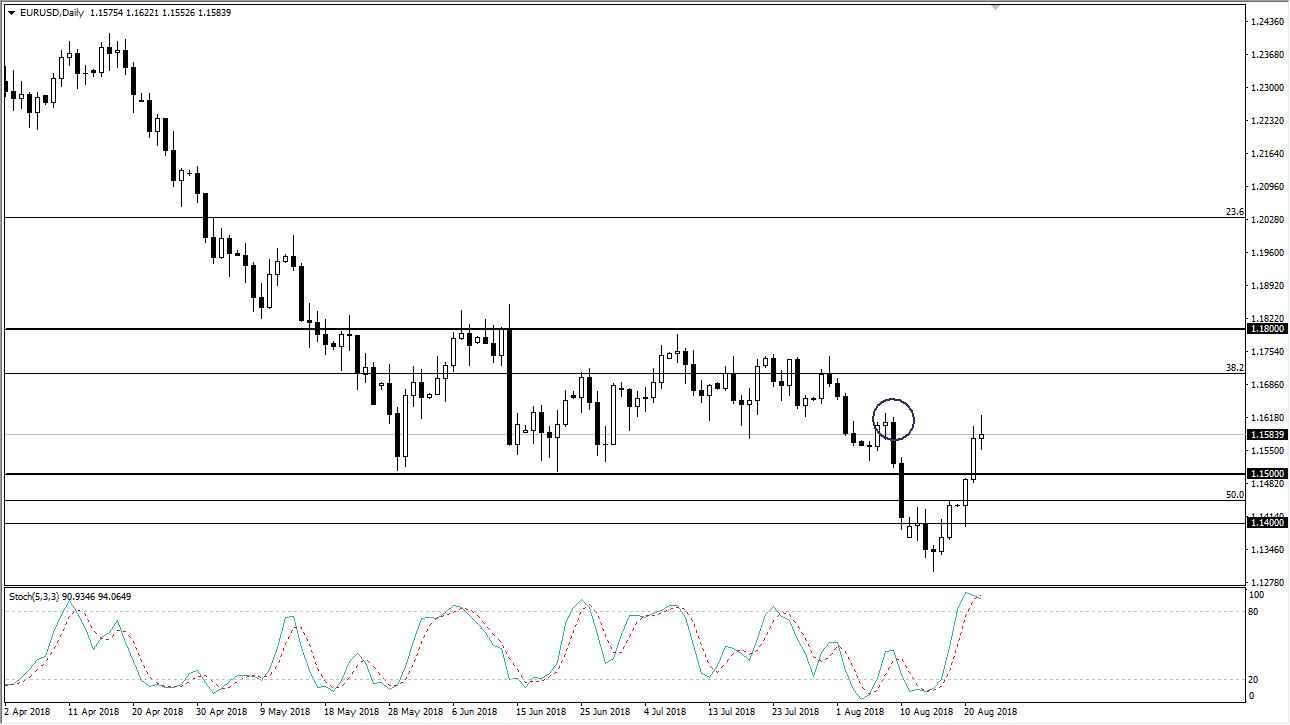

EUR/USD

The Euro initially rallied during the trading session on Wednesday, reaching towards the highs again, but we have seen the market struggle just above at the 1.16 level. It looks as if the market may roll over again, and I have an ellipse drawn around where I feel the supply is starting to overcome the market. Beyond that, if you look at the Stochastic Oscillator, you can see that we have crossed over in the overbought region. Because of this, I think that if we break down below the bottom of the daily candle for the session on Wednesday, the market will roll over and look for the 1.15 level initially, and then possibly the 1.14 level after that. After all, nothing has changed, we still have the Turkish situation and all of that. I believe that this was a relief rally, and it now looks as if the chart is showing a textbook example.

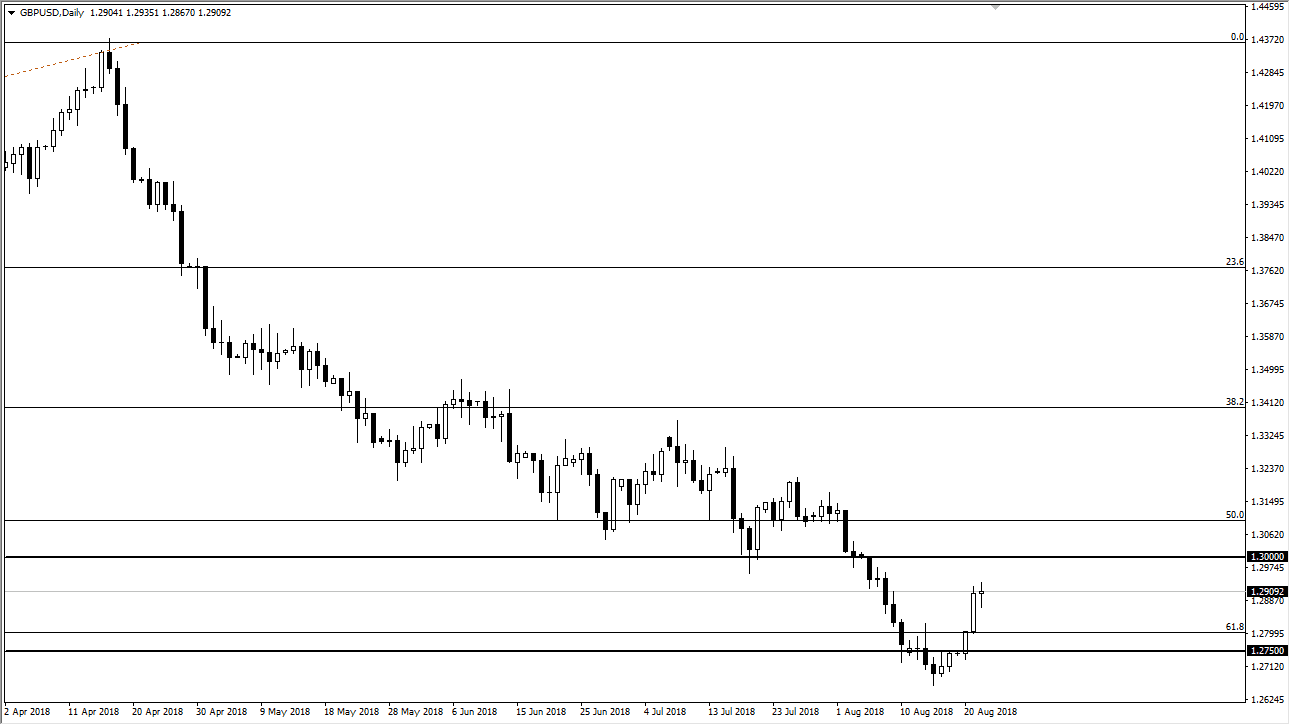

GBP/USD

The British pound did a little better, only because perhaps that it is far too oversold. The 1.30 level above is significant resistance, so I don’t think we get above there anyway. I’m looking for reasons to sell this market, but right now I think we may see a little further upside before that happens. However, if we were to turn around and break down below the bottom of the candle stick for the session on Wednesday, then we should go down to the 1.2750 level. This market is most certainly in a downtrend, and I am not willing to go against that right now. Overall, I believe that the market will reach the lows again, and perhaps even go lower than that. However, if we break above the 1.30 level, it’s likely that we would continue to go higher.