EUR/USD

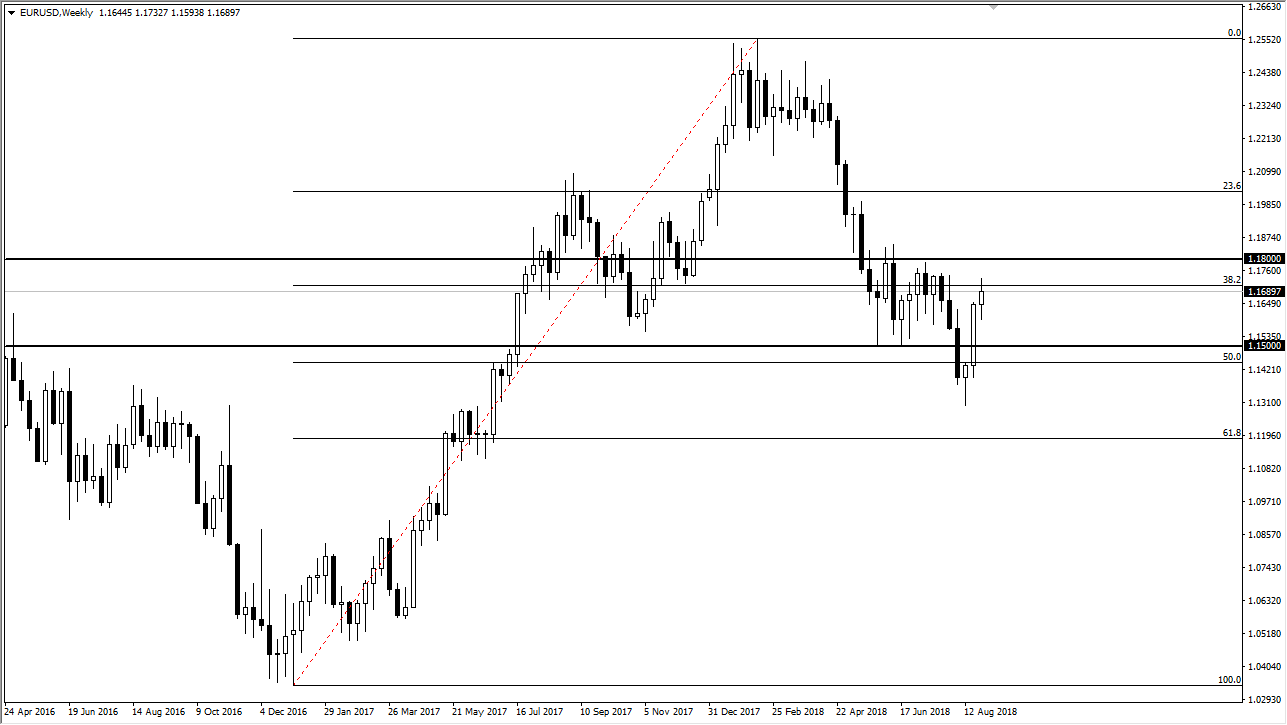

The Euro has rallied again for the last week of August, showing signs of strength. The 1.18 level above now is essentially everything when it comes to this market. If we can continue to see bullish pressure, it’s likely that we will finally clear that level. Once we do, I think that opens the door to the 1.20 level. This is something that could very well happen during the month of September, but I think it will be a bit of a fight. I believe that the most likely path for this market is continued consolidation. If we can break above the 1.18 level, the market should explode to the upside. The 1.15 level below should continue to attract a lot of attention though. Keep in mind that during the month of August, we had formed a hammer at the 50% Fibonacci retracement level, an area that of course attracted a lot of attention in and of itself.

I think there’s a lot of questions to be had out there when it comes to this pair, but I also think that perhaps the idea of Turkish contagion was probably a bit overblown, and that might be what we are seeing on the charts. I anticipate that we will break above the 1.18 level eventually, the question is when will we be able to? I think it may take some time and therefore we may have some choppiness ahead of us. However, I will not question that move once we break above the 1.1850 level, and I would add to an already long position. I would hold out to at least 1.20 at that point, and then firmly expect to move to the 1.23 level next. Expect volatility, but overall I believe that the Euro has been oversold.