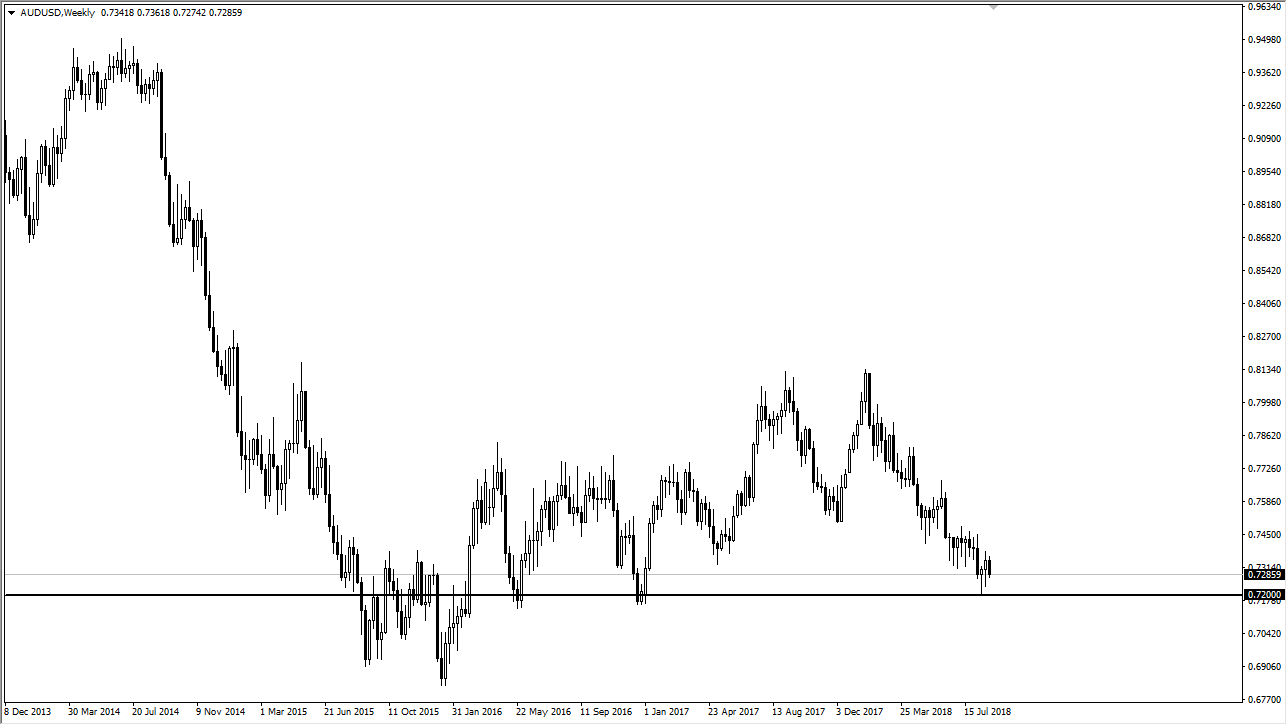

AUD/USD

The Australian dollar has been very noisy during trading over the last several weeks, but the one thing that has become very clear is just how important the 0.72 level seems to be. Because of this, I think that the market will continue to respect that level. We have formed a couple of hammers on the weekly chart, so that’s a very bullish sign. Also, I think that the bounce will be somewhat contained, perhaps to the 0.75 level. If we were to break down below the 0.72 level, I think that the market would unwind down to the 0.70 level. However, the greenback is starting to show signs of weakness. That should help the Australian dollar, and I think that the “one-two punch” will be if the US and China look likely to reach some type of trade deal.

Remember, the Australian dollar is highly sensitive to Asian trading, so keep that in mind as Australia is a major beneficiary, and sometimes victim to the Chinese economy. Pay attention to gold as well, because it of course will have its own say when it comes to where the Australian dollar goes. The US dollar softening overall should be good for equities, commodities, and then by extension “riskier currencies” such as the Aussie. I think that the 0.70 level is even more supportive, so I would be even more interested in going long at that point. We have recently seen a lot of demand in this area, so I think that it is only a matter of time before we rally. We simply need some type of good news to push the market higher. I’m not sure what that will be, but it will be obvious once it happens because everything will go higher.