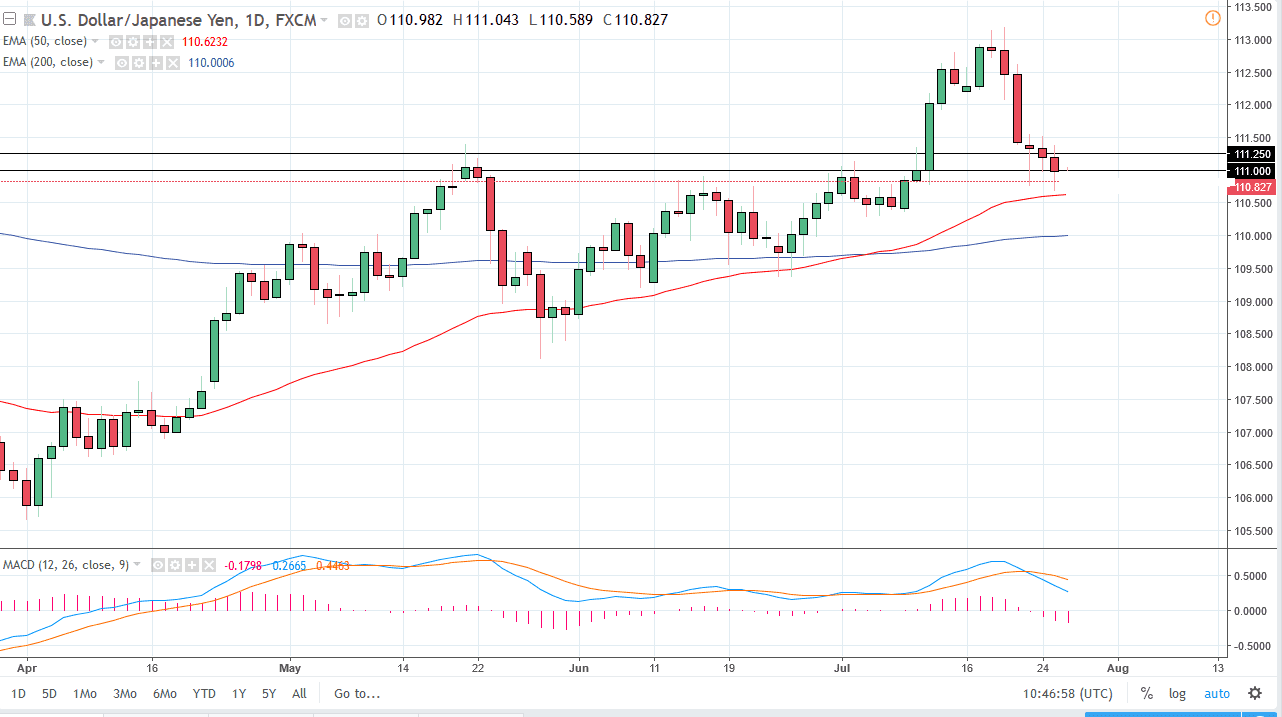

USD/JPY

The US dollar has fallen against the Japanese yen again, as we continue to see a significant amount of bearish pressure on the greenback. It does look like an area that we could find buyers though, but right now we continue to struggle to find reasons to go higher. Obviously, there is a significant amount of noise just below, and we have of course seen plenty of buyers in this market over the last several weeks. I think the ¥113 level above is significant resistance, based upon the recent pullback. I think that overall though, the interest rate differential will continue to favor the US dollar, as the Bank of Japan is light years away from tightening monetary policy. The ¥110 level underneath there should be supportive as well.

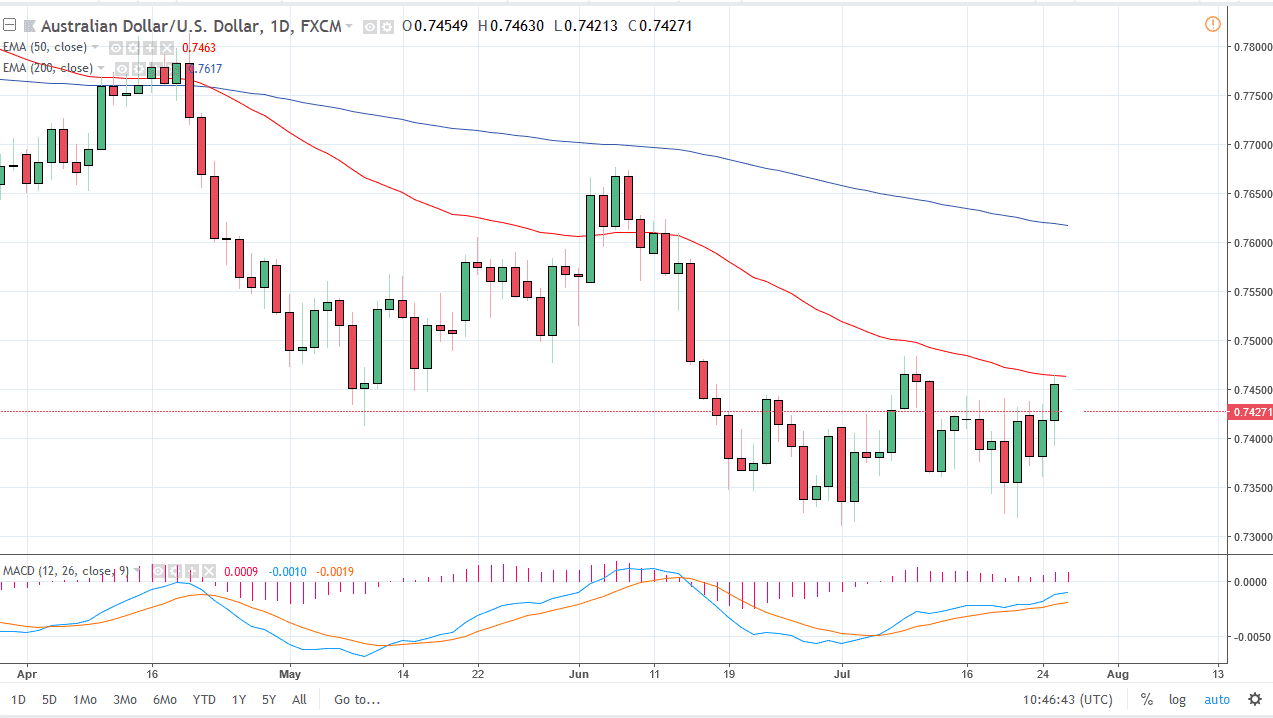

AUD/USD

The Australian dollar has gone back and forth during the trading session on Wednesday, as we cannot break above the 0.7450 level, an area that has been important over the last couple of weeks. I think that if we can break above that level significantly, the market will then challenge the 0.75 handle after that. There are several hammers on the weekly chart in this general vicinity, so I certainly think there is a certain amount of buying pressure and interest in this market. If we were to turn around and break down below the 0.73 level, then at that point I think the market probably goes down to the 0.70 level after that which of course has a certain amount of psychological importance attached to it because of the round number. Pay attention to gold, if it starts to rally that could help this market as well at the correlation is well known.