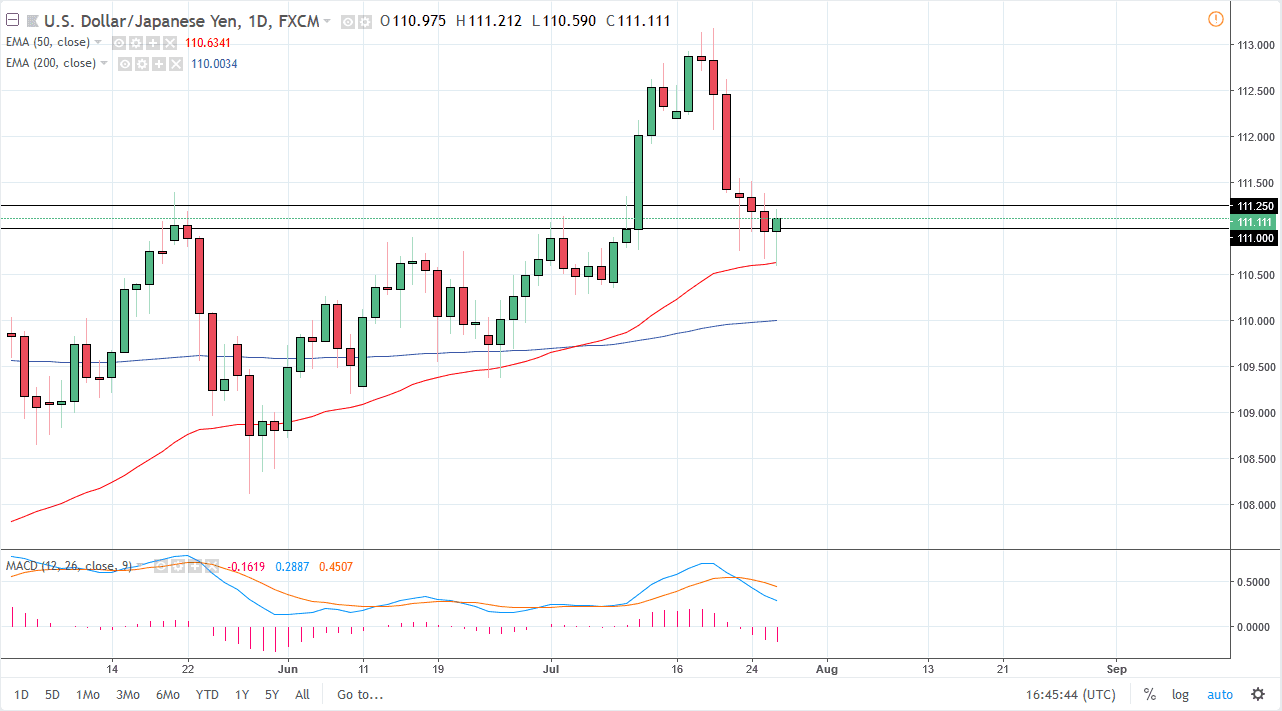

USD/JPY

The US dollar has initially fallen against the Japanese yen but continues to find support at the 50 EMA. Beyond that, the ¥111 level has been offering support as well. There has been a lot of demand in this general vicinity, and the fact that we are forming for hammers in a row suggests to me that we will eventually turn back around and go higher. In fact, I believe there is a massive amount of support all the way down to at least the ¥110 level, so I am bullish in this pair but I also recognize that we need some type of “nudge” to go higher. If we were to break down below the ¥110 level, that would be very negative, and could send this market much lower. Currently, I have a target of ¥113 again, and perhaps even the ¥115 level after that.

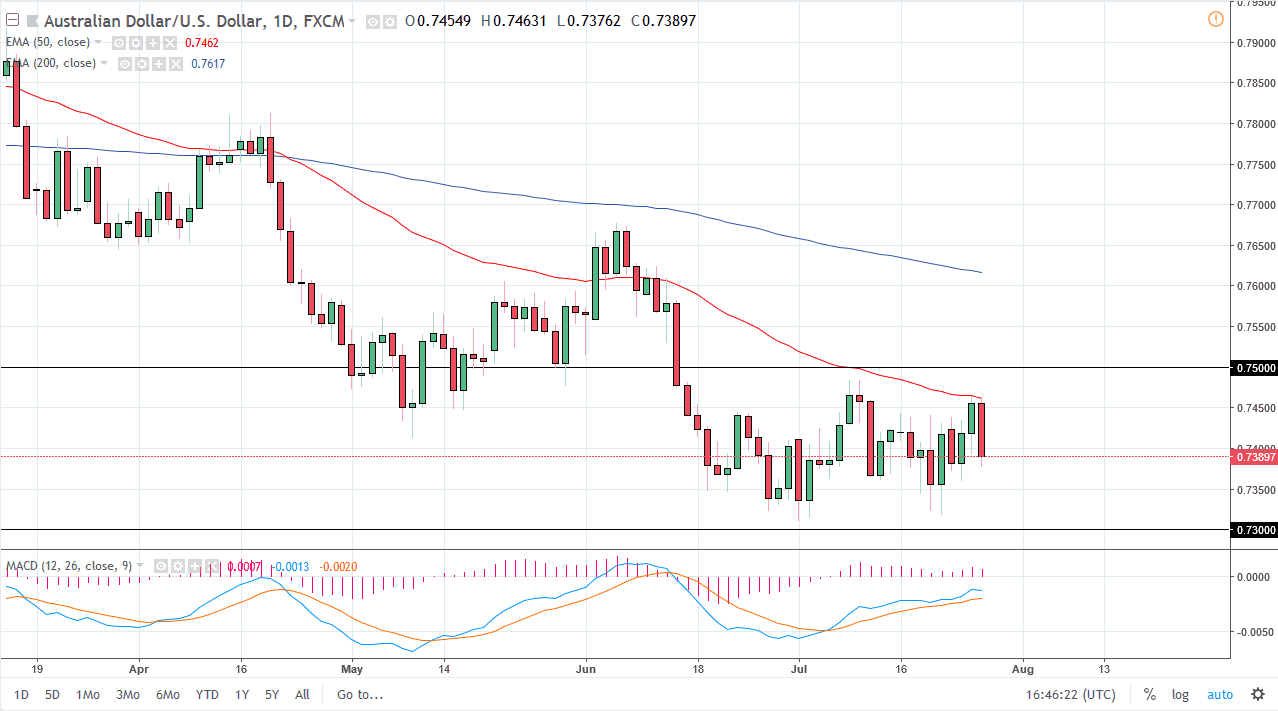

AUD/USD

The Australian dollar has fallen rather significantly during the trading session on Thursday but remains well within the constraints of the consolidation area that we have been watching. The market looks likely to continue to struggle to break out of this range, but one thing that I would look at is the weekly chart, as it shows several hammers in a row. That suggests that there is a lot of demand in this area, or perhaps some type of external support, perhaps a central bank being involved?

Of course, there’s also the possibility that traders simply have no conviction in this pair. With that, I think that we could see a sudden break out, and when we do you should follow it. A break above the 0.7500 level should send this market much higher, perhaps reaching towards the 0.77 handle, followed by the 0.80 level. Otherwise, if we break down below the 0.73 handle, then the market goes down to the 0.70 level.