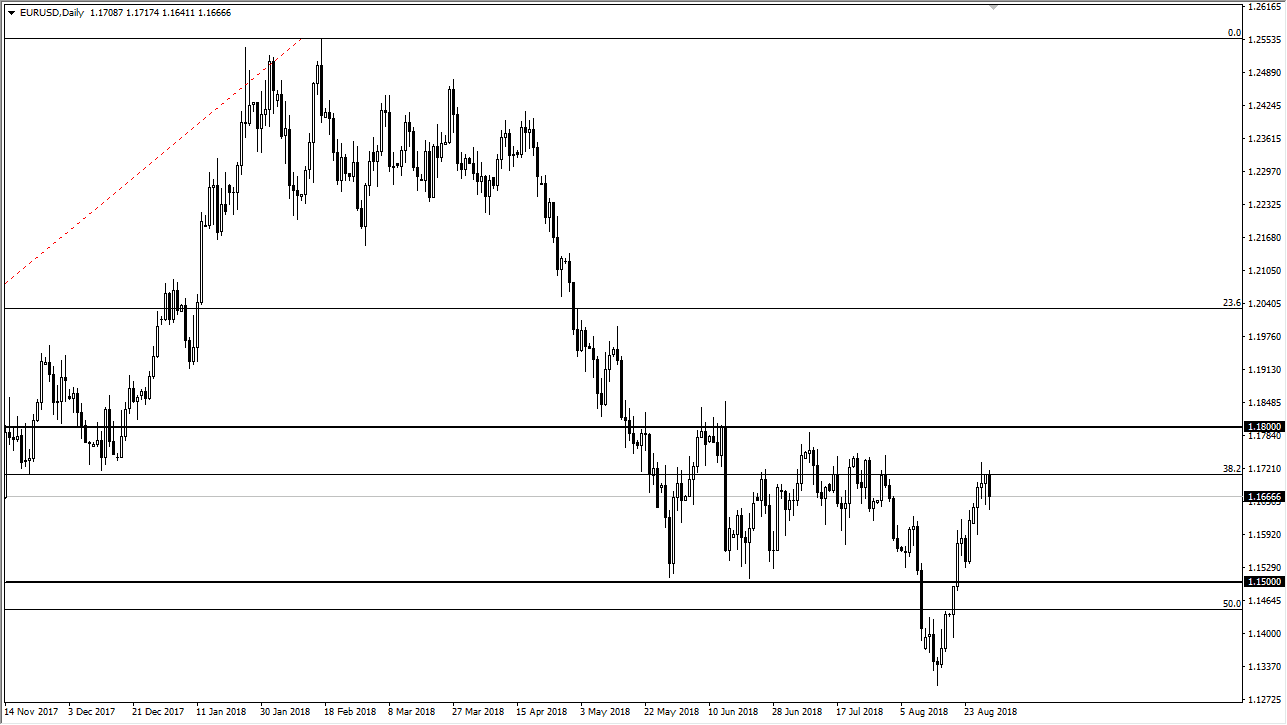

EUR/USD

The Euro fell initially during the trading session on Thursday, reaching down towards the 1.1650 level before bouncing slightly. The previous candle was a hammer, with the one before that being a shooting star. Confused yet? It seems most traders are. I think at this point, we are trying to build up the necessary momentum to reach the 1.18 level. If we can break above there, then the market could go much higher. At that point, I’m looking for a move to the 1.20 level but it will take some time. Don’t be surprised though if we pull back, as we have gotten a bit overbought. I think that we are looking at a rag movements over the next couple of days, at least until traders come back from holiday and more liquidity jumps into the market. Although it’s been very bullish as of late, we are still technically in a downtrend, so don’t forget that. I believe that the 1.15 level underneath is very supportive though.

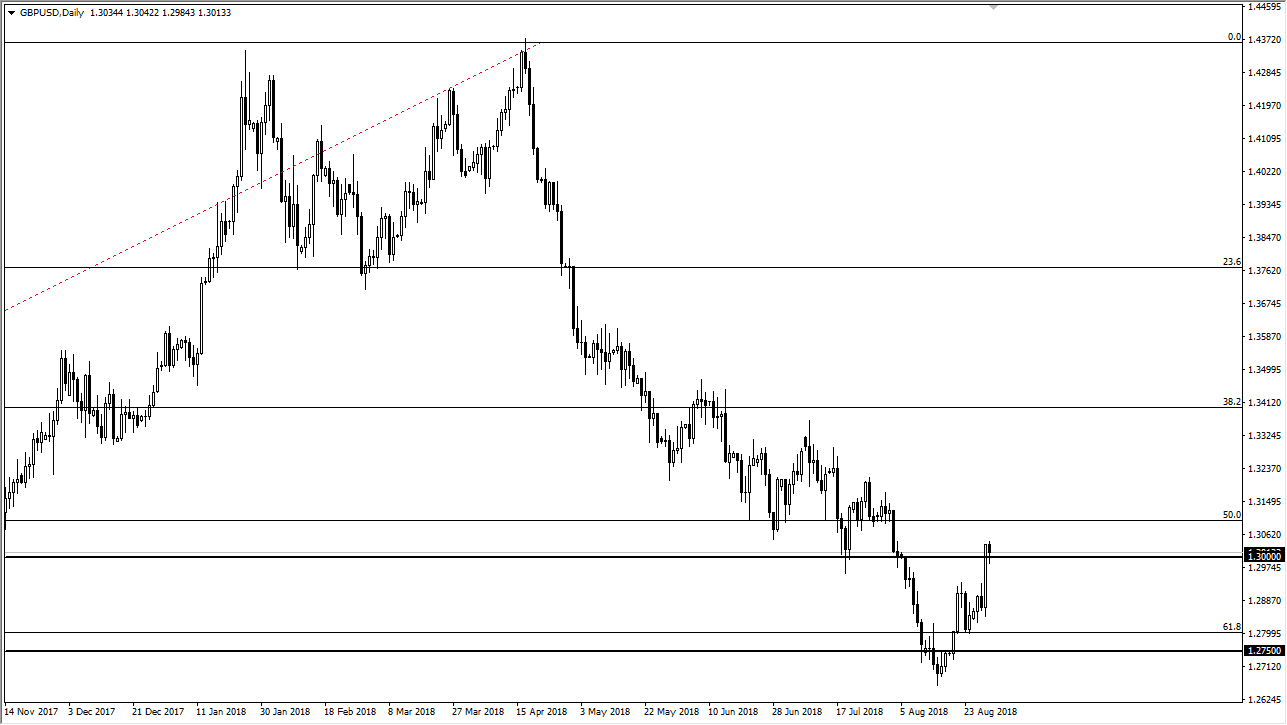

GBP/USD

The British pound initially pulled back during the trading session on Thursday, breaking below the 1.30 level to find buyers in continue to go forward. Ultimately, this is a market that I think is trying to change the overall trend, and the fact that the EU and the UK are coming close to an agreement is exactly what this market is looking for. If we can break higher from here, I think there’s a fight at the 1.1350 level that will determine whether we can pick up momentum. I would anticipate that we should get some type of pullback in the meantime, but the candle stick from the Wednesday session I think will be seen as the beginning of the end of the downtrend. Obviously, you should also pay attention to the US dollar.