AUD/JPY

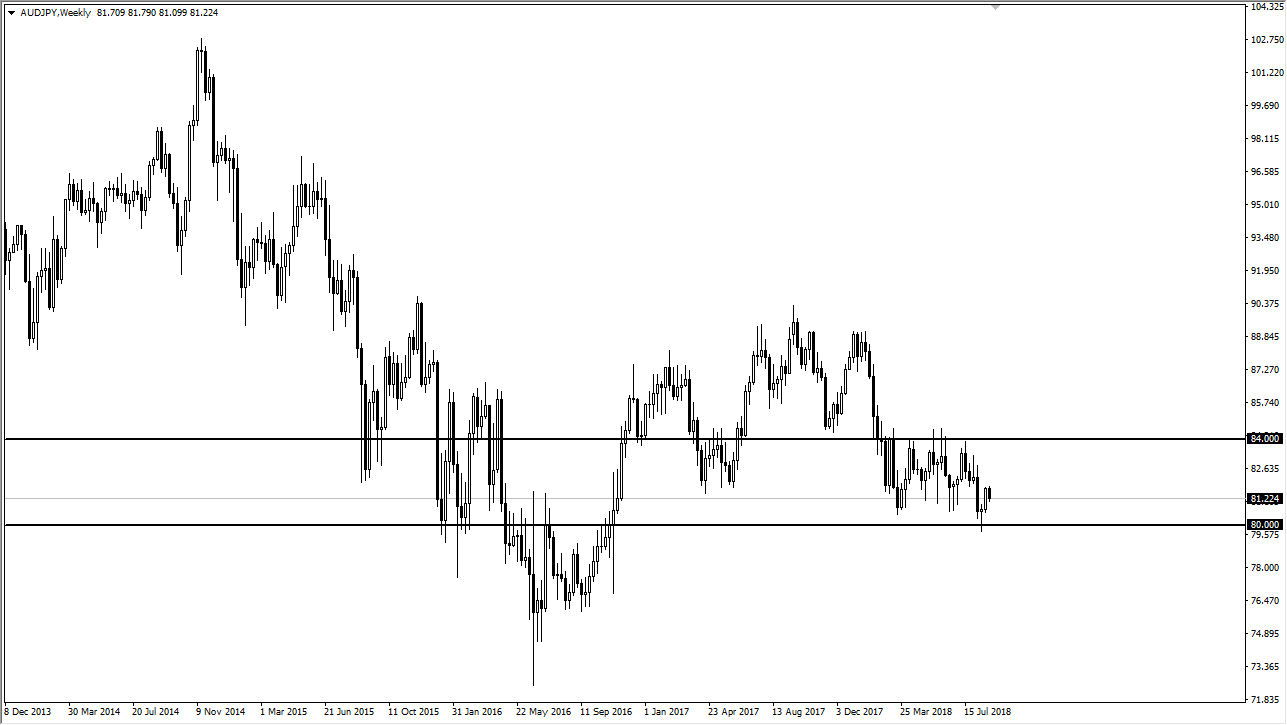

The Australian dollar has been rather noisy over the last couple of months, especially against the Japanese yen. However, this is set up a nice trading range that we have been working with for some time, and I believe this will continue to be the way. However, if it is not we then have clear points of reference that we can reach for.

Recently, we’ve seen the Australian dollar balance between the ¥80 and the ¥84 levels, going back to several months ago. Ultimately, this is a market that I think continues to obey these levels, but if it does break out of them, that should coincide nicely with either a “risk on” or “risk off” type of scenario. Ultimately, this is a marketplace that will move within the range of overall appetite for assets. If we do break down below the ¥80 level, it likely will coincide with some type of selloff in the stock markets or maybe even commodities. Alternately, if we were to break through the ¥84 level, that would show some type of proclivity to go higher and several other markets such as the S&P 500 or even the Nikkei.

Otherwise, you can use shorter-term charts and perhaps something along the lines of the stochastic oscillator to confirm whether you should be buying support or selling resistance. I think this might be one of the better currency pairs to trade during the month of September, especially if we can stay range bound. It makes sense that it has been quiet for some time, because while the Japanese art light years away from tightening monetary policy, the risk appetite out there seems to be jittery to say the least. In other words, this pair simply has no idea what to do next. On a break down, I believe that the market goes looking towards the ¥77 level. If we do break to the upside, then we will probably be looking at ¥88.