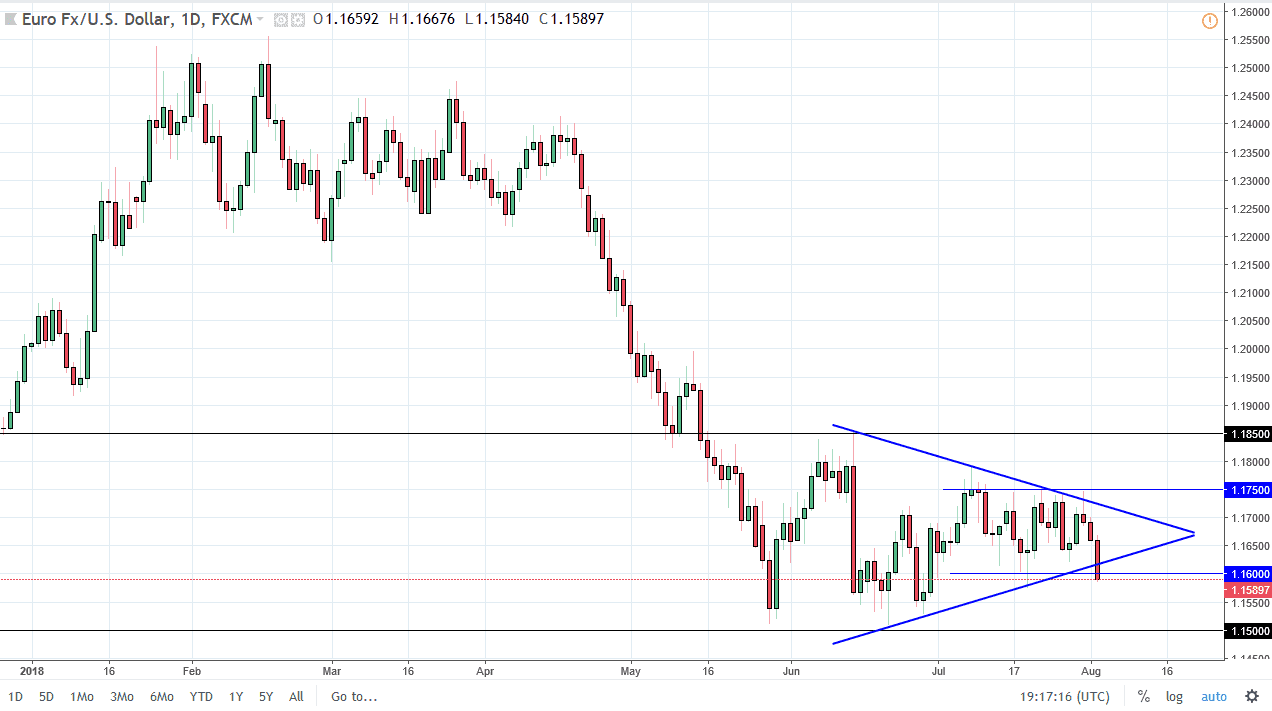

EUR/USD

The Euro fell rather hard during the trading session on Thursday, slicing through the 1.16 level, which is an area of short-term support and technically a break of the symmetrical triangle that I have on the chart. However, I think if we can break down below the bottom of the range we will probably go looking at the 1.15 level where a ton of support should be found. A break down below there would be a major break down in the market. I think that we may get a knee-jerk reaction to the downside with a strong jobs number, only to see a turnaround again. If we get a daily close significantly below the 1.15 level, this market could break down much lower. Otherwise, we will stay within the longer-term consolidation area.

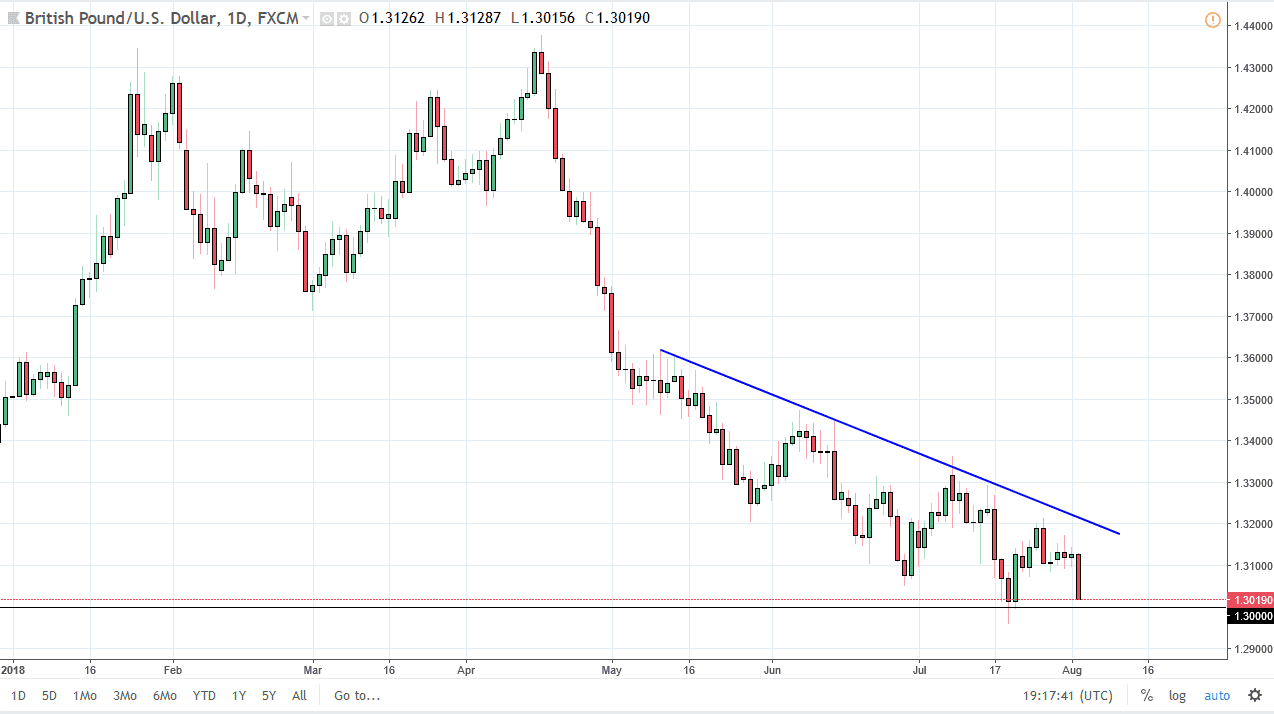

GBP/USD

The British pound has also fallen during the trading session, reaching down towards the 1.30 level underneath, an area that has seen a lot of buying pressure. If we can turn around from here, it could be a nice buying opportunity for longer-term traders. The British pound rallied initially after the interest rate hike coming out of London, but Mark Carney later suggested that a lot of the inflationary numbers were due to a weakening pound, and not necessarily strength in the British economy. I still believe that the market will turn around quite drastically as soon as we get some resolution to the Brexit. Until then, it will be very difficult, but I think that given enough time we will see value hunters come in and pick this market up. Pay attention to the 1.29 level, if it gives way this market goes to the 1.25 level. Today could be very crucial for this market.