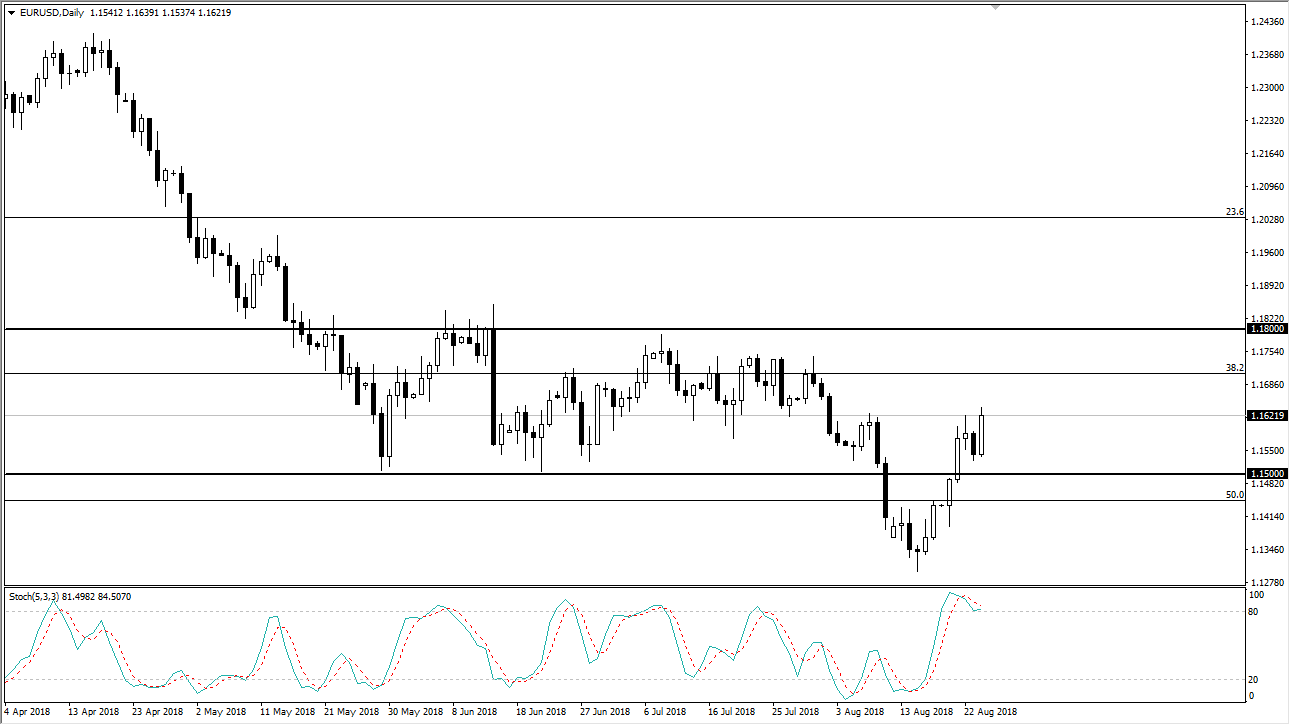

EUR/USD

The Euro rallied significantly during the trading session on Friday, breaking above the shooting star that formed on Wednesday which of course is a very bullish sign. At this point, the market may continue to go higher, but there’s obviously a lot of resistance just above. If we do break to the upside, I think that the market will probably go looking towards the 1.1750 level, followed by the 1.18 level. Pullback should find support and the 1.15 handle, if we can even get down there. The US dollar sold off quite drastically over the course of the week, it looks like people are starting to worry less about the Turkish situation spreading into contagion of European banks, at least for the time being. Because of this, I think that we may see a bit of a continuation of the recovery.

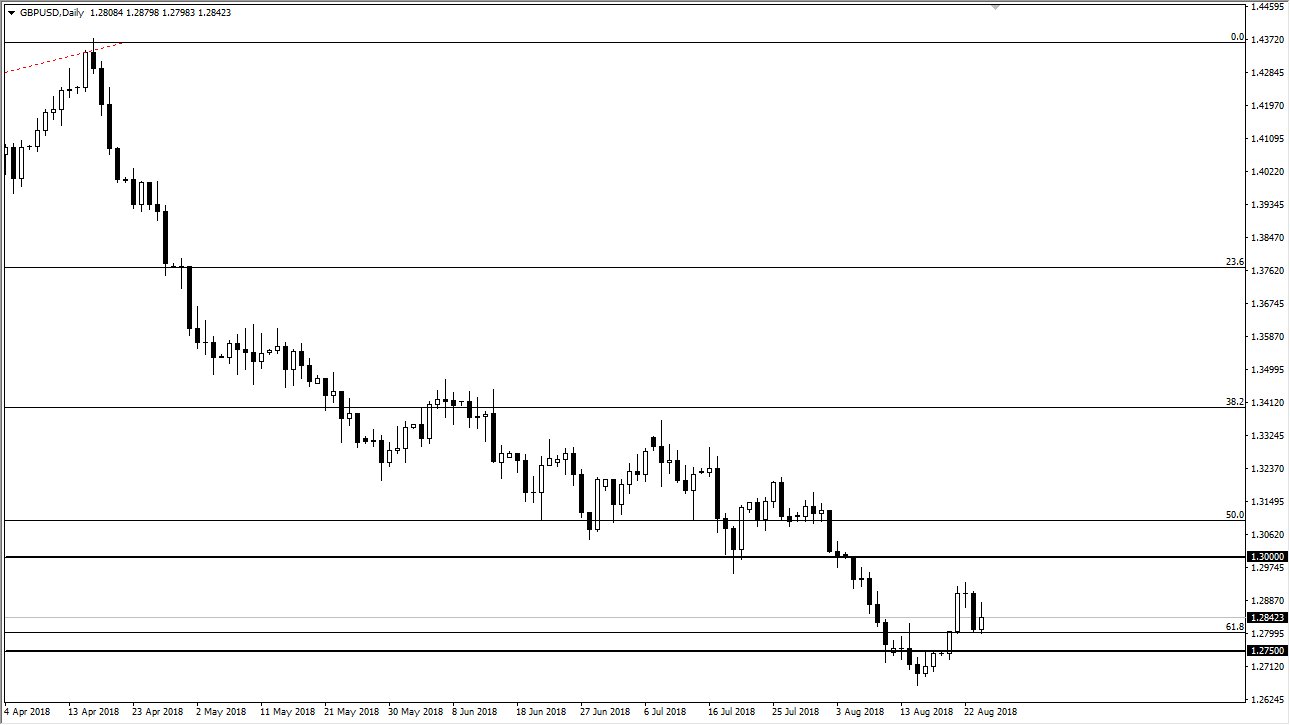

GBP/USD

The British pound also rallied against the US dollar but gave back quite a bit of the gains. That makes sense though, because we have seen so much concern about the Brexit, and of course the US dollar will serve as a bit of a safe haven in that circumstance. I think at this point, it’s likely that the pair will lag behind the EUR/USD pair, but should follow the same overall directionality. If I were to place a trade, it would probably be with the Euro quite frankly, because I think it has a lot less noise attached to it. However, if we can get some type of headline crossing the wires that suggests there is some type of resolution to the Brexit issue, I believe that this pair could skyrocket. I also believe that value hunters and longer-term players are starting to step in front of that news.