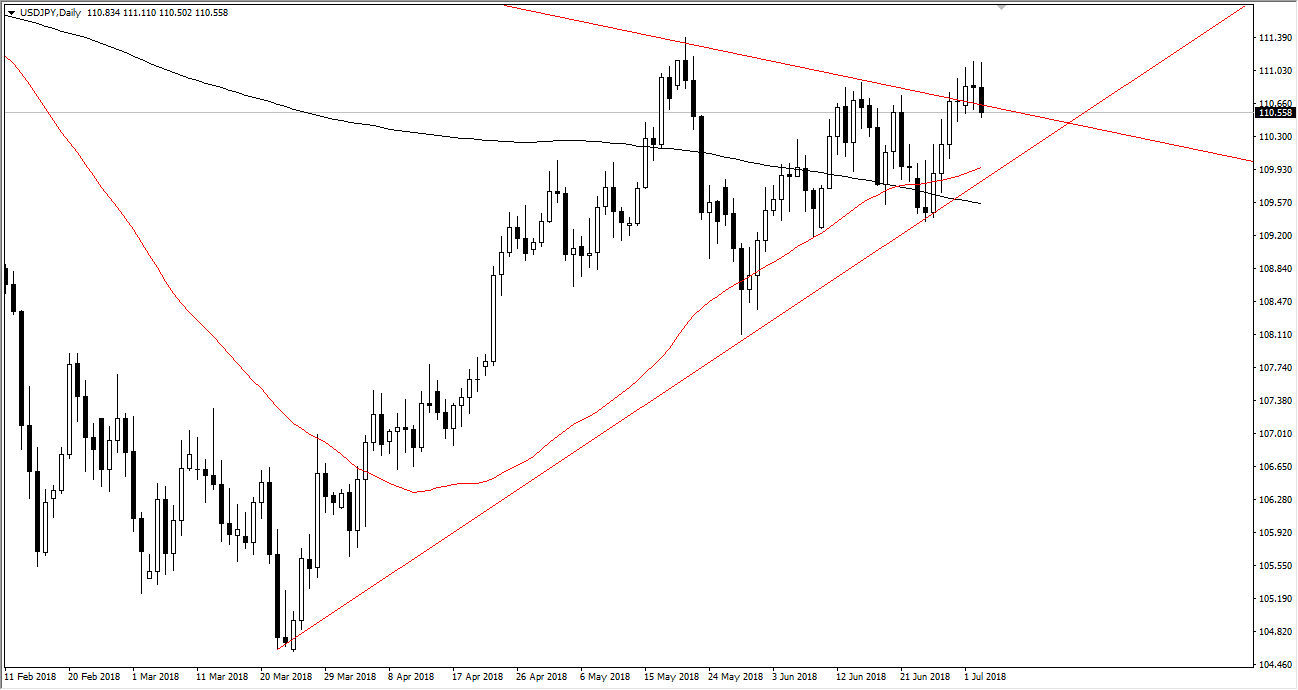

USD/JPY

The US dollar has initially tried to rally against the Japanese yen but turned around at the ¥111 level II break down below the previous downtrend line that formed the overall wedge. At this point though, I think it’s only a matter of time before the buyers come back, as the US dollar seems to be finding a bit of a bid. Counteracting that unfortunately is the fact that this pair tends to be very sensitive to risk in general, so if we get a bit of a “risk off” move, it could also put bearish pressure in this market, but if it’s a general dollar positive move that is based on something beyond fear, then we could see this market rally. With the US stock markets closed during the session today, it’s likely that this pair won’t have a lot of positive momentum.

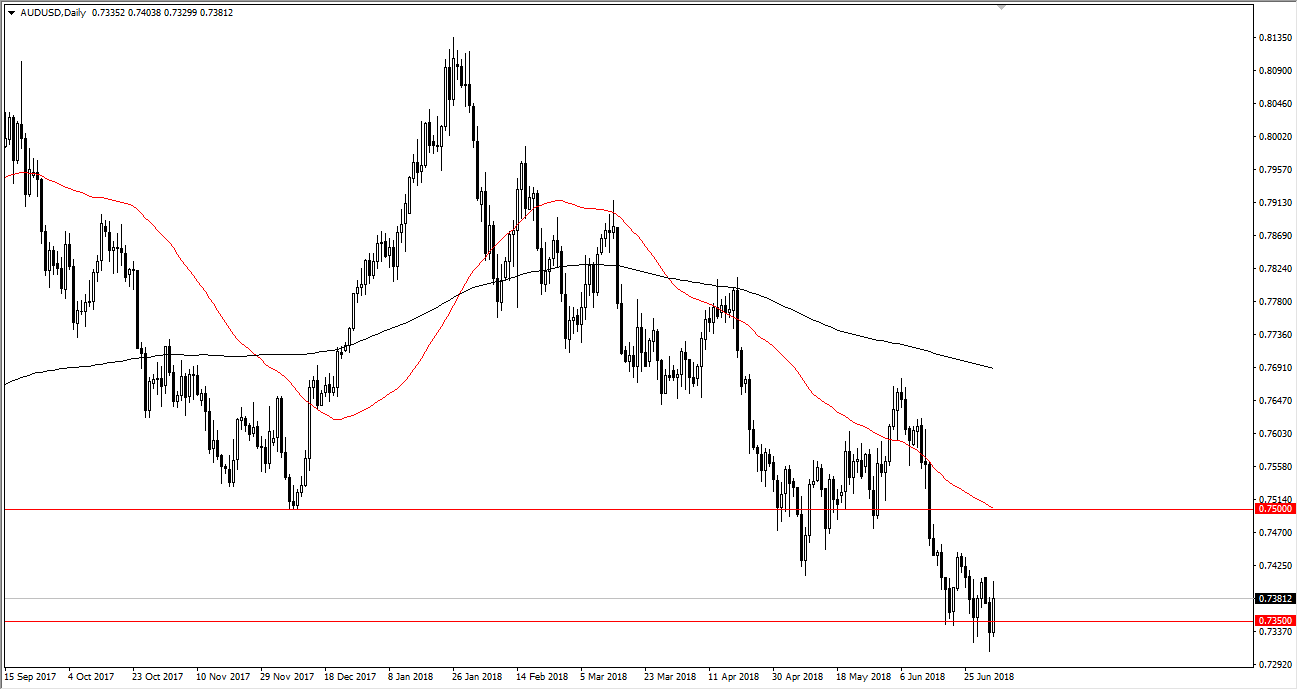

AUD/USD

The Australian dollar has rallied significantly during the trading session after the Asian market speculated that the Chinese central bank was going to step in and support the local currency. Because of this, the Australian dollar got a bit of a boost as it could help the local markets continue to gain, and therefore needs more raw materials from places like Australia which are so instrumental in Asian economies. However, I think this is more or less a “dead cat bounce”, because at the end of the day we still have a lot of concerns when it comes to trade wars, and the Australian dollar will be one of the currencies it takes the brunt of the damage. We have recently made “lower lows”, and therefore I think we continue to grind to the downside before breaking down significantly. The alternate scenario is a move above the 0.75 level, which obviously would take several days of bullishness.