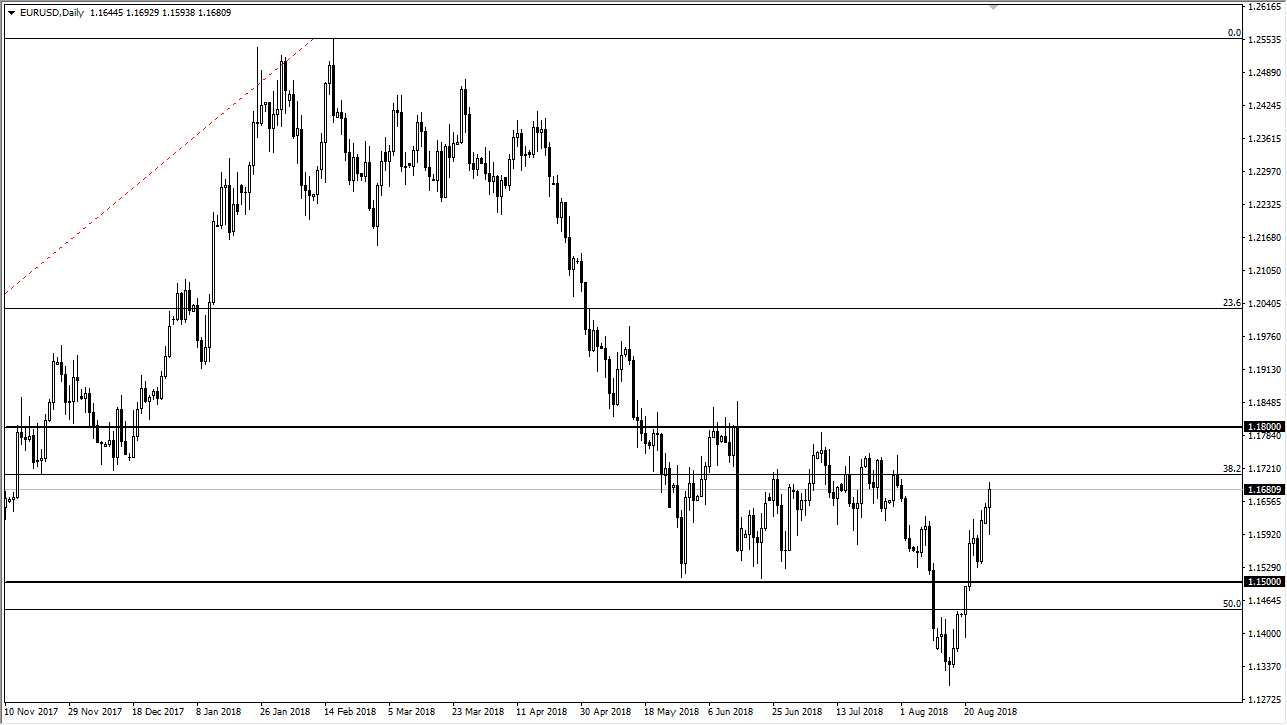

EUR/USD

The Euro initially fell during trading on Monday, but then rally again to reach towards the 1.17 region. The market has been recovering quite nicely as I believe traders starting to pay less attention to the Turkish contagion possibilities. With that, I think short-term pullbacks will be buying opportunities as the US dollar has been overbought, and I think we will also go looking towards the top of the consolidation area which is the 1.18 level. Pullbacks at this point are to be bought unless of course we break down below the 1.15 level, which would show a return to the extremely bearish position. Overall, I think that the market will continue to be choppy but will stay within the range that we have just reentered. If we do break above the 1.18 handle, we could go looking towards the 1.20 level after that.

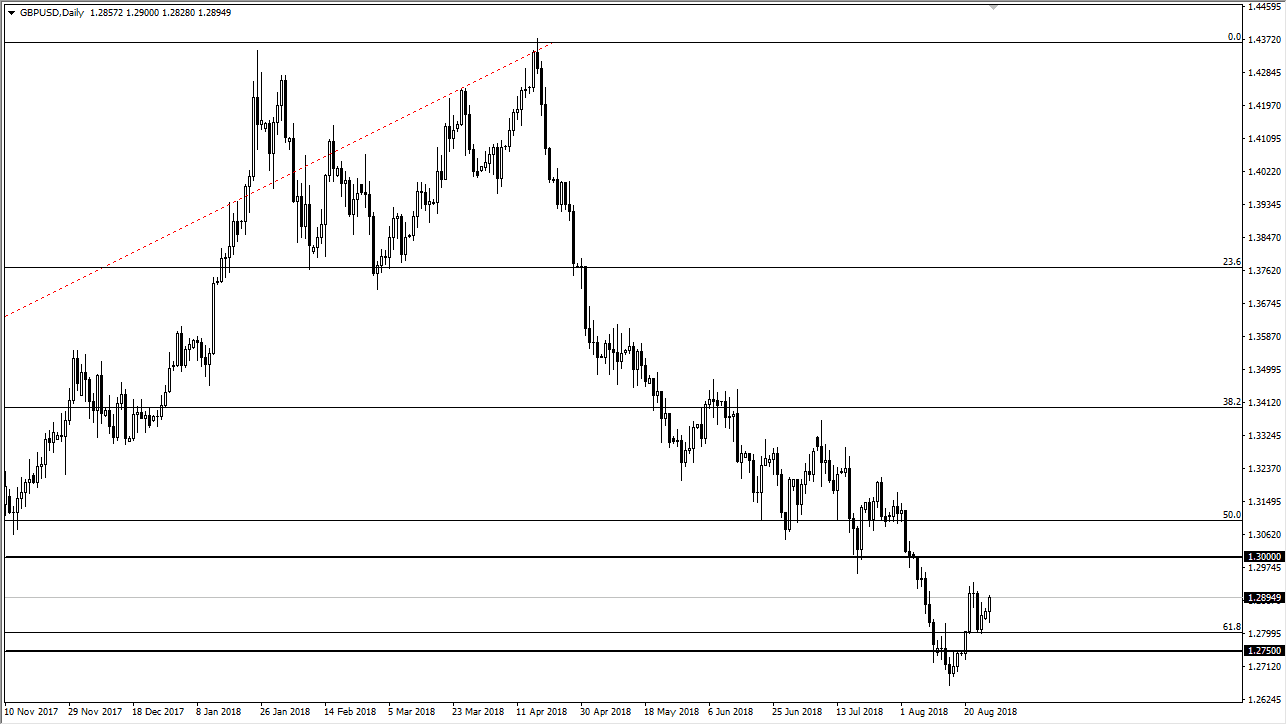

GBP/USD

The British pound also recovered during the day and rallied quite nicely. The British pound is near the one point tonight handle, an area that of course causes a certain amount psychological importance but the real prize will be the 1.30 level now. If we can take that level out to the upside, that would be a very good sign indeed. At this point, I believe that traders are trying to make a stand, and I think that smart money starting to come in and pick up the British pound “on the cheap”, as it has been so oversold. Headlines about the Brexit will of course continue to spook the market, but the real money is made on the longer-term plays, and we are certainly oversold at this point. I wouldn’t jump all in right away but building up a position down here does make a certain amount of sense.