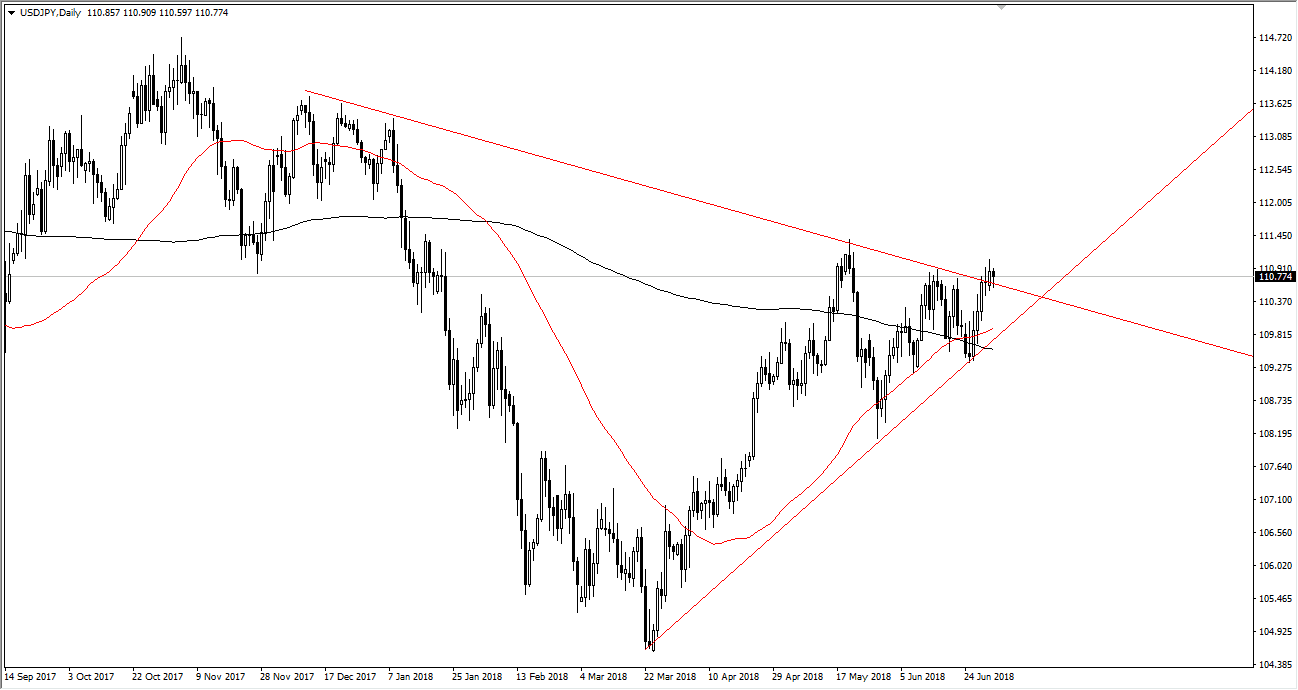

USD/JPY

The US dollar initially fell during trading on Monday against the Japanese yen but has found a bit of support based upon the previous downtrend line which is the top of the overall wedge that we have just broken out of. The ¥111 level above will also cause a significant amount of psychological resistance, but I think it’s only a matter of time before we get above there in continue to go much higher. By forming a slightly supportive looking candle, I think that the market is trying to break out to the upside as we see favor being shown to the greenback in general. However, as trade tensions continue to increase, I would expect a lot of volatility in this pair. We’ve recently formed a “golden cross” as shown on the chart, which of course is a buy signal.

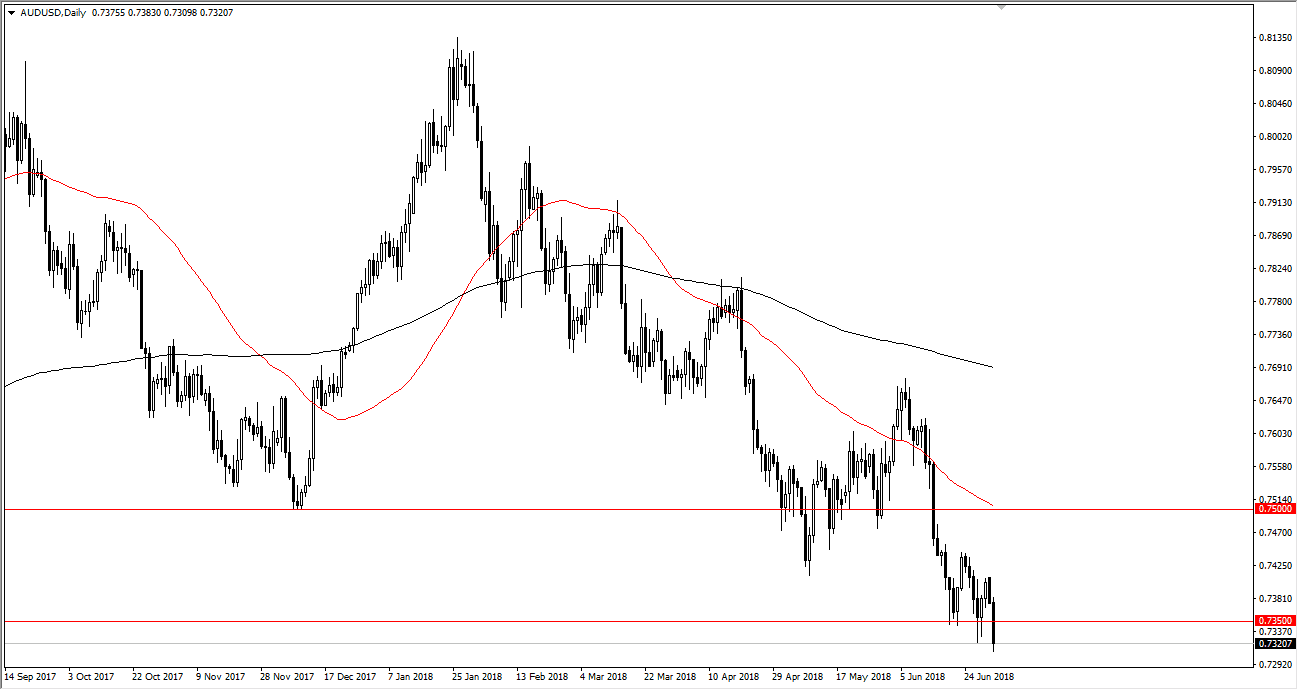

AUD/USD

The Australian dollar has broken significantly to the downside during the trading session on Monday as risk appetite has been damaged. It appears that the Americans will in fact be slapping tariffs on the Chinese this Friday, and of course the Chinese will retaliate in kind. This will of course continue to cause a lot of fear in the marketplace when it comes to global trade, and that of course is bad for the Australian dollar as it is highly leveraged to the Asian economies. I think breaking below the 0.7350 level is a very significant turn of events, and I think that if we break down below the 0.73 level, the market should then go to the 0.72 level underneath, and then possibly the 0.70 level after that. Rallies at this point are more than likely going to be selling opportunities on short-term charts, as we most certainly have a lot of negativity here.