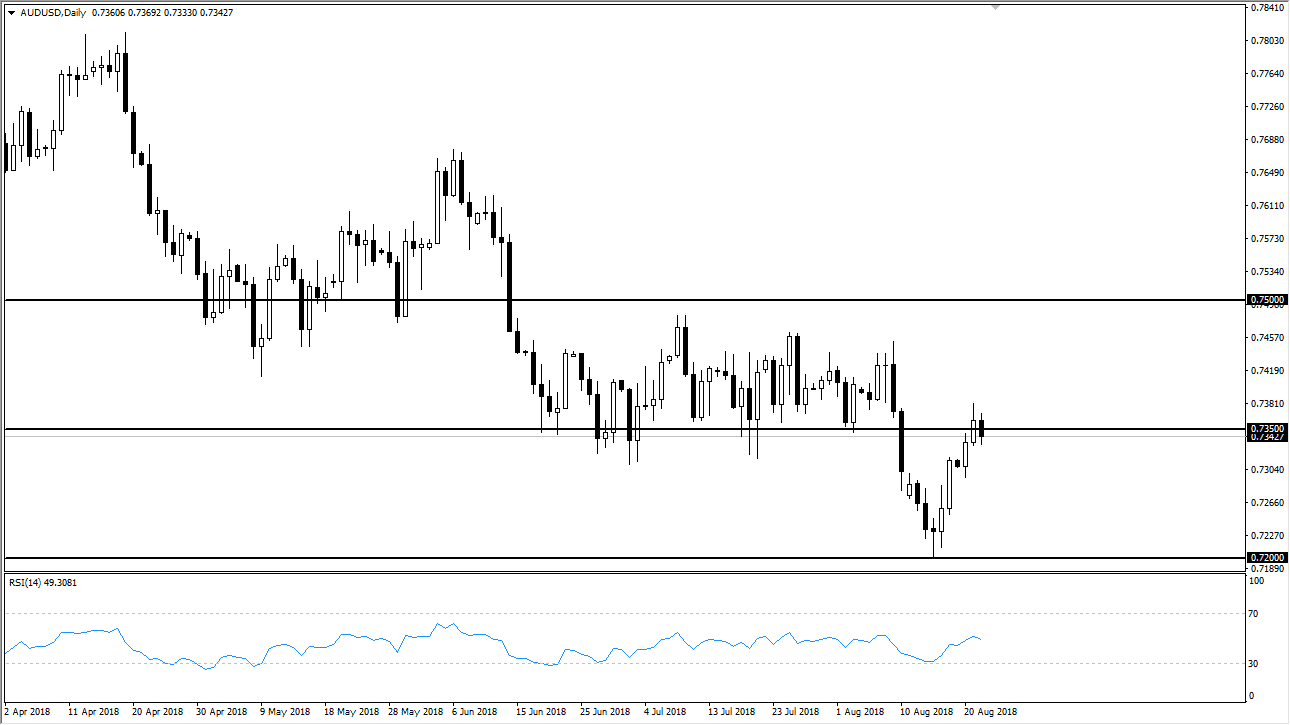

AUD/USD

The Australian dollar has failed a bit at the 0.7350 level, an area that was previous support. It is now obviously going to be somewhat resistive, and if we can break down below the bottom of the candle stick for the trading session on Wednesday, I think we will make a return to the 0.73 handle, followed by the 0.72 area. The market is still going to be very tense and concerned about headline risks, and that doesn’t do much for the Australian dollar in general. If we do rally from here, we will have to contend with the 0.7450 level above as major supply, meaning that it’s going to be very difficult to break above that level. Beyond that, we have the 0.75 level, which of course if we can recapture that I’m willing to consider a potential trend change.