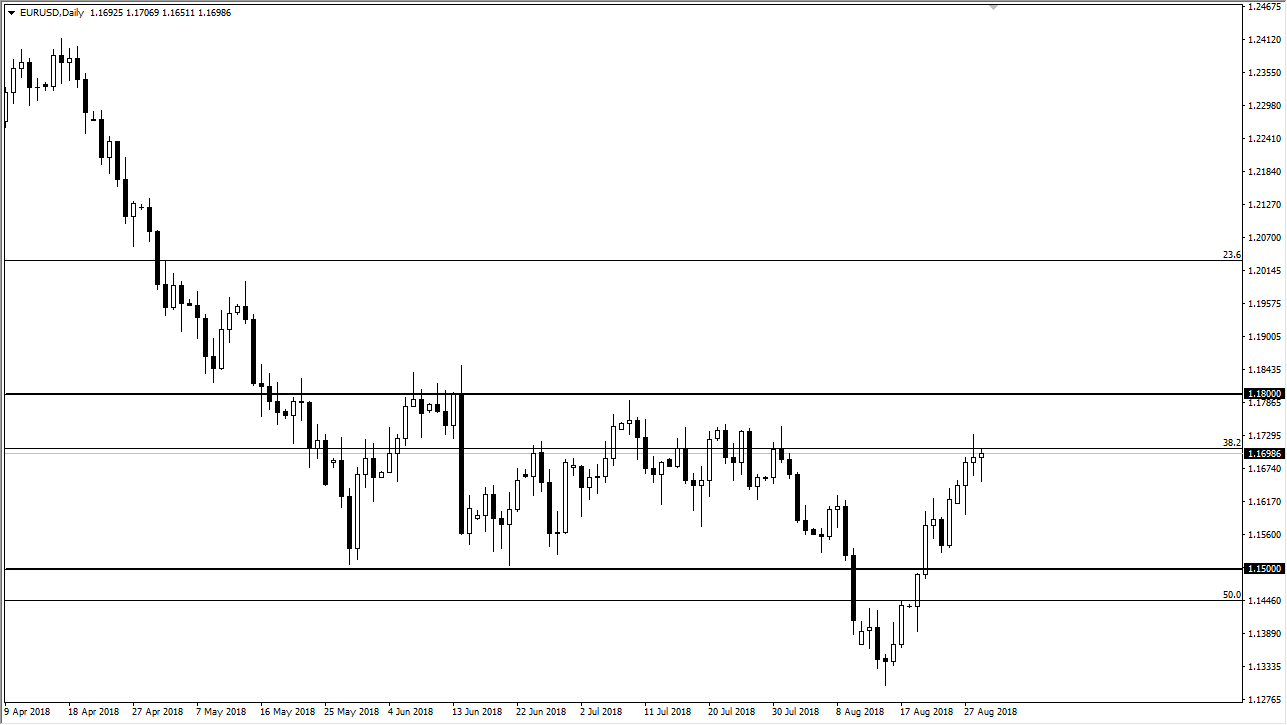

EUR/USD

The Euro initially fell during the trading session, breaking down below the bottom of the shooting star from the previous session. While typically a very negative sign, the market rolled back to the upside and ended up forming a hammer. This shows confusion, but more than anything else I think it shows a resiliency from the bullish side of the equation. There’s a lot of noise between here and 1.18, but I think we will probably continue to try to reach towards that level. Pullbacks at this point should be thought of as buying opportunities, which is essentially what I said yesterday, but it looks as if they will be buying opportunities at much higher levels than I originally anticipated. If we can clear the 1.18 level, we will then start looking towards 1.20 level after that. At this point, unless we get some type of general “risk off” move, is very likely that this pair will continue to rally.

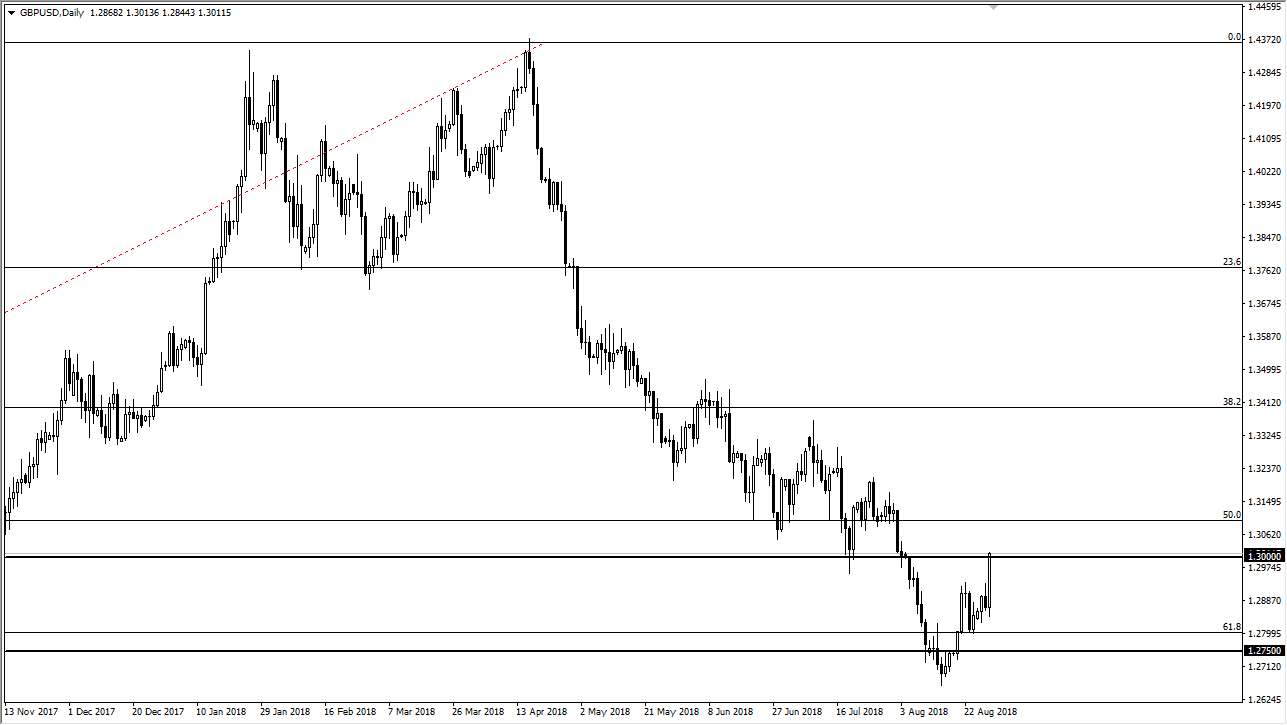

GBP/USD

The British pound exploded to the upside during trading on Wednesday, breaking above the 1.30 level as several officials about the EU and the UK you the impression that we are relatively close to a settlement. As I’ve been saying for some time, that was going to be the catalyst for the British pound to rally. At this point, the market is a little bit overbought in the short-term charts, so what I would look for some type of pullback so that we can take advantage of a little bit of value. There’s no need to chase the trade, unless you are looking for the longer-term move, then the difference of 100 pips won’t make much difference. In a general sense though, I think that perhaps the market is changing trends finally.