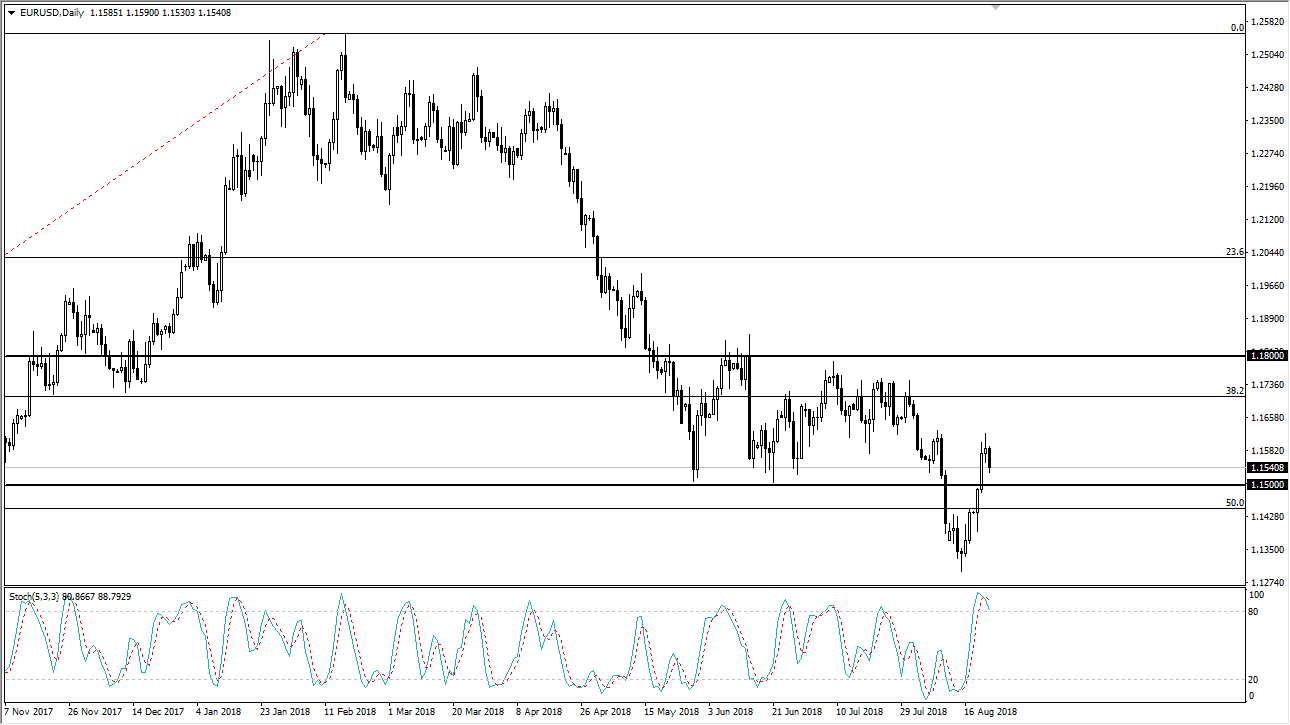

EUR/USD

The EUR/USD pair has fallen just a bit during trading on Thursday, breaking the bottom of the shooting star from Wednesday. As I look at the daily chart, it’s hard not to notice that we have not only rolled over, but we have crossed over on the stochastic oscillator in the overbought section. I think that the market is probably going to continue to show signs of negativity, and perhaps a break down below the 1.15 level will accelerate the selling. Otherwise, we may try to rally but I think it will be a bit difficult in this region. The 1.16 level should offer plenty of resistance, so I think the easier trade is to sell, going right along with the longer-term downtrend in this market. All it would take is a little bit of fear to enter the marketplace to send this pair much lower.

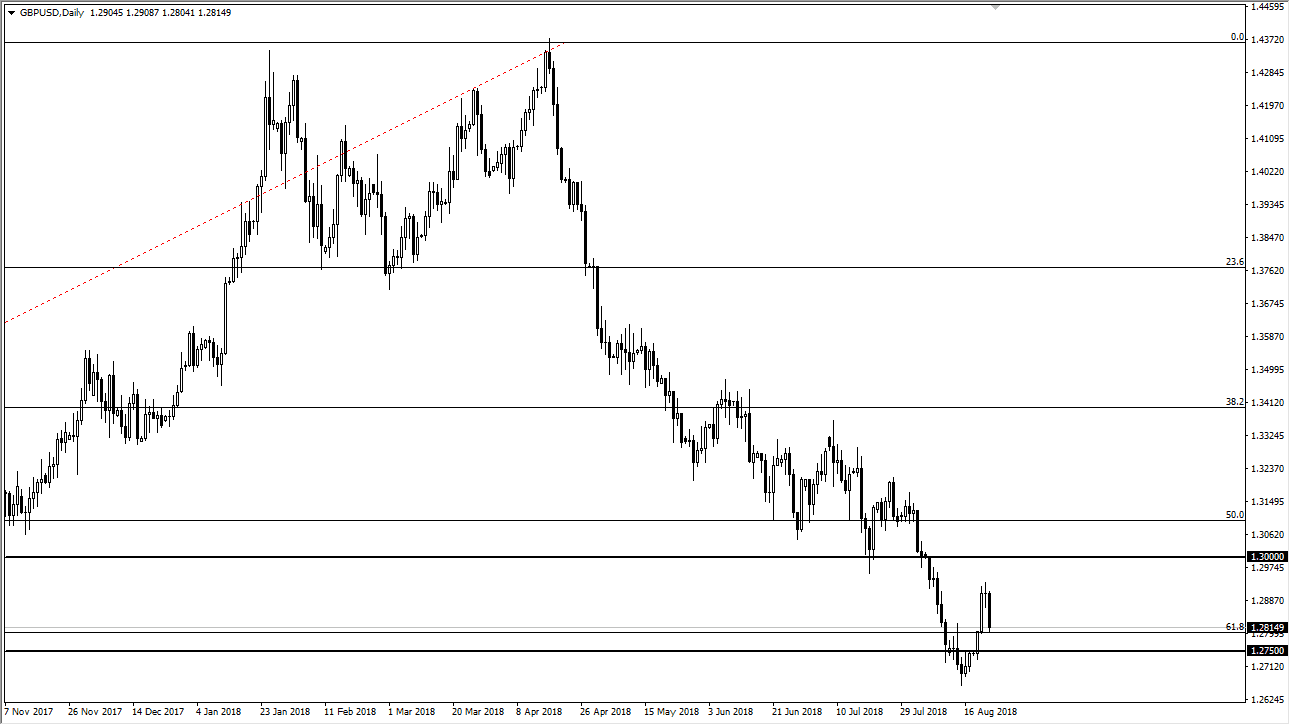

GBP/USD

The British pound fell during the day as well, as one would expect in a session that featured a lot of US dollar strength. It now looks as if we are going to go looking towards 1.2750 level, and perhaps the lows again. Rallies at this point are to be sold, and I believe that the 1.30 level above is essentially the “ceiling” in the market. If we were to break above that level, then of course it would be a very strong signal that we are going to go much higher. At this point though, I don’t see that happening and I believe that sellers will continue to reenter this market on short-term rallies that show signs of exhaustion. If we can break to a fresh, new low, then that sends the market down to the 1.25 level eventually.