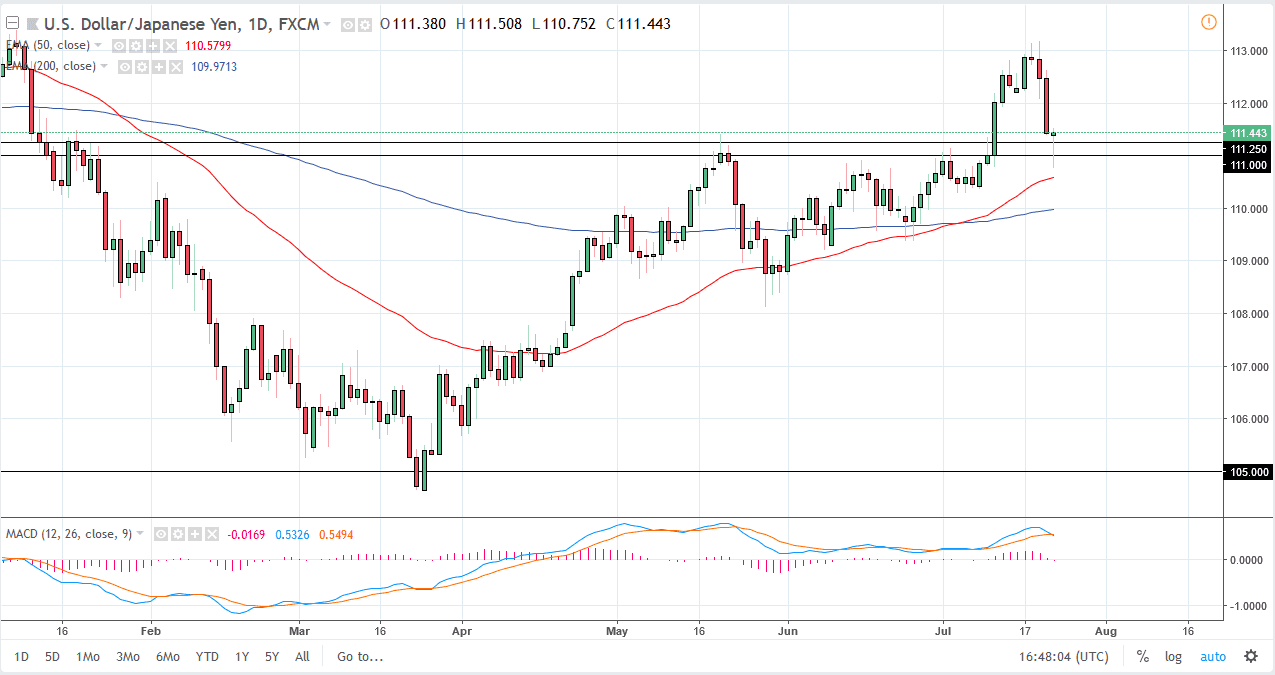

USD/JPY

The US dollar has fallen during most of trading on Monday, testing the 111 level for support. It did find it there, and I think we are ready to continue to reach to the upside, perhaps reaching towards the 113 handle. The 50 EMA is just below, so there is a certain amount of psychological importance that as well. I believe that the selloff is being tested, and I think that we will turn around to go higher from here. By forming a hammer, it’s a perfect technical signal, and I think a lot of traders will be paying attention to that. Ultimately, I do believe that the buyers are coming back as there is a proclivity for the US dollar overall, and the selloff may have been a bit overdone.

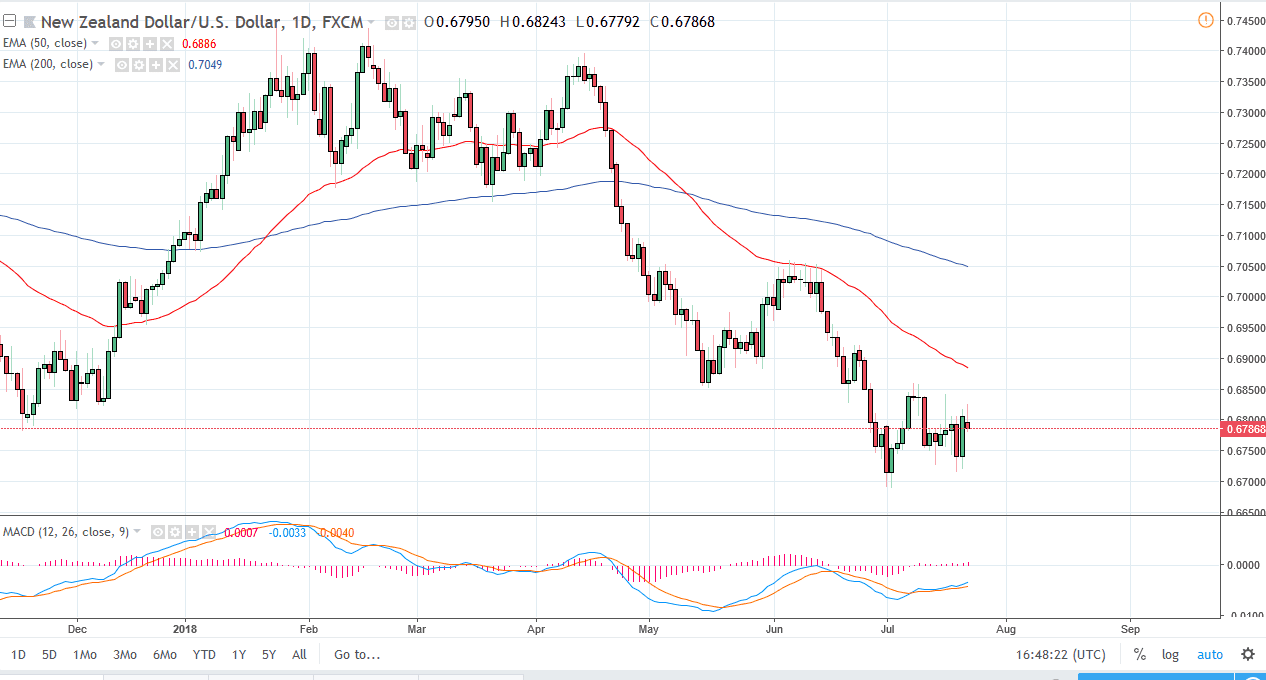

NZD/USD

The New Zealand dollar has initially tried to rally during the trading session but found enough resistance at the 0.6825 region to turn around of form a shooting star. I don’t look for some type of meltdown, I think this will simply be more of the same consolidation that we have seen over the last several sessions. The 0.67 level underneath is very supportive, but a break down below that level signifies that we are going to go much lower. If we can break above the 0.6850 level, then the market could bounce significantly. It’s not until then that I believe that any type of longer-term trade will present itself as far as buyers are concerned. I’m looking for short-term range bound types of moves in this little area here and believe that scalpers will love the New Zealand dollar for the next couple of days. However, impulsivity will return, and when it does it’s time to start following.