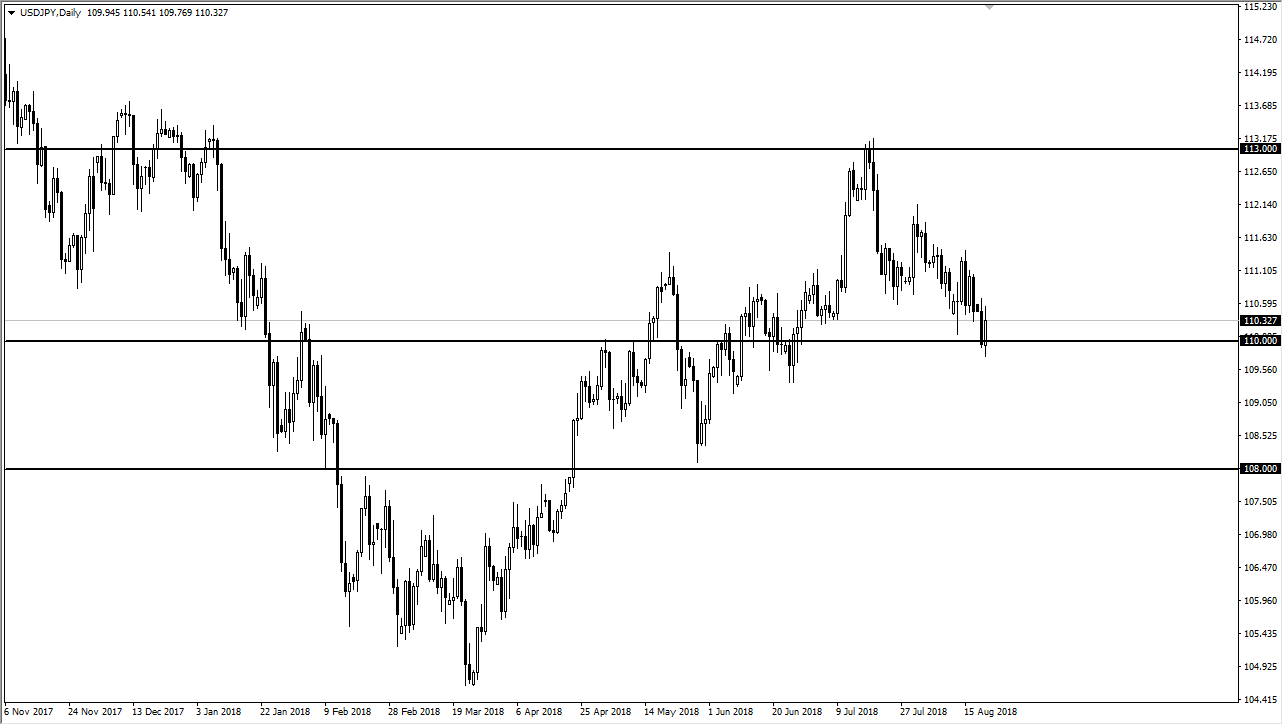

USD/JPY

The US dollar initially drifted lower during the trading session on Tuesday, but then turned around to break back above the ¥110 level, showing signs of resiliency. This is an area that’s been important more than once, and I think at this point we are starting to find some value hunters jumping into the market. This is a bit of a risk sensitive pair, so keep in mind that the Sino-American relations will continue to push this market. I think that if we can break above the ¥111 level, we will probably go to the ¥112 level. Otherwise, if we break down below the last couple of candles, then we could find yourselves unwinding towards the ¥109 level underneath which is support. Overall, this is a market that will continue to follow the overall attitude of trade wars.

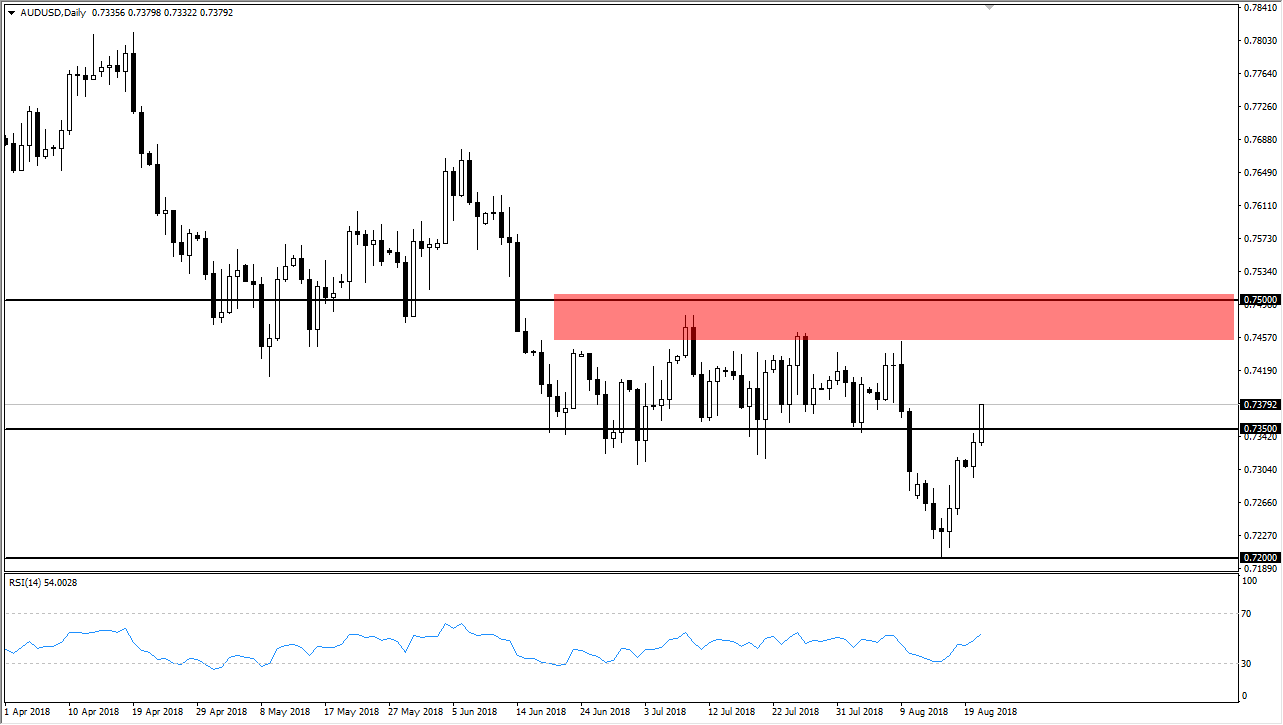

AUD/USD

The Australian dollar has rallied again during trading on Tuesday, breaking above the 0.7350 level. At this point, we are approaching a significant barrier of resistance, and I think we may go looking towards the 0.7450 level above where massive selling occurred. If we can continue a “risk on” attitude, it’s likely that the Australian dollar will continue to climb. Otherwise, if we find ourselves breaking back below the 0.7350 level, then the market probably drops down from there and reaches towards the 0.72 handle. Overall, this is a market that I think has plenty of Sellers above, but clearly it looks as if we are trying to get a bit of a reprieve from the relentless selling that we had seen previously. The US dollar has been soft for a couple of days now, but is still very bullish in general.