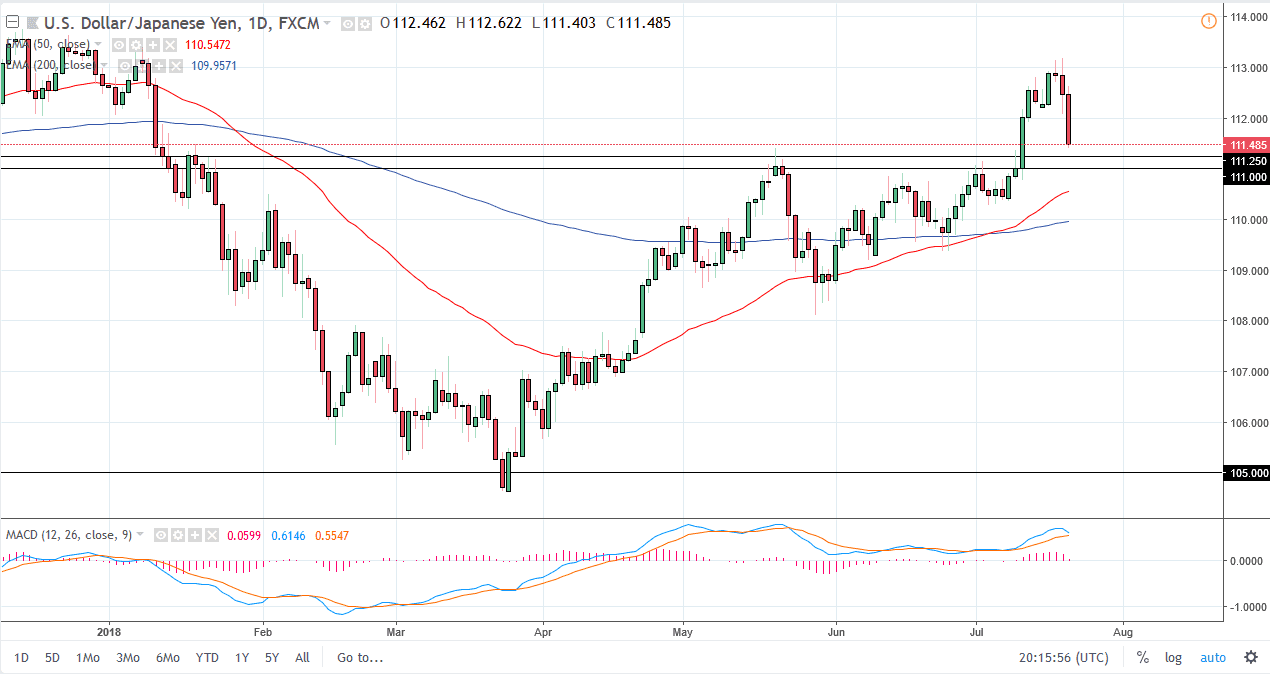

USD/JPY

The US dollar has fallen significantly during the trading session on Friday, reaching towards the ¥111.50 level. There is plenty of support just below, especially between the ¥111 level and the ¥111.25 level. This is an area that had seen an extreme amount of demand, and I think that the buyers will probably come back. This is especially true considering that the significant move on Friday was due to a tweet that Donald Trump put out, suggesting that the Federal Reserve should keep its monetary policy loose and try to keep the US dollar competitive with the other currencies. However, the reality is that we are in and uptrend, because the Federal Reserve will stay on the track of interest rate hikes that have been planned out. In fact, after the tweet came out we had already seen people in the Federal Reserve denying that his opinion would change anything.

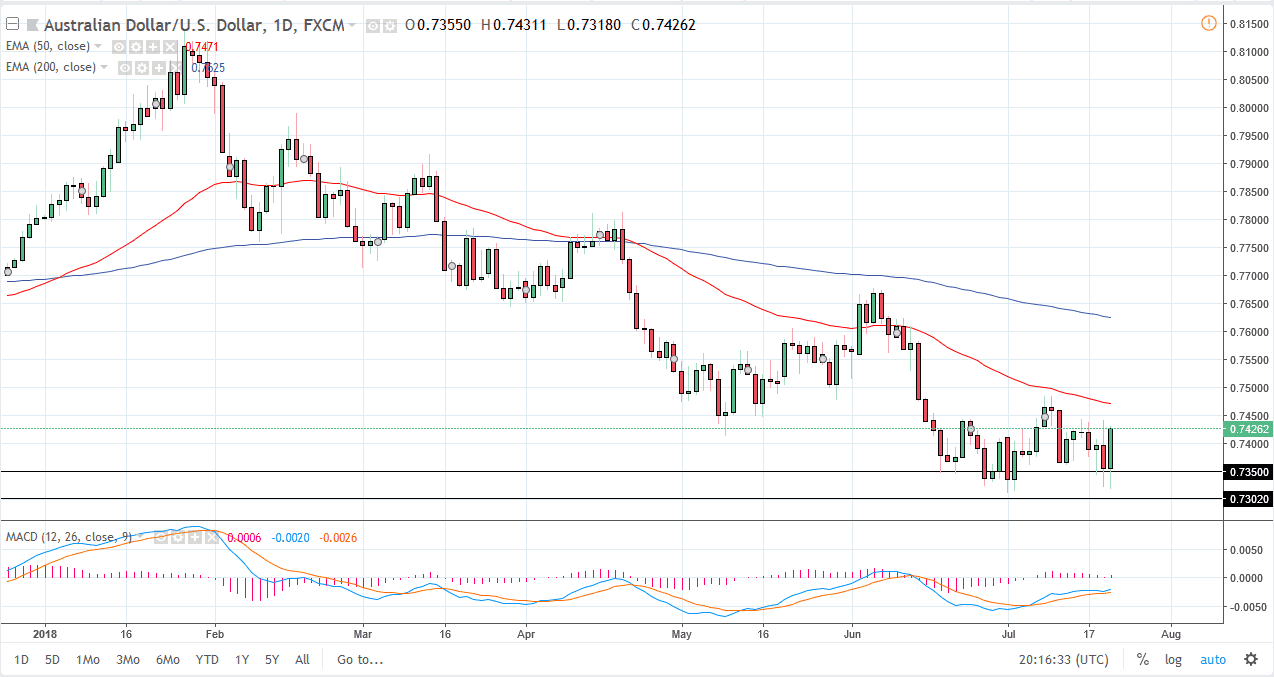

AUD/USD

The Australian dollar initially fell during the trading session on Friday but found enough support in the demands on that I have marked on the chart to keep the market afloat. I believe that this market will continue to grind sideways overall, and that as long as the 0.73 level holds as support, I believe that the buyers will continue to jump into this market looking for value. With that in mind, I believe that this is a “by on the dips” type of situation. If we can break above the 0.75 level above, it’s likely that we will then move towards the 0.7650 level. Pay attention to longer-term charts, because they are telling us that there is a ton of support in this area as well. However, if we broke down below the 0.73 level, the market would probably drop to the 0.70 level.